Blog

Top Stories

Bombay Chamber was invited for interaction with the Select Committee On Income Tax Bill, 2025 today, 16 May 2025.

A delegation from Bombay Chamber’s Direct Tax Committee consisting of Pinky Mehta, Sudhir Kapadia, Rajeshree Sabnavis, Ravikant Kamath, Rakesh Gupta and Indra Anand attended the meeting and presented the Chamber’s suggestions.

(Left to Right)

Mr. Ravikant Kamath, Chairperson, Direct Tax Committee, Bombay Chamber & Tax Partner, Ernst & Young LLP

Ms. Indra Anand, Co-Chairperson, Direct Tax Committee, Bombay Chamber & Group Tax Head, Tata Sons Pvt. Ltd.

Mr. Rakesh Gupta, Sr. Vice President and Group Head- Taxation, RPG Group

Ms. Pinky Mehta, President, Bombay Chamber & CFO, Aditya Birla Capital Ltd.

Mr. Sudhir Kapadia, Past President, Mentor to Direct & Indirect Tax Committee, Bombay Chamber & Senior Advisor, EY

Ms. Rajeshree Sabnavis, Senior Advisor, Tax, Regulatory & Consulting Ecosystems, Grant Thornton

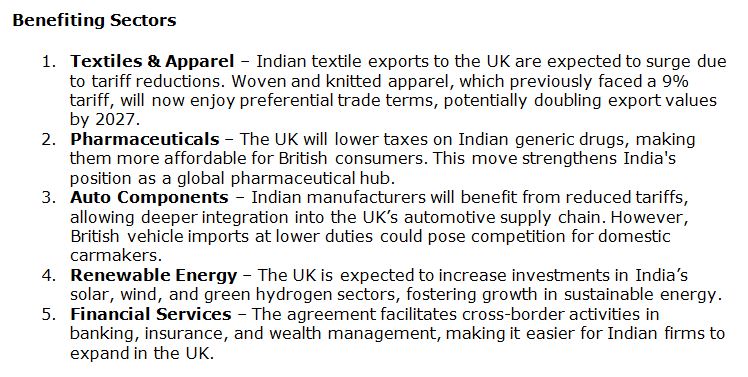

India-UK FTA to enhance bilateral trade, create new job avenues, and boost economic growth

India-UK FTA to enhance bilateral trade, create new job avenues, and boost economic growth

In a landmark move marking a new chapter in global commerce, India and the United Kingdom have successfully concluded a Free Trade Agreement (FTA), bringing an end to years of negotiations. The deal, hailed as a ‘historic milestone’ by Prime Minister Narendra Modi, is expected to significantly enhance bilateral trade, create new job avenues, and boost economic growth.

For India, the agreement presents both opportunities and challenges. While it opens doors for increased exports and foreign investment, it also raises concerns about domestic industries facing heightened competition. The deal is expected to catalyse trade, investment, and innovation, but its long-term impact on India’s economy remains to be seen.

One of the most significant advantages of the FTA is the elimination or reduction of tariffs on a wide range of goods and services. Indian exporters, particularly in labour-intensive sectors such as textiles, footwear, and automobile components, stand to benefit immensely. The UK has agreed to eliminate tariffs on these products, making Indian goods more competitive in the British market.

Additionally, the agreement includes provisions for increased mobility of skilled Indian professionals to the UK, particularly in sectors such as information technology (IT) and healthcare. The Double Contribution Convention, a social security pact, ensures that Indian workers in the UK and their employers are exempt from paying social security contributions for three years, reducing financial burdens and enhancing employment opportunities.

The pharmaceutical and medical device industries are also expected to see a surge in exports, as the UK lowers tariffs on these products. With India being a global leader in generic medicines, this move could significantly boost revenue for Indian pharmaceutical firms.

While the agreement offers numerous benefits, it also presents challenges for certain Indian industries. The reduction of tariffs on British whisky and gin, for instance, has raised concerns among domestic beverage manufacturers. Indian tariffs on these products will be halved from 150% to 75%, and further reduced to 40% over the next decade. This could lead to increased competition for Indian liquor brands, potentially impacting local businesses.

Similarly, the automotive sector faces mixed outcomes. While Indian manufacturers will benefit from reduced tariffs on exports, the influx of British automobiles at lower duties could pose a challenge for domestic carmakers. The UK has negotiated a tariff reduction from 100% to 10% under a quota system, which may lead to increased imports of British vehicles.

