Code on Social Security, 2020 comes into effect from 21.11.25

Blog

Top Stories

Code on Social Security, 2020 comes into effect from 21.11.25

The following sections have been brought into force from 21.11.25

1. sections 1 to 14;

2. sub-sections (1) and (2) of section 15;

3. clause (c) of sub-section (1) of section 16;

4. sections 17 to 141;

5. section 143, except the provisions of the Code specified at serial number (v) of S.O. 2060 (E), dated the 3rd May, 2023;

6. sections 144 to 163;

7. Items 1 and 2 and items 4 to 9 of sub-section (1) of section 164;

8. clause (a) and clause (c) of sub-section (2) and sub-section (3) of section 164.

Notification attached.

Employees’ provident fund dues take precedence over the ‘priority’ rights claimed by banks under the SARFAESI Act – Supreme Court.

Employees’ provident fund dues take precedence over the ‘priority’ rights claimed by banks under the SARFAESI Act – Supreme Court.

Judgement attached

Nilesh Shah stresses ‘Mutual Fund Sahi Hai, Par Sirf Equity Nahin Hai’ at Bombay Chamber Mutual Fund Conclave 3.0

Nilesh Shah stresses ‘Mutual Fund Sahi Hai, Par Sirf Equity Nahin Hai’ at Bombay Chamber Mutual Fund Conclave 3.0

“Mutual Fund Sahi Hai, par sirf equity nahin hai,” said Nilesh Shah, Past President of the Bombay Chamber and Group President & Managing Director of Kotak Mahindra Asset Management Company, in his special address at Mutual Fund Conclave 3.0, organised by the Bombay Chamber in Mumbai. Shah noted that while the industry has effectively built trust in mutual funds, the next phase of growth must expand investor awareness and product adoption beyond equities.

Reviewing the industry’s evolution, Shah pointed out that mutual funds have often provided exit routes to both FPIs and promoters, and reminded that such actions must always remain aligned with the long-term interests of Indian investors. India, he said, enjoys a rare alignment between investors and distributors, placing the domestic mutual fund industry among the most transparent globally.

He highlighted a key contrast: even with ₹80 lakh crore in assets under management, Indians continue to hold large sums of idle cash and participate heavily in derivatives—despite nine out of ten derivative traders losing money. He juxtaposed this with the remarkable success of the SEBI-mandated “Mutual Fund Sahi Hai” campaign, which reached over five crore individuals and played a pivotal role in shaping a more informed investor base. Yet, he observed that while equity participation has risen sharply, categories such as debt and precious metals remain significantly under-represented compared to traditional physical holdings.

Shah cited the example of a woman saving for months to buy gold jewellery—despite high making charges and limited financial returns—to illustrate how investment behaviour is shaped by generations of habit, not short-term persuasion. He urged the industry to build products and investor engagement models that appeal to safety-seeking savers, supporting them on the journey from traditional accumulation to structured financial growth.

Setting the theme for the Conclave, Navneet Munot, Director at the Bombay Chamber and Managing Director & CEO of HDFC Asset Management Company, in his video address, reflected on the role of mutual funds in helping build a more inclusive and confident financial Bharat. He noted that India is transitioning from a nation of savers to a nation of investors, with nearly 60% of new SIP registrations now coming from Tier-2 and Tier-3 cities. Monthly SIP flows of ₹29,000 crore and annual domestic equity flows of nearly $40 billion reflect a structural shift in household financial behaviour, reducing dependence on foreign capital. Munot described this as a “silent revolution,” built on track record, transparency, technology and investor training—pillars that have strengthened trust and widened participation. He urged the industry to maintain its mission-led approach as India progresses toward 2047, ensuring that capital markets contribute to broad-based prosperity and long-term value creation.

The first panel discussion of the day, Mutual Funds – Mobilising Savings from Bharat, led by Moderator Neil Borate, Editor-in-Chief, thefynprint, featured panellists Madhu Lunawat (Founder & CEO, The Wealth Company Asset Management), Swarup Mohanty (Vice Chairman & CEO, Mirae Asset Investment Managers) and Chitra Iyer (CEO, MFA), highlighted the importance of improving relevance and access for first-time investors, particularly across Bharat. Chitra Iyer, CEO of MFA, stressed that SIPs must be treated not as products but as behavioural commitments, and called for communication that empowers investors rather than merely sells to them. Swarup Mohanty, Vice Chairman & CEO of Mirae Asset Investment Managers, posed a fundamental question—why don’t more Indians feel the need to invest—and encouraged deeper reflection on making mutual funds more meaningful to new investors. Madhu Lunawat, Founder & CEO of The Wealth Company Asset Management, advocated for a hybrid distribution model that blends digital outreach with personal engagement, noting that many distributors still lack even a basic online presence. Rishi Kohli, CIO of JioBlackRock Mutual Fund, observed that digital partners often focus disproportionately on new customer acquisition, and stressed the need for stronger post-investment support, including service infrastructure and call-centre capabilities, to empower and retain investors.

