Blog

Top Stories

47 New National Waterways (NWs) to be operational by 2027; Cargo volume to rise up to 156 MTPA by 2026”: Sarbananda Sonowal

Union Minister of Ports, Shipping & Waterways, Shri Sarbananda Sonowal, today chaired a meeting of the Consultative Committee on Inland Waterways Transport in Mumbai, where it was revealed that 76 waterways are targeted to be made operational by 2027, with cargo volume expected to surge by 156 million tonnes per annum (MTPA) by end of FY 2026. The Inland Waterways Authority of India (IWAI), the nodal agency under the Ministry, presented a comprehensive review of major projects, future projections, and the roadmap ahead. Members of Parliament attending the meeting acknowledged and appreciated the progress made and supported increased budgetary allocations to boost the sector’s growth.

The footprint of inland water transport is expected to expand significantly—from 11 states in FY 2024 to 23 states and 4 Union Territories by FY 2027. To support this growth, projects worth ₹1,400 crore were launched or announced during the Inland Waterways Development Council (IWDC) meeting held on January 10, 2025. Additionally, the Inland Waterways Authority of India (IWAI) is conducting 10,000 km of longitudinal survey each month to assess Least Available Depth (LAD) for improved navigability. Cargo Volume is likely to make an incremental growth up to 156 MTPA by March, 2026 inching closer towards the Maritime India Vision 2030 target of 200 MTPA.

Speaking on the occasion, the Union Minister Shri Sarbananda Sonowal said, “Inland waterways are emerging as the watershed moment in India’s logistics and transport ecosystem. Under the visionary leadership of Prime Minister Narendra Modi ji, we are witnessing a transformational shift with policy interventions like the National Waterways Act, 2016, the Inland Vessels Act, 2021 and supplemented by multiple programmes like Jal Marg Vikas Project, Arth Ganga, Jalvahak scheme, Jal Samriddhi scheme, Jalyan & Navic among others. Through Maritime India Vision 2030 and the Maritime Amrit Kaal Vision 2047. These roadmaps are not just policy documents—they are catalysts driving India toward becoming a global maritime powerhouse. Today’s meeting with esteemed Members of Parliament reflects a unified commitment to boost infrastructure and unlock the immense economic potential of our rivers and coasts. With enhanced budgetary support and cooperative federalism, we are building a greener, more efficient, and future-ready waterway network across the country.”

The Regional Waterways Grid aims to boost economic activity by ensuring seamless vessel movement from Varanasi to Dibrugarh, Karimganj, and Badarpur via the IBP route, creating a 4,067 km economic corridor. A traffic study and DPR for renovating the Jangipur navigation lock are underway. The project’s cargo potential is estimated at 32.2 MMTPA by 2033.

On NW 1 (Ganga), a dedicated waterway corridor spanning 1,390 km is being developed to enable seamless movement of vessels, enhancing the efficiency of inland transport. As part of this initiative, capacity augmentation of NW-1 is underway to support the navigation of 1,500–2,000 DWT vessels, alongside the creation of key cargo handling facilities at Varanasi (MMT), Kalughat (IMT), Sahibganj (MMT), and Haldia (MMT).

Inland Waterways has major projects in the Northeast. A ₹5,000 crore roadmap is planned over the next five years. On NW-2 (Brahmaputra), four permanent terminals—Dhubri, Jogighopa, Pandu, and Bogibeel—and 13 floating terminals are supported by fairway and navigation upgrades. A ₹208 crore ship repair facility at Pandu and a ₹180 crore alternative road are set for completion by 2026 and 2025, respectively. On NW-16 (Barak), terminals at Karimganj and Badarpur are active, while NW-31 (Dhansiri) is being developed to support NRL’s expansion.

Adding further, Shri Sarbananda Sonowal said, “In line with the Harit Nauka Guidelines, the Inland Waterways Authority is committed to green and sustainable transport solutions, including the procurement of electric catamarans and hydrogen fuel cell-powered vessels. By strengthening urban water transport through water metro projects and promoting eco-friendly cruise tourism, we are paving the way for a cleaner, greener future in inland waterways transportation. The Regional Waterways Grid aims to seamlessly connect Assam and the Northeast with the rest of India through an integrated network of inland waterways. This will boost regional trade, tourism, and connectivity while unlocking economic potential across the Brahmaputra and Barak River systems. Government is also working on a ₹5,000 crore roadmap for Inland Waterways Development in Northeast Over Next 5 Years.”