Agriculture remains another sensitive area. India has excluded certain agricultural products, such as dairy, apples, and cheese, from duty concessions to protect its farmers. However, concerns persist about the potential impact of increased competition from British agricultural exports.

The FTA is expected to have a positive impact on India’s gross domestic product (GDP) growth, with projections indicating a substantial increase in bilateral trade. The British government estimates that trade between the two nations will rise by £25.5 billion annually from 2040 onwards. This surge in trade is likely to contribute to India’s economic expansion, fostering job creation and investment.

Moreover, the agreement strengthens India’s position as a global trade partner, reinforcing its commitment to economic liberalisation. By opening up key sectors and reducing trade barriers, India is positioning itself as a flexible and attractive destination for foreign investment.

(Write to us at editorial@bombaychamber.com)

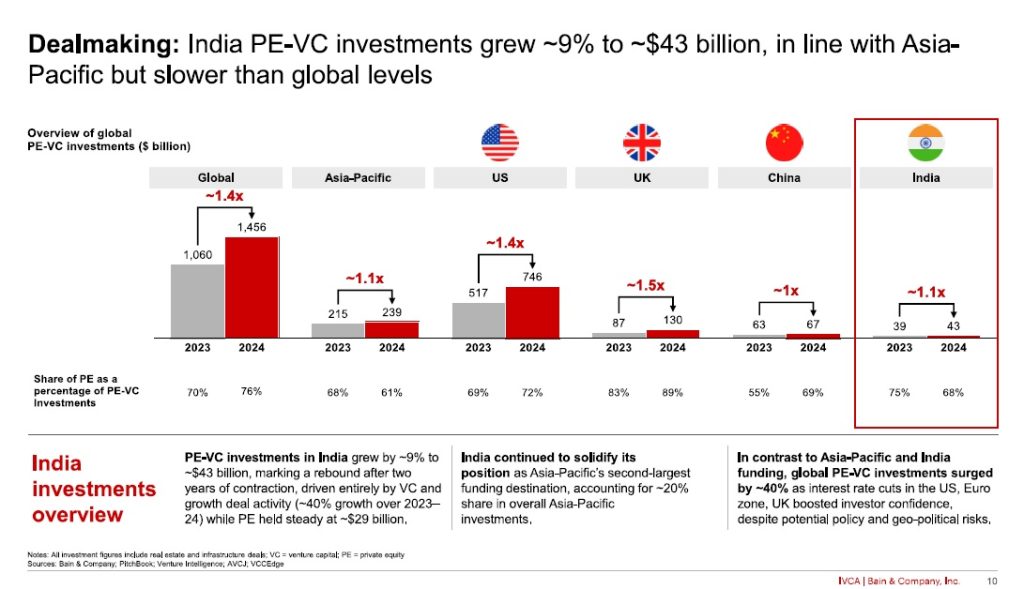

Private equity, venture capital market in India surges to $43 billion as buyouts dominate

Private equity, venture capital market in India surges to $43 billion as buyouts dominate

India’s private equity and venture capital (PE-VC) market rebounded strongly in 2024, reversing two years of contraction with a 9% rise in investments to reach $43 billion across 1,600 deals. As Asia-Pacific’s second-largest PE-VC hub, India continues to attract global capital, signalling renewed investor confidence in its macroeconomic stability and long-term growth potential.

According to Bain & Company’s ‘India Private Equity Report 2025’, published in collaboration with the Indian Venture and Alternate Capital Association (IVCA), while growth-stage investments drove much of the resurgence, private equity remained steady at $29 billion. A major shift towards buyouts was evident, with their share of total PE activity surging to 51% from 37% in 2022. Investors are increasingly securing control positions in high-quality assets, leveraging record dry powder reserves to pursue scalable opportunities.

Real estate and infrastructure emerged as standout performers, collectively accounting for 16% of total PE-VC funding, with deal values soaring by 70% compared to the previous year. Financial services also experienced robust growth of 25%, particularly within non-banking financial companies (NBFCs), driven by affordable housing finance, micro-lending, and MSME financing. Large transactions in companies such as Shriram Housing Finance and Aavas Financiers underscore investor confidence in high-yield, asset-secured businesses.

