Blog

Top Stories

RBI Deputy Governor unveils product offerings for transforming ATM infrastructure at GFF 2024

At the Global Fintech Fest (GFF) 2024, the Reserve Bank of India (RBI) Deputy Governor Shri T. Rabi Sankar announced the launch of product offerings aimed at transforming the ATM infrastructure in the country. Unveiled in association with National Payments Corporation of India (NPCI), the initiatives include UPI Interoperable Cash Deposit (UPI-ICD) and banks showcasing Digital Banking Units (DBUs).

The introduction of UPI ICD allows customers to deposit cash at ATMs operated by banks and white label ATM operators (WLAOs) using UPI to their own bank account or any other bank account without the need for a physical card. These ATMs are cash recycler machines which are used for both cash deposits and withdrawals. Leveraging their mobile numbers linked to UPI, virtual payment addresses (VPA) and account IFSCs, customers can now make cash deposits, making the process more seamless, inclusive and accessible.

Consumers will be able to access these features as the banks gradually roll them out. ATM machines with open architecture can host bank apps positioning them as DBUs offering cash deposits, withdrawals and other banking services such as opening bank accounts, applying for credit cards, initiate fixed deposits, applying for safe deposit lockers, etc. Additionally, recently at the GFF 2024, Shri Vivek Deep, Executive Director, RBI announced rebranding of Bharat Bill Payment System (BBPS) to Bharat Connect. This is an important step to refresh and strengthen BBPS brand. Bharat Connect embodies NPCI Bharat BillPay’s (NBBL’s) values and vision for stakeholders and customers, going beyond a bill payment system to create an ecosystem that connects individuals and businesses, through an integrated platform. The launches took place in the presence of Shri Ajay Kumar Choudhary, Non-Executive Chairman and Independent Director, NPCI.

Department for Promotion of Industry and Internal Trade (DPIIT) prepares for Special Campaign 4.0

Department for Promotion of Industry and Internal Trade (DPIIT) prepares for Special Campaign 4.0

Department for Promotion of Industry and Internal Trade (DPIIT) is preparing for the implementation of Special Campaign 4.0 for institutionalising Swachhata and minimising pendency in the department and across 19 organisations under its administrative control. The Preparatory Phase of the Campaign will start from 16th to 30th September 2024 to identify targets in respect of Pendency’s of PMO, VIP, State Govt., MP, Cabinet References, and Record/Space Management. While the Implementation Phase will start from October 2, 2024 and will last up to October 31, 2023. During the Implementation Phase special focus will be on achieving the targets identified.

With the beginning of the preparatory phase of the Special campaign, approx. 70 field/outstation offices have been identified under its 19 Attached, Subordinate, and Autonomous Organisations spread across the country for conducting Special Campaign 4.0. Guidelines have been shared with all field functionaries to mobilise their efforts to prepare for the Special Campaign 4.0. Training on Record Management was conducted for ASO/SO/US/DS/Dir. level officers of DPIIT for efficient management of Record and Space.

In its earlier administrative efficiency spree, DPIIT successfully completed various activities under Special Campaign 3.0 for institutionalising Swachhata and minimising pendency in the Government. DPIIT and its 19 Attached, Subordinate and Autonomous Organisations spread across the country, participated in the Campaign and achieved overwhelming results in reducing the pendency.

Resignation can be withdrawn before it’s acceptance is communicated to the employee – Supreme Court

Eid-e-Milad holiday in Mumbai district rescheduled from 16 September 2024 to 18 September 2024.

The Supreme Court held that Internal communication about accepting the employee’s resignation letter could not be said to be acceptance of the resignation letter. It added that unless such acceptance was communicated to the employee, the resignation could not be deemed to be accepted.

Copy of judgement attached.

Eid-e-Milad holiday in Mumbai district rescheduled from 16 September 2024 to 18 September 2024.

Eid-e-Milad holiday in Mumbai district rescheduled from 16 September 2024 to 18 September 2024.

The Government of Maharashtra has issued a notification dated 13.9.24 rescheduling the public holiday of Eid-e-Milad to Wednesday, September 18, 2024 instead of Monday, September 16, 2024.