The committee also reviewed the ongoing works on NW -1 (river Ganga), NW 2 (Brahmaputra) among other states like Odisha, Jammu & Kashmir, Goa, Kerala, Maharashtra, Andhra Pradesh, Gujarat, Madhya Pradesh, Karnataka, and Tamil Nadu.

India’s river cruise tourism is witnessing robust growth, with 15 river cruise circuits now operational across 13 National Waterways (NWs) spanning nine states. The number of NWs supporting river cruises has risen from just three in 2013-14 to 13 in 2024-25, while luxury river cruise vessels have increased significantly from three to 25 during the same period. To further boost inland water-based tourism, 51 additional cruise circuits have been identified on 47 NWs for development by 2027. Three World class river cruise terminals are also planned, with construction underway at Kolkata. Feasibility studies for terminals at Varanasi and Guwahati are being conducted by IIT Madras, while four more terminals at Silghat, Bishwanath Ghat, Neamati, and Guijan are set to be developed by 2027.

Speaking on the occasion, Minister of State for Ports, Shipping and Waterways, Shri Shantanu Thakur said, “Special efforts are underway to advance river cruise tourism across India by developing modern cruise terminals and related infrastructure. Through strategic partnerships and MoUs with private enterprises, we are boosting luxury river cruises on the Ganga and Brahmaputra, while also expanding cruise tourism on the Yamuna, Narmada, and key rivers in Jammu & Kashmir. These initiatives not only promote tourism but also contribute to sustainable economic growth in the regions we serve.”

The Consultative Committee meeting was chaired by the Union Minister of Ports, Shipping & Waterways, Shri Sarbananda Sonowal while Minister of State for Ports, Shipping & Waterways, Shri Shantanu Thakur was also present. The meeting was attended by Shatrughan Prasad Sinha, Lok Sabha MP (Asansol, West Bengal), Bibhu Prasad Tarai, Lok Sabha MP (Jagdispur, Odisha), Hibi Eden, Lok Sabha MP (Ernakulum, Kerala), M.K. Raghavan, Lok Sabha MP (Kozhikode, Kerala), Naba Charan Majhi, Lok Sabha MP (Mayurbhanj, Odisha), Abhimanyu Sethi, Lok Sabha MP (Odisha) and Seema Dwivedi (Rajya Sabha MP from Uttar Pradesh).

Bids-5

Ref.: MCM/ADM/11 28 May 2025

The Director General

Bombay Chamber of Commerce and Industry

Mackinnon Mackenzie Building

3rd floor, 4, Shoorji Vallabhdas Road

Ballard Estate, Mumbai – 400 001

Dear Sir/Madam,

Invitation for Bids

Please see enclosed notices for invitation for bids from organizations in Mauritius.

Prospective bidders may be requested to regularly visit the website to take cognizance of any addendum and/or clarification(s) issued.

The Consulate would highly appreciate if you could kindly circulate the Notices among the members of your Organization.

Thank you for your understanding and cooperation.

Yours sincerely,

D. K. Bucktowar

Consul and Head of Mission

Consulate of the Republic of Mauritius

1107, Regent Chambers

11th Floor, Jamnalal Bajaj Marg

208, Nariman Point

Mumbai – 400 021

Tel. : 022 22825421 /22

Fax No. 022 22845468

Gratuity is protected from attachment only when it is received by the employee and not by the legal heirs – Delhi HC

MSME credit growth in India soars to ₹35.2 lakh crore amid financial resilience

MSME credit growth in India soars to ₹35.2 lakh crore amid financial resilience

India’s Micro, Small and Medium Enterprises (MSME) sector has seen robust growth in its commercial credit portfolio, rising by 13% year-over-year (YoY) as the total credit exposure reached Rs 35.2 lakh crore by the end of March 2025. This surge has primarily been attributed to an increased supply of credit to existing borrowers, as outlined in the latest MSME Pulse Report from TransUnion CIBIL and the Small Industries Development Bank of India (SIDBI). The MSME sector includes borrowers with credit exposures up to Rs 50 crore.