The healthcare sector maintained strong momentum, with an 80% increase in deal volume. Investments in medical technology, pharmaceutical outsourcing, and single-specialty hospitals – particularly in areas like eyecare, oncology, and IVF – highlighted a strategic push towards underpenetrated categories.

Meanwhile, IT-enabled services saw remarkable expansion, with deal activity tripling. Notable transactions such as Perficient’s $3 billion deal, Altimetrik’s $900 million investment, and GeBBS’s $865 million acquisition reinforced the sector’s growing dominance in digital transformation and revenue cycle management.

India also led the Asia-Pacific region in private equity exits, with exit values reaching a record-breaking $33 billion across 360 deals, marking a 16% year-over-year increase. Public market exits gained prominence, making up 59% of total exit value compared to 51% in 2023, as strong IPO activity fuelled investor optimism. The IPO landscape expanded significantly, with 33 listings in 2024 – up from 23 the previous year – driven largely by consumer-focused sectors.

Domestic fundraising hit new highs, further strengthening India’s private capital ecosystem. Kedaara Capital closed a landmark $1.7 billion fund, while ChrysCapital raised a record $2.1 billion. Global funds also intensified their presence, with Blackstone announcing plans to double its India-based assets under management from $50 billion to $100 billion, reflecting growing international confidence in India’s economic trajectory.

The private equity and venture capital market in India rebounded in 2024 and the outlook for 2025 remains positive. However, sustaining the momentum will require funds to navigate shifting economic and market conditions. Investors with strong operational capabilities, sector-specific expertise, and a focus on sustainable value creation will be best positioned to capitalise on opportunities. As the market tilts towards traditional industries and domestic fundraising reaches new highs, India’s PE-VC landscape looks set for a steady and long-term growth.

(Write to us at editorial@bombaychamber.com)

Bombay Chamber Hosts Conclave on Future of Fund Management: AIFs in GIFT City

Bombay Chamber Hosts Conclave on Future of Fund Management: AIFs in GIFT City

The Bombay Chamber of Commerce and Industry hosted its PEVC Conclave on the theme “Future of Fund Management: AIFs in GIFT City.” The event brought together fund managers, policymakers, regulators, and industry experts to explore the growing significance of GIFT City and its role in shaping India’s financial services landscape.

The conclave opened with a welcome address by Sandeep Khosla, Director General of the Bombay Chamber, who outlined the Chamber’s wide-ranging initiatives and reaffirmed its longstanding role as a bridge between industry and government. He emphasised the importance of fostering collaborative dialogue to support India’s evolving financial ecosystem.

Setting the theme of the Conclave, Ashith Kampani, Chair of the PE&VC Committee at the Bombay Chamber and Chairman of CosmicMandala15 Securities highlighted the Chamber’s focus on collaborative development toward a Viksit Bharat, grounded in digitalisation, ESG integration, ease of doing business, and inclusive growth—principles reflected throughout the day’s discussions. Kampani underscored how these pillars are directly relevant to the evolving financial landscape in GIFT City, India’s first operational smart city and International Financial Services Centre (IFSC). He highlighted the momentum GIFT City has gained, with over 80 fund managers operating within its ecosystem and more than $20 billion in fund commitments, as evidence of its growing prominence. He also noted that the progressive regulatory framework, especially following the introduction of the Fund Management Regulations in 2022, offers unparalleled flexibility in fund structuring, cross-border investments, and tax incentives—making GIFT City a highly attractive jurisdiction for global capital and investment innovation.

Swati Khemani, Founder and CEO of Carnelian Asset Management & Advisors, delivered the keynote address. She emphasised that GIFT City represents a transformational shift in India’s financial sector, offering regulatory transparency, tax incentives, and infrastructure that rival global standards. With over $36 billion in assets under management and 124 registered fund units as of March 2024, GIFT City is becoming a preferred destination for asset and wealth managers worldwide.

Khemani also connected GIFT City’s evolution with the government’s broader vision under Amrit Kaal, projecting India’s share in global trade to rise from 12 percent to 16 percent and targeting per capita income of $18,000. She noted the city’s multi-currency capabilities, favorable tax treatment, and appeal for non-resident investors as key differentiators, positioning GIFT as a global center for financial innovation.