Copy of notification attached.

Procurement Notice – State Pharmaceuticals Corporation of Sri Lanka

We wish to inform you that, the Chairman, Standing Cabinet Appointed Procurement Committee of the Ministry of Health has invited sealed bids for supply of following items to the Ministry of Health for year 2024.

| Bid Number | Closing Date & Time | Item Description | Non – refundable Bid Fee (LKR) |

| DHS/P/C/WW/05/23 | 07.10.2024

at 10.00 a.m. |

6,000 vials of Tenecteplase

Injection 40mg vial. |

100,000/-+ Tax |

Please find attached herewith a copy of the procurement notice of the above.

It would be appreciated, if you could kindly make necessary arrangements to disseminate the same among your membership.

Thank you.

With warm regards,

Shirani Ariyarathne

Actg. Consul General

Minister (Commercial)

Consulate General of Sri Lanka

34, Homi Mody Street, Fort

Mumbai 400001

Tel: (+ 91 22 )22045861/22048303

Fax: (+ 91 22) 22876132

E -mail: slcg.mumbai@mfa.gov.lk

It would be appreciated, if you could kindly make necessary arrangements to disseminate the same among your membership.

Invitation for Bids (IFB) – Ceylon Petroleum Storage Terminals Limited.

Invitation for Bids (IFB) – Ceylon Petroleum Storage Terminals Limited.

Contract No. KPR/60/2024 – Repairs to Petrol Loading Tanks No. TK-31 and TK-32 at Muthurajawela Terminal

We wish to inform you that, the Chairman, Ministry Procurement Committee (MPC), on behalf of the Ceylon Petroleum Storage Terminals Limited has invited sealed bids from eligible and qualified bidders for Repairs to Petrol Loading Tanks No. TK-31 and TK-32 at Muthurajawela Terminal. The total construction period is 300 calendar days.

Closing date for the submission of above IFB is on or before 1400 hrs (Sri Lanka local time GMT+5:30) on 11th October 2024.

Please find attached herewith a copy of the procurement notice of the above.

It would be appreciated, if you could kindly make necessary arrangements to disseminate the same among your membership.

Thank you.

With warm regards,

Shirani Ariyarathne

Actg. Consul General

Minister (Commercial)

Consulate General of Sri Lanka

34, Homi Mody Street, Fort

Mumbai 400001

Tel: (+ 91 22 )22045861/22048303

Fax: (+ 91 22) 22876132

E -mail: slcg.mumbai@mfa.gov.lk

Invitation for Bids – Ministry of Defence

Invitation for Bids – Ministry of Defence.

Commercial Explosives, Firearms and Ammunition Procurement Unit (CEFAP) Welisara, Ragama

We wish to inform you that, the Chairman, Department Procurement Committee of Sri Lanka Navy on behalf of Commercial Explosives, Firearms and Ammunition Procurement Unit (CEFAP) has invited sealed bids from eligible and qualified bidders for following Electric Detonators.

| File No | Description | Quantity |

| CEFAP/PRT/05/2022 | Red Phospurus | 6,000 Kgs |

| CEFAP/PRT/08/2022 (SD)

|

Electric Detonators (4 MTR) | 1,000,000 Nos |

Closing date for the submission of above bid is on 24th September 2024 at 1400 hrs (Sri Lanka local time GMT+5:30).

Please find attached herewith a copy of the paper advertisement of the above.

Thank you.

With warm regards,

Shirani Ariyarathne

Actg. Consul General

Minister (Commercial)

Consulate General of Sri Lanka

34, Homi Mody Street, Fort

Mumbai 400001

Tel: (+ 91 22 )22045861/22048303

Fax: (+ 91 22) 22876132

E -mail: slcg.mumbai@mfa.gov.lk

It would be appreciated, if you could kindly make necessary arrangements to disseminate the same among your membership.