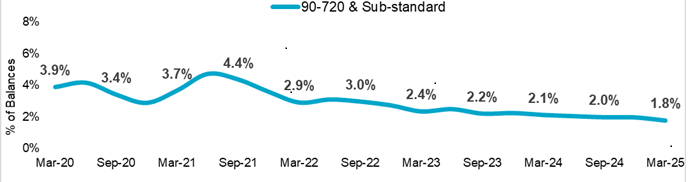

Alongside this expansion in credit, the sector has witnessed a notable improvement in balance-level serious delinquencies — measured as 90 to 720 days past due (DPD) and reported as ‘sub-standard’, which dropped to a five-year low of 1.8%. This improvement, particularly among borrowers with exposures ranging from Rs 50 lakh to Rs 50 crore, marked a 35 basis points decline from the previous year. In contrast, borrowers with exposures of up to Rs 10 lakh saw a slight deterioration, with delinquency levels climbing to 5.8% from 5.1% a year earlier. Similarly, delinquency rates among those with exposures between Rs 10 lakh and Rs 50 lakh rose marginally to 2.9%.

Highlighting the significance of MSMEs to the economy, Manoj Mittal, Chairman and Managing Director of SIDBI, noted that the sector plays a vital role in employment generation and export growth. “Though the credit flow to the sector has improved over the years, the sector still has an addressable credit gap. Providing support to MSMEs can help the sector’s growth and aid the overall economic growth of our country,” he said, underscoring the need for continued efforts to foster innovation, enhance skill development and improve access to financial resources.

While demand for commercial credit grew by 11% year-over-year in the quarter ending March 2025, supply increased at a slower pace, rising by just 3% YoY in the financial year 2024-25. The last quarter of the fiscal year, however, saw an 11% decline in credit supply, possibly due to heightened caution among lenders in response to external economic uncertainties. Nevertheless, credit extended through new cash credit facilities demonstrated resilience, posting a 7% YoY increase. The share of New-to-Credit (NTC) MSME borrowers among total loan originations remained significant at 47%, although lower than the 51% recorded a year earlier.

Public sector banks played a key role in supporting new borrowers, accounting for 60% of NTC loan originations in the quarter ending March 2025. The trade sector contributed the largest proportion of NTC borrowers at 53%, while the manufacturing sector recorded the highest year-over-year growth at 70% in the number of new MSME borrowers securing commercial loans.

Bhavesh Jain, MD and CEO of TransUnion CIBIL, asserted that MSMEs require assistance in accessing formal credit and managing debt effectively. “Fluctuations in the business cycle affect these enterprises disproportionately, as they often lack the financial reserves or support necessary to navigate adverse conditions. Therefore, it is crucial to extend support to this sector and equip them with tools for effective financial management,” he said.

Despite representing only 23% of total loan originations, the manufacturing sector commanded a greater share of the origination value at 34%. However, its share of loan originations by value has steadily declined over the last two years, shifting towards professionals, other services and other industries, which now account for 36% of new loan disbursements –– an increase of five percentage points over the past four years.

Geographically, Maharashtra, Gujarat, Tamil Nadu, Uttar Pradesh and Delhi continued to lead in commercial lending, collectively accounting for 48% of overall originations in the quarter ending March 2025. While the manufacturing sector dominated originations in Maharashtra, Gujarat, Tamil Nadu and Delhi, Uttar Pradesh saw the highest number of loans granted to the trade sector.

(Write to us at editorial@bombaychamber.com)

There is no ceiling or cap on the number of children to claim maternity benefit – Supreme Court

There is no ceiling or cap

on the number of children to claim maternity benefit

Copy of judgement attached.

India Participates in 9th BRICS Industry Ministers’ Meeting in Brasília

India Participates in 9th BRICS Industry Ministers’ Meeting in Brasília

India participated in the 9th BRICS Industry Ministers’ Meeting held under the Chairship of Brazil on 21st May 2025 at the Itamaraty Palace, Brasília – Federal District. The overarching theme of the meeting was “Strengthening Global South Cooperation for More Inclusive and Sustainable Governance”.

The meeting witnessed the presence of Industry Ministers and representatives from all BRICS member countries including Brazil, Russia, India, China, South Africa, as well as newly inducted members Egypt, Ethiopia, Iran, Indonesia, Saudi Arabia, and the United Arab Emirates. The Joint Declaration adopted at the meeting reaffirmed the collective commitment to fostering an open, fair, and resilient global environment, strengthening the multilateral system, and enhancing economic and social resilience amid rapid global transformations.