A Fireside Chat with Sundeep Sikka, Chairman of AMFI and ED & CEO of Nippon Life India AMC, conducted by Latha Venkatesh, Executive Editor, CNBC-TV18, explored the growing footprint of mutual funds across the country. Sikka remarked that directly or indirectly, every Indian is already a mutual fund investor, and highlighted that financial behaviour is shaped slowly through experience, trust, and sustained education. He called on the industry to scale responsibly, build deeper investor touchpoints, and continue nurturing a data-led, trust-driven investing culture across Bharat.

The second panel of the day, titled Mutual Funds & IPOs – Growth Drivers for a Viksit Bharat, was moderated by Niraj Shah, Executive Editor, NDTV Profit, and brought together Dhiraj Relli (MD & CEO, HDFC Securities Ltd), B. Gopkumar (MD & CEO, Axis AMC), and D.P. Singh (DMD & Joint CEO, SBI Mutual Fund). Relli highlighted the importance of professionally managed portfolios, particularly for individuals who lack the time or expertise to manage investments, and pointed to GIFT City as a gateway opening global markets to Indian investors. Gopkumar stressed the need to support households in building wealth prudently even during expensive market phases, reinforcing the value of discipline and long-term investing. Singh noted that while current flows remain concentrated in regulated markets, India is steadily moving toward greater participation in private markets—a shift that could unlock substantial wealth creation.

Bombay Chamber Sustainability Conclave focuses on Circular Economy and product innovations needed to achieve material efficiency

Bombay Chamber Sustainability Conclave focuses on Circular Economy and product innovations needed to achieve material efficiency

Bombay Chamber’s annual Sustainability Conclave 2025 held yesterday at the St Regis Hotel Mumbai, focused on Closing the Loop: Circular Pathways to Business.

With a line-up of eminent leaders in the field, the Conclave touched upon the current scenario in circularity and the challenges within. Panelists were in agreement that policy interventions were the need of the hour to incentivise players who have entered the field.

In his theme setting address, Anirban Ghosh, Head – Centre for Sustainability, Mahindra University and chairperson Sustainability Committee, Bombay Chamber said, “Our societal norms often encourage uncontrolled consumption and waste, which harms the environment. This is where the concept of a circular economy comes in – a system that promotes sustainability and efficient use of resources. The need for a circular economy is urgent, as there’s no Planet B to fall back on.

To achieve this, we need to adopt pathways like reducing the use of virgin materials and increasing the lifespan of materials in use. Research in circular economy is gaining momentum, focusing on: Circular materials and bio-based polymers and urban mining and e-waste recovery.”

He observed that the potential value from waste management is substantial. “Just a few years ago, the value was negligible, but now it’s over ₹100 crores. This shift highlights the importance of embracing a circular economy and rethinking our relationship with resources, “he said.

This was followed by a panel discussion on Beyond Compliance: Leveraging EPR for Business Sustainability. The panel was moderated by Abhishek Deshpande – Co-Founder & COO, Recykal and the panelists included Alok Chandra – Chief HSE & Sustainability Officer, Tata Chemicals; Ramnath Vaidyanathan – Head – Environmental Sustainability Godrej Industries Group; Prabodha Acharya – Chief Sustainability Officer, JSW Group and Abhinay Lakhmapure, Chief Business Officer – Sustainability, The Shakti Plastic Industries.

This was followed by a Fireside Chat on Collaboration Across Value Chains: Building Ecosystems for Circular Growth between Prof. Vikram Vishal, Professor and Convener, National Centre of Excellence in CCUS, IIT Bombay, Co-founder and CEO, UrjanovaC and Sumit Issar, MD & CEO, Mahindra Accelo Ltd. and Mahindra Steel Service Centre Ltd.; Director, CERO (Mahindra MSTC Recycling Pvt. Ltd.); Board Member, Mahindra Auto Steel Pvt. Ltd., Mahindra Middle East, and PT Mahindra Auto Steel Indonesia. Issar outlined the purpose of setting up CERO – to bring the hassle-free vehicle recycling experience to every doorstep and help everyone contribute towards a greener future. Prof Vishal spoke about the initiatives IIT Bombay is doing in the field of circularity.