MSME Conclave 2024 Focuses on Funding the Backbones of India’s Economy

MSME Conclave 2024 Focuses on Funding the Backbones of India’s Economy

Mumbai – Micro, Small, and Medium Enterprises (MSMEs) are the backbone of India’s economy, comprising over 6 crore enterprises that contribute significantly to employment, innovation, and economic diversification. Despite their importance, MSMEs often face significant challenges in accessing adequate and timely finance, hindering their growth potential. The Bombay Chamber of Commerce & Industry hosted the 2024 MSME Conclave, focusing on the crucial theme of “Financing SME Growth.”

In her welcome address, Pinky Mehta, President of the Bombay Chamber, and Director, Aditya Birla Sun Life Insurance Ltd, highlighted the Chamber’s 188-year legacy in India’s development and its extensive representation of MSMEs. She underscored the Chamber’s commitment to supporting MSMEs in overcoming financial challenges and unlocking their growth potential.

Rajan Raje, Chairperson of the MSME Committee, Bombay Chamber and CEO of Nichem Solutions, set the theme for the Conclave. He emphasised that while the MSME sector is the largest employment generator, it often lacks professionalism and resources. He acknowledged the government’s initiatives, such as the New Credit Guarantee Scheme, increased Mudra Loan limits, and the expansion of the TReDS platform, which support the sector’s growth. “The SME sector must think big and explore the export market systematically,” Raje stated, adding that credit availability is largely determined by the “3 C’s” – Cash Flow, Character, and Collateral.

The keynote address was delivered by Nilesh Shah, Group President & MD of Kotak Mahindra AMC, who discussed the challenges and opportunities faced by MSMEs. He spoke about the need for resources in the form of equity, debt, and hybrid financing to enable faster growth. Shah highlighted three successful models that MSMEs could emulate: The Morbi Model: Post-flood rebuilding of Morbi into a ceramics hub, now accounting for 90% of India’s ceramics production with $2 billion in exports. The Tirupur Model: Textile manufacturers form a cooperative for efficient cost management and industry-scale benefits, including centralised purchasing, advertising, and pollution management and the Amul Model: The cooperative that transformed India into the world’s largest milk producer and aims to be the largest FMCG company by 2047. Shah also lauded the Reserve Bank of India’s new system for instant verification of SMEs and borrowers, which will significantly shorten the credit appraisal cycle.

The Conclave featured two insightful panel discussions. The first panel on “Export-Import Financing” for SMEs, moderated by Gopika Gopakumar, Senior Assistant Editor, Livemint, Mr. Sunil Kumar Sharma, General Manager & Zonal Head, Bank of Baroda, Shri Rudra Mishra, Assistant General Manager, SIDBI, N Srinivasan, General Manager Transaction Banking, IDBI Bank and Sheeba Chithajan, DGM (SME) SBI LHO Mumbai Metro. They discussed how their institutions are supporting SMEs in entering and thriving in the export market, including the range of financial products available for the MSME sector. They highlighted the hygiene factors that banks expect SMEs to meet before receiving export support. The panel also examined the challenges MSMEs face in accessing funding, especially for exports to developing countries, and shared success stories and their impacts on SME growth.

The second panel, titled “Financing Through NBFCs,” was moderated by Neil Borate, Deputy Editor at Livemint, and featured Shobha Iyer, Director Commercial at Olea; Shirish Mathur, Head of SME Products & Digital Platforms at Aditya Birla Finance Ltd.; Prakash Sankaran, Managing Director & CEO of Invoicemart; and Sandeep Varma, CEO of the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). The discussion highlighted the crucial role of Non-Banking Financial Companies (NBFCs) in supporting SMEs through tailored financial products, flexible loan terms, and faster processing times compared to traditional banks. The panellists also explored potential solutions, including government subsidies, credit guarantees, and fostering a competitive lending environment to help reduce interest rates.

In a fireside chat titled “Catalysing SME Growth Through Innovative Financing Solutions,” Shri Deependra Singh Kushwah, I.A.S., Development Commissioner (Industries), Government of Maharashtra, discussed government initiatives to support MSMEs, including the MAITRI portal and the MIDC Plug and Play facility. He also requested members of the MSME sector to leverage these tools and initiatives and proactively approach the Government for any support or guidance.