The first panel discussion, titled GIFT AIFs: Unlocking Inbound and Outbound Investment Potentials, was moderated by Tejas Desai, Co-Chair of the PE&VC Committee at the Bombay Chamber and Partner at Ernst & Young. The panellists included Pavan Shah, General Manager, International Financial Services Centres Authority (IFSCA); Mitul Mehta, Chief Financial Officer, Blume Ventures; Lakshmi Iyer, CEO – Investment & Strategy, Kotak Alternate Asset Managers; Clarence Anthony, Managing Partner, Clarence & Partners; and Niutpol Handique, Assistant Vice President – International Business Development, Mirae Asset Management Company.

The session addressed the game-changing nature of 100 percent NRI-focused funds, the challenges faced by domestic SEBI AIFs in making offshore investments, and how the FEMA non-resident status of GIFT AIFs offers a compelling solution. The discussion also covered recent amendments to the Fund Management Entity Regulations and the tax advantages of launching asset-specific funds through GIFT City, especially for investing in Indian mutual funds.

The second panel, Dual Listing in GIFT City, moderated by Jyoti Vineet Tandon, Compliance Consultant and Co-Founder of FinCrimeExpert, featured Pradeep Ramakrishnan, Executive Director, International Financial Services Centres Authority (IFSCA); Vijay Krishnamurthy, Managing Director and CEO, India INX; Siddharth Shah, Partner, Khaitan & Co.; and Veenit Surana, Partner, Ernst & Young. The panellists provided insights into IFSCA’s regulatory vision, the readiness of market infrastructure institutions, and the broader ecosystem required to make dual listings a viable and attractive route for Indian and global market participants.

The event concluded with a vote of thanks from Sandeep Khosla who underscored the value of the discussions and the Chamber’s ongoing efforts to support industry-policy collaboration.

- To learn more about Bombay Chamber’s initiatives, visit our Events Page

- Explore more about our Private Equity & Venture Capital Committee

- Visit Our LinkedIn Page

For More Details Contact: Priya Singh at priya.singh@bombaychamber.com OR 022 61200238

Pune to Host India’s First-Ever International Agritech Hackathon

Pune to Host India’s First-Ever International Agritech Hackathon

Pune, April 21, 2025 – In a landmark initiative to revolutionize the agriculture sector through innovation and technology, Pune will host the country’s first-ever International Agritech Hackathon. The event was officially launched on 21st April 2025 by Hon’ble Guardian Minister (Pune) and Deputy Chief Minister of Maharashtra State, Shri Ajit Dada Pawar, at Ganesh Kala Krida Manch, Pune.

The International Agritech Hackathon is a collaborative effort between the District Administration, Pune, and the Bombay Chamber of Commerce & Industry. During the launch, a MoU was signed by Mr. Jitendra Dudi, District Collector, Pune and Chief Organizer of the Hackathon, Mr. Rajan Raje, Chairperson, Agriculture & Food Processing Committee – Bombay Chamber and CEO, Nichem Solutions and Mr. Chetan Dedhia, Expert Committee Member, Agriculture & Food Processing Committee – Bombay Chamber and Managing Partner, J.J.Overseas.

Through this MoU, the Bombay Chamber has extended full support to the district administration to ensure the successful execution of the Hackathon.

The International Agritech Hackathon aims to bring together students, startups, developers, researchers, and innovators from diverse backgrounds, all driven by a shared goal — to transform the future of agriculture through cutting-edge technology.

Registrations are now open, and interested participants can register via the official website: https://www.puneagrihackathon.com/

Bombay Chamber and SOFOFA sign landmark MoU to strengthen India-Chile trade relations

Bombay Chamber and SOFOFA sign landmark MoU to strengthen India-Chile trade relations

The Bombay Chamber of Commerce & Industry and SOFOFA, the Chilean Federation of Industry, have formally entered into a historic Memorandum of Understanding (MoU) aimed at deepening economic engagement between India and Chile. The agreement was signed by Rosario Navarro, President of the Chilean Federation of Industry, and Pinky Mehta, President of the Bombay Chamber of Commerce & Industry and CFO of Aditya Birla Capital, during a networking meeting organised by the Bombay Chamber in collaboration with the Chile Business Forum on April 03, 2025.