As a key initiative, India launched the BRICS Startup Knowledge Hub on 31st January 2025, under the aegis of the BRICS Start-Up Forum. This is the first-of-its-kind dedicated platform for BRICS nations, aimed at enhancing cross-border collaboration and strengthening startup ecosystems across member countries. India extended an invitation to all BRICS nations to contribute to and derive benefits from this platform through the exchange of policy insights, innovations, and best practices.

In line with the Joint Declaration, India also emphasized the critical role of Micro, Small, and Medium Enterprises (MSMEs) in the national and global economy. India highlighted that with 5.93 crore registered MSMEs employing more than 25 crore individuals, the sector contributed 45.73% of the country’s total exports in 2023–24.

The Ministers underscored the need to deepen industrial cooperation and promote sustainable and inclusive growth across BRICS nations. The Joint Declaration emphasized the pivotal role of innovation and digital technologies under Industry 4.0 as key drivers of sustainable development. India, in its intervention, articulated its vision for a future-ready industry that is inclusive, innovative, and digitally empowered, aligning with the objectives of the Fourth Industrial Revolution.

It was noted that India’s Digital India campaign has transformed the country into the world’s largest digitally connected democracy. The number of internet users in India increased significantly from 251.59 million in 2014 to 954.40 million as of March 2024.

India concluded its remarks by calling upon BRICS members to be guided by the principles of Sahyog (Collaboration), Samanjasya (Harmony), Samagrata (Inclusiveness), and Sarvasammati (Consensus) in all cooperative endeavours going forward.

Supreme Court summarises legal principles relating to interpretation of standard form employment contracts

Supreme Court summarises legal principles relating to interpretation of standard form employment contracts.

Copy of judgement attached.

Bombay Chamber was invited for interaction with the Select Committee On Income Tax Bill, 2025 today, 16 May 2025.

Bombay Chamber was invited for interaction with the Select Committee On Income Tax Bill, 2025 today, 16 May 2025.

A delegation from Bombay Chamber’s Direct Tax Committee consisting of Pinky Mehta, Sudhir Kapadia, Rajeshree Sabnavis, Ravikant Kamath, Rakesh Gupta and Indra Anand attended the meeting and presented the Chamber’s suggestions.

(Left to Right)

Mr. Ravikant Kamath, Chairperson, Direct Tax Committee, Bombay Chamber & Tax Partner, Ernst & Young LLP

Ms. Indra Anand, Co-Chairperson, Direct Tax Committee, Bombay Chamber & Group Tax Head, Tata Sons Pvt. Ltd.

Mr. Rakesh Gupta, Sr. Vice President and Group Head- Taxation, RPG Group

Ms. Pinky Mehta, President, Bombay Chamber & CFO, Aditya Birla Capital Ltd.

Mr. Sudhir Kapadia, Past President, Mentor to Direct & Indirect Tax Committee, Bombay Chamber & Senior Advisor, EY

Ms. Rajeshree Sabnavis, Senior Advisor, Tax, Regulatory & Consulting Ecosystems, Grant Thornton

Restrictive covenant prescribing a minimum tenure of service is not in restraint of trade or opposed to public policy – Supreme Court

Restrictive covenant prescribing a minimum tenure of service is not in restraint of trade or opposed to public policy.

Copy of judgement attached

Bids-2

Ref.: MCM/ADM/11 14 May 2025

The Director General

Bombay Chamber of Commerce and Industry

Mackinnon Mackenzie Building

3rd floor, 4, Shoorji Vallabhdas Road

Ballard Estate, Mumbai – 400 001

Dear Sir/Madam,

Invitation for Bids

Please see enclosed notices for invitation for bids from organizations in Mauritius.

Prospective bidders may be requested to regularly visit the website to take cognizance of any addendum and/or clarification(s) issued.

The Consulate would highly appreciate if you could kindly circulate the Notices among the members of your Organization.

Thank you for your understanding and cooperation.

Yours sincerely,

D. K. Bucktowar

Consul and Head of Mission

Consulate of the Republic of Mauritius

1107, Regent Chambers

11th Floor, Jamnalal Bajaj Marg

208, Nariman Point

Mumbai – 400 021

Tel. : 022 22825421 /22

It is a long established fact that a reader will be distracted by the readable content of a page when lookin