The Conclave also featured a presentation by the Bank of Baroda on “Empowering MSME Growth: Leveraging Our Flagship Products & Trade Finance Offerings,” delivered by Sandeep Prakash, Assistant General Manager of MSME Sales, and Tania Das, Senior Manager of the Forex Department, Mumbai Zone. Additionally, Shirish Mathur presented the facilities and services available to MSMEs on the Aditya Birla Udyog Plus website.

Rajiv Anand, Senior Vice President of the Bombay Chamber and Deputy Managing Director of Axis Bank, delivered the Vote of Thanks . The event was supported by Bank of Baroda, Aditya Birla Finance Ltd., SIDBI, and SBI.

Bombay Chamber CSR Conclave focuses on leveraging Technology for Social Good

Bombay Chamber CSR Conclave focuses on leveraging Technology for Social Good

With the new CSR mandate, companies in India must look to integrate digitalisation into their CSR journeys. Keeping this in context, Bombay Chamber of Commerce & Industry organised its annual CSR Conclave in Mumbai yesterday. The theme of the Conclave was CSR in the Digital Era.

In her opening remarks, Pinky Mehta, President, Bombay Chamber & Chief Financial Officer, Aditya Birla Capital said, “In today’s world, with technology and digital platforms revolutionising the way we live, work, and connect, CSR strategies need to embrace technology for driving meaningful impact.

With AI and Blockchain, ChatGPT and Data Analytics, digitalisation emerges as a potent instrument for organisations to magnify their CSR endeavours, engage stakeholders, and foster a culture of transparency and good governance. Leveraging technology for Social Good is not just a choice anymore, it is an

imperative.”

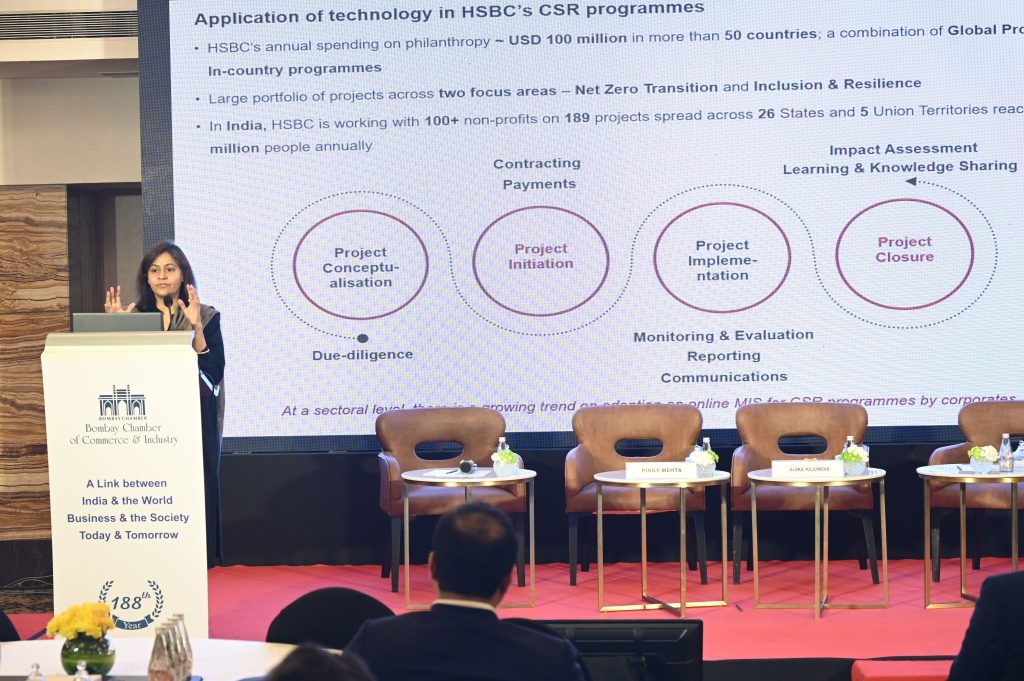

This was followed by a presentation by Aloka Majumdar, Chairperson, CSR Committee, Bombay Chamber and Managing Director, Global Head of Philanthropy & Head of Sustainability, India, HSBC. She shared the practical application of CSR integration into a business, and how she effectively facilitates collaboration and knowledge sharing on this very important area in her organisation.