The signing ceremony was attended by several eminent dignitaries, including Jose Miguel Benavente H. Vice Presidente Ejecutivo, Corfo; Viraj Kulkarni, Chairman of the International Trade and Commerce Committee of the Bombay Chamber; Ivan Marambio, President of the Chilean Chapter of the Chile-India Business Council; Nandan Mehta, Corporate Affairs-EMEA, Tata Consultancy Services; and Siddhartha Roy, Business Head-New Country Development, Marico and other esteemed guest from Chile & India.

A key pillar of the MoU is to establish a strategic commitment by both organisations to support their respective governments in the negotiation of a Comprehensive Economic Partnership Agreement (CEPA) between Chile and India. Through technical insights and industry perspectives, both parties aim to contribute constructively to the advancement of trade discussions.

Additionally, should a CEPA be successfully concluded, the Bombay Chamber and SOFOFA will collaborate to facilitate its effective implementation, monitor emerging business opportunities, and drive private sector participation through trade missions, industry briefings, and sectoral collaboration initiatives.

Established in 2020, the Chile-India Business Council aims to double trade volumes between India and Chile by 2026, with a focus on food and beverage exports. “To facilitate this growth, the Council is actively engaging Indian business partners, leveraging industry expertise and market insights to create structured trade opportunities. The Council is focused on transforming trade discussions into measurable business outcomes, ensuring long-term commercial success between Chile and India,” said Marambio.

Speaking at the event, Siddhartha Roy, Business Head-New Country Development, Marico, reflected on Chile’s rich cultural legacy and the strong commercial ties between both nations. “Over the years, India and Chile have demonstrated resilience and dynamism. Chile’s mining industry has thrived, and Indian companies are actively exploring greenfield and brownfield investments. Likewise, Indian IT firms have established a strong presence in Chile,” he said.

India-Chile bilateral trade has witnessed remarkable expansion, rising from $1.5 billion in 2020 to $3.8 billion in 2024. Investment opportunities are evolving beyond traditional sectors, with agriculture, digital services, pharmaceuticals, and automobiles emerging as areas for enhanced cooperation.

Viraj Kulkarni, Chairman of the International Trade and Commerce Committee of the Bombay Chamber, emphasised Mumbai’s economic prominence, citing its gross domestic product (GDP) of over $600 billion and its pivotal role as India’s financial centre. “Mumbai is a gateway to East Asia, just as Santiago could serve as a strategic hub for India’s presence in Latin America. This MoU ensures structured collaboration, enabling businesses to leverage the immense opportunities before them,” he said.

This MoU marks a significant step taken by the Bombay Chamber and SOFOFA, laying the groundwork for structured commercial growth. Both organisations have pledged to support CEPA negotiations and drive cross-border cooperation through sustained industry engagement.

Union Minister Sarbananda Sonowal joins Global Maritime Leaders at Singapore Maritime Week (SMW)

Union Minister Sarbananda Sonowal joins Global Maritime Leaders at Singapore Maritime Week (SMW)

The Union Minister of Ports, Shipping & Waterways, Shri Sarbananda Sonowal joined Global Maritime Leaders at the Singapore Maritime Week (SMW) to discuss, deliberate and devise strategies based on the shared vision for a secure, sustainable and prosperous maritime future. The Minister highlighted the challenges and India’s vision to channel growth of the maritime sector around that. Shri Sonowal also argued for strengthening maritime connectivity and supply chains while the need for collective effort towards a green sustainable maritime future.

On digitalisation and future ready shipping, the Union Minister reiterated how it is the core strategy of India’s maritime policy. India’s maritime policies like ONOP, NLP (Marine), and MAITRI are streamlining port services, cutting transaction times, and enabling real-time data. India is also partnering with the UAE and Singapore to create Virtual Trade Corridors for seamless cargo movement.

Speaking on the occasion, the Union Minister, Sarbananda Sonowal said, “India’s maritime vision, rooted in ‘Vasudhaiva Kutumbakam’, promotes collaboration and shared prosperity. As a reliable and responsible partner, India is committed to building a green, secure, and inclusive maritime future. Alongside Singapore and global partners, we aim to drive innovation and collective action for a resilient maritime ecosystem.”