The second panel discussion was on Design to Disposal: Product Innovation, Data and Material Efficiency. The session was moderated by Sandeep Kumar Mohanty, PwC, Partner – Sustainability Transformation, iBT, One Consulting and the panel members were Surya Valluri – Chief Sustainability Officer, Grasim Industries; Dr. Neeru Bansal – Chief Sustainability Officer, Cement Business, Adani Group; Pratibha Dewett – Chief Sustainability Officer, Lucro Plastecycle and Nishtha Gupta– Group Head – Sustainability & ESG, Suzlon Energy. The panel deliberated on how it is necessary for organisations to move from compliance to competitiveness and design products sustainable by nature. They agreed that scalability brings competitiveness and this will come only when consumers are aware of it. Brands and value chains need to brand around circularity which is not the scenario at the moment. They also discussed how digitalization can help move the needle on circularity.

EPFO’s 18 January 2025 circular restricting higher pension to retirees struck down by Calcutta High Court

EPFO’s 18 January 2025 circular restricting higher pension to retirees struck down by Calcutta High Court

Judgement attached.

Digital Personal Data Protection (DPDPA) Rules, 2025 published for public comments

Digital Personal Data Protection (DPDPA) Rules, 2025 published for public comments

Notification attached.

Credit guarantee scheme aims to boost India’s export competitiveness.

Credit guarantee scheme aims to boost India’s export competitiveness

Mumbai: The Union Cabinet’s approval of the Credit Guarantee Scheme for Exporters (CGSE) is expected to provide a significant boost to India’s export-oriented industries, particularly micro, small and medium enterprises (MSMEs). The scheme, to be implemented by the Department of Financial Services (DFS) through the National Credit Guarantee Trustee Company Limited (NCGTCL), will extend collateral-free credit support of up to ₹20,000 crore to eligible exporters. Member Lending Institutions (MLIs) will receive 100 per cent guarantee coverage, reducing risk and enabling them to provide additional credit facilities to businesses engaged in international trade. A management committee chaired by the secretary of the DFS will oversee implementation, ensuring accountability and monitoring progress.

Exports remain a critical pillar of the Indian economy, accounting for nearly 21 per cent of gross domestic product (GDP) in FY2024-25 and contributing substantially to foreign exchange reserves. Export-oriented industries directly and indirectly employ more than 45 million people, with MSMEs responsible for nearly 45 per cent of total exports. The CGSE is therefore positioned to strengthen liquidity across a wide base of enterprises, ensuring smoother operations and supporting employment in sectors that are highly sensitive to global demand fluctuations.

The scheme is expected to enhance the global competitiveness of Indian exporters by enabling them to diversify into new and emerging markets. Access to collateral-free credit will allow businesses to invest in product development, expand production capacity and meet compliance requirements in overseas markets. For MSMEs, which often face difficulties in securing affordable finance, the guarantee mechanism offers a pathway to scale operations and participate more effectively in global supply chains.

India has set an ambitious target of achieving $1 trillion in exports, and sustained growth in this area is vital for maintaining macroeconomic stability. By addressing liquidity constraints, the CGSE provides exporters with the financial flexibility needed to navigate tariff barriers, rising costs and slowing demand in traditional markets. The scheme also reinforces the government’s broader objective of building resilience in the economy and advancing the vision of Aatmanirbhar Bharat.

Export-oriented industries such as textiles, engineering goods, pharmaceuticals and handicrafts stand to benefit from the initiative. These sectors have consistently contributed to India’s trade performance but face challenges in accessing timely credit. The CGSE offers a structured solution by reducing risk for lenders and ensuring that exporters, particularly smaller firms, are not excluded from financial support due to lack of collateral.

To make this scheme a success, effective execution will be essential, along with exporters’ ability to use the additional liquidity for expanding markets and strengthening competitiveness. If carried out efficiently, the CGSE has the potential to play a pivotal role in sustaining export growth while supporting millions of jobs connected to the sector.

(Write to us at editorial@bombaychamber.com)