She pointed out that there is increasing expenditure on CSR – as per the latest Economic Survey, CSR spending has increased from ₹17,096 crore in FY 2017-18 to ₹26,278 crore in FY 2021-22. “There is a growing need for enhanced governance for CSR across the grant cycle; increasing compliance (internal and external); greater focus on measuring outcomes, impact assessment, reporting and communication including disclosures; process improvements and building institutional memory,” she stated.

She elaborated on the need for technology in CSR. “We need to bring in technology and governance to increase compliance, BSR, ESG and other reporting. Raise funds for non-profit organisations and capture the right data,” she added.

The first panel discussion on Technology and Social Entrepreneurship Funding was moderated by Hemant Gupta, MD & CEO, EQUIPPP Desi Investments. The panelists included Anuj Sharma, Founder Director, Alsisar Impact; Jignesh Thakkar, Partner & COO, ESG Advisory & Head, Social & CSR Consulting, KPMG India and Vineet Rai, Founder and Chairman, Aavishkaar Group.

The discussion observed that Technology assists us in multiple sectors, hence it is both an enabler and a solution and service to all. In the role that technology should play in social development, localising the solution is very important.

A Fireside Chat on AI for Social Good saw Rakesh Kaul Punjabi, Technology Consulting Partner, EY India and Dr. Sujata Seshadrinathan, Director – IT, Basiz Fund Services, Mumbai in discussion with Hardik Parikh, Senior Consultant, Sattva.

The discussion revolved around three main aspects – the potential of AI for social good, the Indian AI landscape and how to bolster AI and the CSR system.

The second panel discussion focused on Leveraging Digital Platforms to drive CSR. The session was moderated by Ashwath Bharath, Senior Director, Teach For India and the panelists included Abhejit Agarwal, Head – Sustainability & CSR, Axis Bank; Shrutika Jadhav, Head- Catalytic Philanthropy, Dasra; Gopal Kumar, Head, CSR, Aditya Birla Capital and Prerana Langa, CEO, Aga Khan Agency, Habitat India.

The discussion revolved around using technology to reach out to the community effectively and transparently. The panel also called upon the need to invest in non profit building systems that reduce the time spent on compliance issues and reusing data ethically to be able to make decisions at a meta level.

The event was supported by Excel Industries.

Invitation for Bids (IFB) – Ceylon Petroleum Storage Terminals Limited.

Invitation for Bids (IFB) – Ceylon Petroleum Storage Terminals Limited Contract No. KPR/58/2024 – Consultancies Services for Developing and Implementing a Comprehensive Oil Balance Work of Proposed 6 Nos. Storage tanks at Kolonnawa Installation – Stage 2.

We wish to inform you that, the Chairman, Standing Cabinet Appointed Procurement Committee (SCAPC), on behalf of the Ceylon Petroleum Storage Terminals Limited has invited sealed bids from eligible and qualified bidders for Balance Work of Proposed 6 Nos. Storage Tanks at Kolonnawa Installation – Stage 2.

Closing date for the submission of above IFB is on or before 1400 hrs (Sri Lanka local time GMT+5:30) on 27th September 2024.

Please find attached herewith a copy of the procurement notice of the above.

It would be appreciated, if you could kindly make necessary arrangements to disseminate the same among your membership.

Thank you.

With warm regards,

Shirani Ariyarathne

Actg. Consul General

Minister (Commercial)

Consulate General of Sri Lanka

34, Homi Mody Street, Fort

Mumbai 400001.

Tel: (+ 91 22 )22045861/22048303

Fax: (+ 91 22) 22876132

E -mail: slcg.mumbai@mfa.gov.lk

It is a long established fact that a reader will be distracted by the readable content of a page when lookin