Shri Sonowal met Senior Minister and ex PM of Singapore, Lee Hsien Loong at the SMW. Union Minister was ushered to the bilateral meeting with Murali Pillai, Minister of State, Ministry of Law and Ministry of Transport, Singapore. The Union Minister also held individual meetings with other senior members of the government including Dr Tan See Leng, Minister for Manpower and Second Minister of Trade and Industry, Singapore; Vivian Balakrishnan, Minister for Foreign Affairs, Singapore. Sonowal said at the SMW that India is addressing supply chain vulnerabilities by developing key corridors like IMEEC, the Eastern Maritime Corridor, and the North-South Transport Corridor to secure trade routes. A USD 20 billion investment would enhance logistics, port connectivity, and trade facilitation. India targets a top-five global shipbuilding rank by 2047 through policy reforms and infrastructure upgrades.

Ports aim to grow their global cargo share from 6% to 15% by 2047, supported by a Maritime Development Fund for fleet and shipyard expansion. The GIFT City is also rising as a global hub for maritime finance and ship leasing, offering a competitive gateway to global capital, highlighted Shri Sarbananda Sonowal at the SMW Adding further, he said, “The maritime sector faces both challenges and opportunities, from climate change and geopolitics to digital disruption and shifting trade patterns. Guided by PM Narendra Modi’s vision of Viksit Bharat and Atmanirbhar Bharat, India is advancing as a modern, self-reliant, and globally connected economy. The maritime sector is key to driving growth, resilience, and sustainable connectivity. India is expanding port infrastructure, integrating logistics, and boosting ease of doing business—resulting in greater port efficiency, stronger cargo flows, and growing investor confidence.”

In his concluding remark, Shri Sarbananda Sonowal said, “Sustainability is central to India’s maritime strategy. We are advancing green port infrastructure, promoting low-emission shipping, and supporting innovation in low-carbon vessels. Three Green Hydrogen Hub Ports— Kandla, Tuticorin, and Paradip—will drive alternative fuel adoption and green hydrogen production.

India is also leading the IMO’s Green Voyage 2050 initiative, helping developing nations in their energy transitions. Our commitment, under the leadership of Prime Minister Shri Narendra Modi ji, extends to developing Green Shipping Corridors, including the proposed India-Singapore Green and Digital Corridor, focused on clean energy and smart logistics. Oceans unite us. Through partnerships, we can turn today’s maritime challenges into shared, sustainable opportunities.” Sarbananda Sonowal also met Industry Captains including Jeremy Nixon, Global CEO, ONE and Masashi Hamada along with other corporate leaders from the Maritime Sector including APM Terminals, Gateway Terminals.

National Academy of Customs, Indirect Taxes, and Narcotics (NACIN) and Indian Maritime University (IMU) sign MoU for strategic knowledge partnership

National Academy of Customs, Indirect Taxes, and Narcotics (NACIN) and Indian Maritime University (IMU) sign MoU for strategic knowledge partnership

A Memorandum of Understanding (MoU) was signed between the National Academy of Customs, Indirect Taxes, and Narcotics (NACIN) and the Indian Maritime University (IMU) in Chennai, today. This collaboration aims to strengthen the Marine Customs Training Centre by enhancing the maritime enforcement and operational capabilities of CBIC officers, while also creating a platform for mutual learning and institutional synergy between NACIN and IMU.

The MoU was signed by Shri Gaigongdin Panmei, Principal Director General for NACIN, and Dr. Rajoo Balaji, Pro Vice-Chancellor for IMU (representing the Vice Chancellor), in the presence of Smt. Aruna Narayan Gupta, Member, Central Board of Indirect Tax and Customs, and, Additional Director Generals, Dr. M.G. Thamizh Valavan and Dr. Ezhilmathi K, along with Shri K. Saravanan, Registrar, IMU, and Dr. P.J. Rangachari, Director, IMU Chennai Campus, among other senior officials from both institutions

Addressing the esteemed dignitaries and officials present, Smt. Gupta stated that the collaboration marks a significant step towards enhancing the capabilities of CBIC officers engaged in marine preventive work, thereby strengthening collective efforts in safeguarding national security.

This MoU between NACIN and IMU establishes a collaborative framework for the training of CBIC officers involved in marine operations. It outlines the development of a comprehensive training programme aimed at bridging existing knowledge gaps in maritime enforcement and operational practices. The curriculum will be enriched by incorporating both domestic and international perspectives. The collaboration seeks to mutually benefit both institutions—leveraging IMU’s academic and technical expertise and NACIN’s enforcement experience.