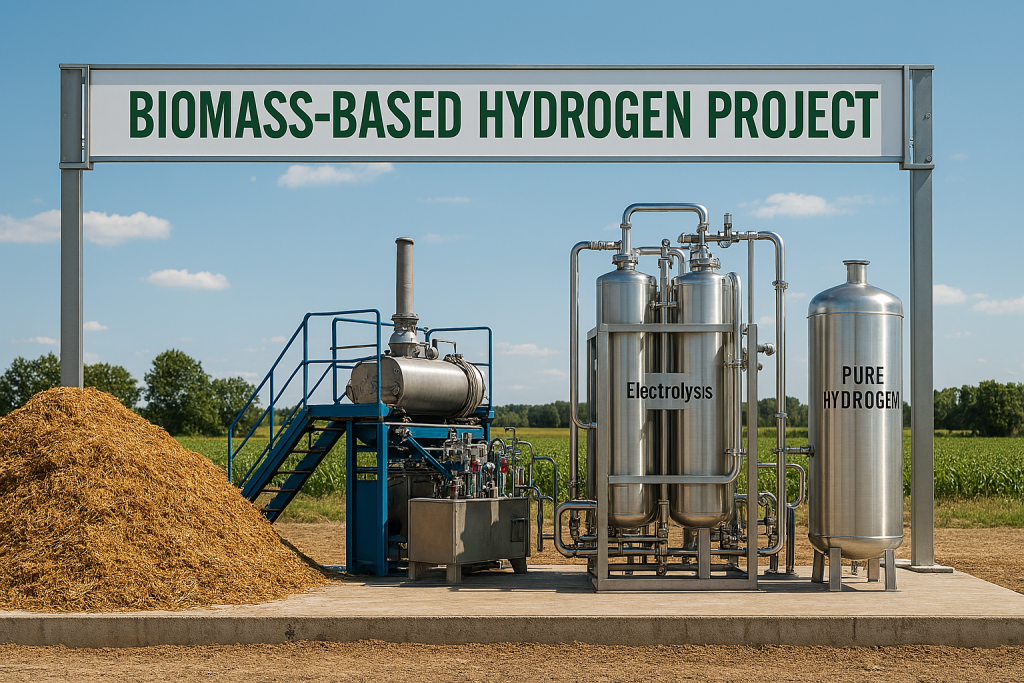

Government targets startups, industrial players with ₹100 crore biomass hydrogen fund

Government targets startups, industrial players with ₹100 crore biomass hydrogen fund

Mumbai: The Indian government has unveiled a ₹100 crore funding initiative aimed squarely at startups, industrial players and research institutions developing biomass-based green hydrogen technologies. The initiative invites proposals for pilot projects that convert biomass and waste materials into green hydrogen, with the Biotechnology Industry Research Assistance Council (BIRAC) designated to oversee its implementation. Union Minister for New & Renewable Energy Pralhad Joshi unveiled the scheme at the 3rd International Conference on Green Hydrogen in New Delhi, highlighting the importance of diversifying hydrogen production pathways beyond conventional electrolysis.

The initiative falls under the National Green Hydrogen Mission (NGHM), launched in 2023 with a budget of ₹19,744 crore. The mission aims to decarbonise hard-to-abate sectors and position India as a global hub for green hydrogen. According to the Ministry of New and Renewable Energy, the scheme is intended to catalyse innovation in thermochemical and biochemical conversion processes, as well as in hydrogen storage, transport and end-use applications. Each selected project could receive up to ₹5 crore, with the goal of demonstrating scalable and cost-effective solutions.

The move comes amid growing interest in alternative hydrogen pathways that can leverage India’s agricultural and organic waste streams. By supporting decentralised production models, the government hopes to reduce reliance on water-intensive electrolysis and promote rural innovation.

The NGHM has already made headway through its Strategic Interventions for Green Hydrogen Transition (SIGHT) programme. Incentives have been awarded for 3,000 MW per annum of domestic electrolyser manufacturing and 8.62 lakh metric tonnes per annum of green hydrogen production. India currently records the world’s lowest green ammonia price at ₹49.75 per kg for 7.24 lakh metric tonnes per annum of output.

Additional investments include ₹132 crore in green steel pilots, ₹208 crore for hydrogen-fuelled vehicles and refuelling stations, and ₹35 crore for the country’s first hydrogen bunkering facility at V.O. Chidambaranar Port. The government has also approved 43 hydrogen-related skill qualifications and certified over 6,300 trainees to support workforce development.

Speaking at the conference, Principal Scientific Adviser Prof. Ajay K. Sood noted that India enjoys a cost advantage in green hydrogen production compared to several other nations, which could enable it to become a major exporter to markets such as the European Union, Japan and South Korea.

The biomass pilot scheme is expected to attract early-stage innovators and contribute to the broader goal of building a resilient and inclusive hydrogen ecosystem. As India moves towards its target of 500 GW of renewable capacity by 2030, the success of such initiatives will be critical in shaping the country’s energy transition.

(Write to us at editorial@bombaychamber.com

Bids-5

Ref.: MCM/ADM/11

The Director General

Bombay Chamber of Commerce and Industry

Mackinnon Mackenzie Building

3rd floor, 4, Shoorji Vallabhdas Road

Ballard Estate, Mumbai – 400 001

Dear Sir/Madam,

Please see enclosed notices for invitation for bids from organizations in Mauritius.

Prospective bidders may be requested to regularly visit the website to take cognizance of any addendum and/or clarification(s) issued.

The Consulate would highly appreciate if you could kindly circulate the Notices among the members of your Organization.

Thank you for your understanding and cooperation.

Yours sincerely,

1107, Regent Chambers

11th Floor, Jamnalal Bajaj Marg

208, Nariman Point

Mumbai – 400 021

Tel. : 022 22825421 /22

It is a long established fact that a reader will be distracted by the readable content of a page when lookin