Blog

Bombay Chamber post-budget webinar: Navigating India’s

The Bombay Chamber of Commerce and Industry organised a Post-Budget Analysis Webinar on 5 February 2026, bringing together economists, industry leaders, and policy experts to examine the Union Budget 2026–27 and its implications for India’s growth trajectory amid an increasingly complex global environment.

Delivering the welcome address, Rajiv Anand, on behalf of the Chamber, emphasised that the Union Budget is not merely an annual financial exercise but a strategic statement of national priorities. He noted that post-budget dialogues play a critical role in interpreting policy intent, assessing real-world impact, and enabling businesses to align their strategies with emerging economic priorities.

He highlighted key signals from the Budget, including the record capital expenditure allocation of ₹12.2 lakh crore to strengthen long-term productive capacity, continued emphasis on manufacturing and MSME growth, enhanced focus on connectivity and urban development, targeted policy reforms to support investment-led growth, and a significant defence allocation of approximately ₹7.8 lakh crore underscoring national security and indigenous capability building.

Anand underscored that while these measures present strong opportunities, they also raise important questions around execution, demand recovery, cost structures, exports, and credit availability. He reaffirmed the Bombay Chamber’s role as a trusted bridge between government and industry, committed to equipping its members with clarity, confidence, and actionable insights through knowledge-driven platforms.

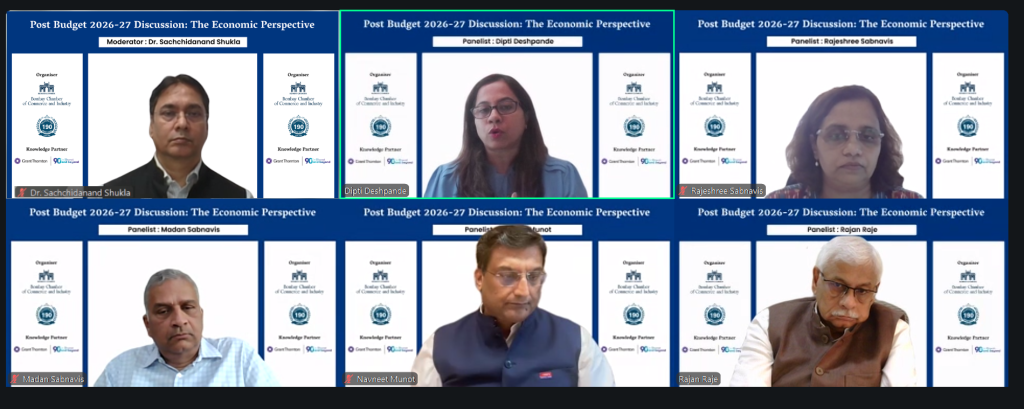

The session was moderated by Dr. Sachchidanand Shukla, Chair, EPRD Committee, Bombay Chamber, and Group Chief Economist, L&T, and featured Navneet Munot, Director, Bombay Chamber, and MD & CEO, HDFC Asset Management Company; Madan Sabnavis, Chief Economist, Bank of Baroda; Rajan Raje, Director, Bombay Chamber, and Founder & CEO, NICHEM Solutions; Dipti Deshpande, Principal Economist, CRISIL; and Rajeshree Sabnavis, Director, Bombay Chamber, and Senior Advisor – Tax, GT Bharat LLP.

Setting the global context, Dr. Shukla observed that the world is entering a phase of heightened uncertainty driven by geopolitical shifts and changing economic assumptions. “We are witnessing a new global disorder, and the Union Budget must be viewed as part of a broader strategy to manage volatility while sustaining growth,” he said.

Providing a macroeconomic assessment, Dipti Deshpande noted that India’s fundamentals remain resilient despite global headwinds. “The macro house is in order, with sustainable growth, moderating inflation, and improved fiscal metrics. This budget extends India’s growth runway through continued capex and structural reforms,” she said.

Explaining fiscal and bond market dynamics, Madan Sabnavis addressed concerns around government borrowing. “The focus should be on net borrowing rather than headline numbers. Fiscal deficit control remains the key anchor, and post-budget market volatility was largely a short-term overreaction,” he said.

From a capital markets perspective, Navneet Munot advised investors to look beyond immediate market movements. “Budget day reactions are often misleading. India’s long-term growth story, supported by strong corporate balance sheets and domestic liquidity, remains firmly intact,” he said.

Addressing taxation and compliance, Rajshree Sabnavis highlighted steps taken to improve predictability and reduce compliance burden. “There is a clear move towards rationalisation, certainty, and lower compliance costs, although customs duty reform remains an area for further progress,” she said.

Focusing on MSMEs, Rajan Raje welcomed the shift from short-term relief to long-term capability building. “The Budget recognises that sustainable MSME growth requires upskilling, integration into formal supply chains, and innovative financing mechanisms,” he said.

The panel also discussed the outlook for the rupee, private sector capex revival, FDI flows, and the balance between public and private investment. Speakers broadly agreed that while the Budget remains capex-led, its success will depend on effective execution and stronger private sector participation.