For CBIC, the collaboration significantly strengthens its marine enforcement capabilities by providing officers with specialized, hands-on training in advanced maritime technologies, aligned with global best practices. For IMU, this partnership offers a valuable opportunity to extend its academic reach into the domain of maritime enforcement, enhance the practical application of its training modules, and engage in collaborative research on emerging technologies such as drone surveillance and recent advancements in the maritime sector.

Furthermore, the MoU paves the way for the inclusion of personnel from other departments and international participants, underscoring the global relevance and strategic scope of this initiative.

The collaboration with IMU will further elevate NACIN’s capabilities by integrating academic excellence, cutting-edge technology, and global best practices into its training framework. This partnership not only ensures the development of a robust and future-ready maritime enforcement training ecosystem but also reinforces India’s commitment to fostering institutional synergies to safeguard its maritime interests. The Marine Customs Training Centre, empowered by this collaboration, is poised to emerge as a centre of excellence for marine enforcement training in the region and beyond.

Government of India Taking Measures Against Misuse of Personal Data

Government of India Taking Measures Against Misuse of Personal Data

Unsolicited Commercial Communications (UCC) are regulated by the Telecom Regulatory Authority of India (TRAI). TRAI has issued Telecommunications Commercial Communications Consumers Preference Regulations, 2018 (TCCCPR-2018) which deals with UCC. Under the TCCCPR-2018 regulations a number of directions have been issued for the implementation of its provisions. These directions inter-alia have provisions for registering preferences for commercial communication where a telecom subscriber can opt to block all commercial communications or can selectively block commercial communications as per preference categories.

Customers can register complaint against senders of UCC through Mobile App, sending SMS or calling on a specific number 1909.

The Government of India has taken major initiatives like enactment of Information Technology (IT) Act, 2000, setting up of Indian Computer Emergency Response Team and National Critical Information Infrastructure Protection Centre, releasing of National Cyber Security Policy 2013, appointing Chief Information Security Officer, thus ensuring security and privacy of personal information of users in India. The Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011 under the IT Act prescribes reasonable security practices and procedures to protect sensitive personal data of users.

Digital Personal Data Protection Act, 2023 (“DPDP Act”) provides the legal framework for processing of personal data, notice to be issued to data principal, consent of the data principal including withdrawal of such consent, rights of the data principal, obligations of the data fiduciaries, penalties for non-compliance, etc.

The DPDP Act provides legal framework for Data Fiduciaries to notify breaches and ensure effective observance of the provisions Act by implementing appropriate technical and organizational measures.

Further, the DPDP Act establishes a robust framework of accountability mechanisms to ensure the lawful processing of digital personal data with Data Protection Board of India as an independent adjudicatory body empowered to investigate complaints, conduct inquiries, and impose penalties. Ministry of Home Affairs has also established the Indian Cyber Crime Coordination Centre to deal with cyber-crimes in a comprehensive and coordinated manner.

Public awareness campaigns, such as Cyber Security Awareness Month and Safer Internet Day, are organized to educate citizens about online safety, secure online transactions and digital services.

This information was given by the Union Minister of Railways, Information & Broadcasting and Electronics & Information Technology Shri Ashwini Vaishnaw in Rajya Sabha today.

Empowerment can help women seafarers navigate their careers with dignity and pride: Capt. Aakriti Barthwal

Empowerment can help women seafarers navigate their careers with dignity and pride: Capt. Aakriti Barthwal

In August 2005, nine girls enrolled with the Maritime Training Institute, The Shipping Corporation of India (SCI), with the dream of making a successful career in the male-dominated shipping industry. This was a unique situation at the time, as very few females chose to train as pre-sea cadets. The nine girls were equally divided into three batches comprising 40 students in each.

“The numbers clearly established the fact that it was a male-dominated industry. It was also a very bold step for us nine girls to be joining shipping at that time. Later, I did realise that very few of us would come up (the ranks),” said Capt. Aakriti Barthwal, QHSE Superintendent, Synergy Navis Marine Pvt. Ltd.

Continuing her journey, chalking out a growth plan, proving her capabilities, credibility and dedication for the next over a decade, her efforts finally got rewarded. In January 2017, she earned her command on board the vessel Swarna Krishna, owned and managed by SCI.

“This was only possible because The Shipping Corporation of India gave us females the opportunity and the floor to grow, expand and know our horizons. I also had immense support from my family, especially my husband, who, being a seafarer himself, understood the challenges and rewards of a career in shipping,” she shared.

Interestingly, among the nine girls who took up training as pre-sea cadets, only one made it to the rank of a master. Of her eight batchmates, some advanced to positions like second officer or chief officer, others diversified their careers, and a few left the field entirely to pursue non-shipping careers. “I often wondered why this happened,” Capt. Barthwal reflected.

Citing reasons that were possibly responsible for such an outcome, she said that while women began exploring a career in shipping in the years between 2004 and 2008, there was a lot of apprehension among their parents and relatives as the career path and growth was not very clear.

“There were challenges on board including bitter experiences, lack of inclusivity and gender biases. Also, despite the selection criteria being the same for everyone, there was a sense of unacceptability on board for many females, which made them lose out. The roadblock is still the same and that’s why discussions about women in shipping and identifying ways and means for them to grow are very crucial,” she said.

Sharing her personal experience about challenges faced, Capt. Barthwal said that it took her 11 months to find a shore job after she decided to leave (for family reasons) sailing in January 2019. “It may look easy now but landing a shore job was a huge challenge five years ago. Despite the fact that I was a master mariner from an oil and chemical tankers background, companies were still hesitant on taking a female for the job,” said Capt. Barthwal. She added that after numerous meetings and rounds of interviews, she finally succeeded in November 2019 and became a QHSE (Quality, Health, Safety, and Environmental) Superintendent at Synergy Navis Marine.

“Synergy gave me the opportunity to become their first-ever female QHSE Superintendent after I proved that women bring equal credibility, having undergone the same rigorous training and work experiences,” she said.

Another significant milestone came in December 2024 when Capt. Barthwal became India’s first female RightShip inspector. RightShip, the world’s leading ESG (Environmental, Social, and Governance)-focused maritime platform, is renowned for its expertise in safety, sustainability, and social responsibility.

So how is the industry scenario like now for women aspiring to make a career in shipping? She said, “Things have changed drastically. There are various initiatives by the Government of India like the Maritime India Vision 2030 that has outlined 150 initiatives including becoming a top seafaring nation with world-class education, research and training.”

She pointed to the 2019 guidelines issued to ensure a conducive work environment for women on board ships. Initiatives like scholarships by the Maritime Training Trust and the ‘Sagar Mein Samman’ programme aim to enhance the role of women in the maritime sector. “This programme fosters respect and empowerment, helping women seafarers navigate their careers with dignity and pride,” she added.

Additionally, companies have embraced diversity, equity, and inclusion (DEI) initiatives, offering scholarships to underprivileged girls to remove financial barriers.

Seminars and webinars held by the government and private organisations have also played a role in addressing parents’ concerns, encouraging them to support their daughters’ ambitions in shipping.

Today, women are excelling in various roles, not just as officers but also as ratings professionals on chemical tankers, gas tankers, and other vessels. “These developments prove that when given the chance, women thrive and succeed in their shipping careers,” said Capt. Barthwal.

Despite all the initiatives and programmes by the government and the private sector to bring more women in shipping, challenges remain. Women constitute less than 2% of the global seafaring workforce. While more women are entering the field, only a small fraction rises to managerial or commanding positions. Entry into the industry has become easier, but career growth remains a challenge.

She stressed that promotions, leadership roles, and access to advanced training courses are still hurdles for women, whether on board ships or in shore-based roles. “The real challenge isn’t just recruiting women into shipping, it’s retaining them, supporting their growth, and enabling them to take leadership roles. Only then can the industry’s goals of gender equality and inclusivity become a reality,” she concluded.

Initiatives to foster leadership among women

To bridge the gap and support women in taking on leadership roles, the sector needs to:

– Provide more opportunities for women to gain experience and take on challenging assignments that prepare them for leadership positions.

– Implement structured mentorship programs that pair experienced women leaders with aspiring female seafarers and shore-based professionals.

– Offer leadership development training and coaching specifically tailored for women in the industry.

– Ensure fair and transparent promotion processes that evaluate candidates based on merit, not gender biases.

– Foster an inclusive work culture that values diversity and actively supports the career advancement of women.

– Collaborate with industry associations and the government to create policies and initiatives that enable women’s progression to senior roles.

(Write to us at editorial@bombaychamber.com)

It is a long established fact that a reader will be distracted by the readable content of a page when lookin