Blog

Top Stories

Corporate reorganisations take centre stage at Bombay Chamber seminar

Mumbai: The Bombay Chamber of Commerce and Industry, through its Direct Tax Committee, hosted a seminar on Recent Trends in Corporate Reorganisation, offering a comprehensive platform for dialogue and insight into evolving approaches to tax and corporate structuring.

The seminar featured two focused panel discussions — Strategic value unlocking and promoter shareholding realignment, and IPO and upside sharing — both moderated by Ravikant P Kamath, Chairperson of the Direct Tax Committee, Bombay Chamber and Partner at Ernst & Young LLP.

Expert speakers shared perspectives on key aspects of corporate reorganisation, including strategic value unlocking, realignment of promoter shareholding, upside sharing mechanisms, and fast-track mergers and demergers. Case studies based on recent trends offered attendees practical frameworks to navigate increasingly complex reorganisation scenarios.

In the first session, Navin Jain, Taxation Director – South Asia, Hindustan Unilever Ltd; K Mahesh, Vice President & Group Head – M&A and Divestments, Larsen & Toubro Ltd, and Archit M Shah, Tax Partner, EY India, shared their experiences on aligning reorganisation strategies with long-term business goals. Discussions focused on tax implications and value creation arising from promoter realignments and transaction structuring.

The second session, centered on initial public offerings and upside sharing, featured insights from Veenit Surana, FAAS Partner at EY India, Amish Dedhia, Principal at Chiratae Ventures, Tejas Mody, Tax Partner at EY India and Nikhil Naredi, Partner at Shardul Amarchand Mangaldas, and moderator Kamath. Their commentary addressed the shifting deal landscape — from private transactions to public offerings — alongside complexities such as lock-in restrictions and withholding tax during offer for sale (OFS) events.

Additional themes covered included advance tax obligations, cost of acquisition, accounting and disclosure frameworks, tax treaty compliance, evolving tax insurance practices, and valuation methodologies within earn-out structures and cross-border mergers or demergers.

The interactive format allowed participants to engage with EY M&A Tax Partners, who provided hands-on guidance for navigating structuring challenges across sectors. The seminar underscored the importance of multidisciplinary collaboration and regulatory clarity in executing successful reorganisations.

(Write to us at editorial@bombaychamber.com)

Roundtable Discussion on “Future of Insurance Distribution in India – Innovation, Access, and Accountability”

Roundtable Discussion on “Future of Insurance Distribution in India – Innovation, Access, and Accountability”

The Bombay Chamber of Commerce & Industry successfully hosted a high-level roundtable discussion on the Future of Insurance Distribution in India – Innovation, Access, and Accountability on June 19, 2025. The closed-door event brought together senior leaders, policy influencers, and stakeholders from the insurance ecosystem to deliberate on emerging trends and regulatory shifts shaping the distribution landscape.

Shri. Satyajit Tripathy, Member – Distribution, IRDAI, was the Chief Guest for the Roundtable Discussion. His insightful address set the tone for a meaningful exchange of ideas and perspectives around digital innovation, distribution accessibility, and the evolving accountability frameworks within the sector.

The session was inaugurated by Sandeep Khosla, Director General, Bombay Chamber, followed by an introductory overview by Ravi Reddy, Executive Director, Beacon Insurance Brokers Pvt. Ltd. & Member, BFSI Committee, Bombay Chamber.

The highlight of the event was a strategic dialogue with Shri. Tripathy, where participants explored collaborative approaches to navigate regulatory challenges and futureproof distribution strategies in a rapidly digitizing environment.

The event concluded with a vote of thanks by Sandeep Khosla, Director General, Bombay Chamber, followed by lunch and informal networking.

Empowering India’s Growth Engines: Bombay Chamber’s MSME Conclave Spotlights Jobs, Finance & Global Trade

Empowering India’s Growth Engines: Bombay Chamber’s MSME Conclave Spotlights Jobs, Finance & Global Trade

“MSMEs are not just the backbone of Maharashtra’s economy—they are its growth engines, its job creators, and its promise for the future,” said Hon’ble Shri Uday Samant, Cabinet Minister, Ministry of Industries, Government of Maharashtra, during his special address at the Bombay Chamber of Commerce and Industry’s MSME Conclave 2025 – 1.0, held on June 18 at the Taj Santacruz in Mumbai.

Themed “New Business Opportunities for MSMEs,” the conclave brought together a distinguished gathering of policymakers, industry leaders, diplomats, and financial experts to chart new pathways for the growth and global integration of India’s MSMEs. A key highlight of the day was the unveiling of the Bombay Chamber’s new survey report titled “MSME Workforce Insights 2025.” The report was launched jointly by Sandeep Khosla, Director General of the Bombay Chamber; Pinky Mehta, President of the Bombay Chamber and CFO of Aditya Birla Capital Ltd; Shri Uday Samant; Rajan Raje, Chairperson of the MSME Forum; and R. Srinivasan, Co-Chairperson of the MSME Forum. The insights from the survey formed the foundation of Shri Samant’s address, shaping the context for several key announcements.

Based on inputs from over 100 MSMEs across the Mumbai Metropolitan Region, the report revealed pressing employment-related challenges in the sector. It found that MSMEs currently require 55,000 skilled workers, with the majority of demand for fitters, electricians, and welders. At the same time, unemployment remains high, particularly in the technology and creative sectors, where skill mismatches persist. The survey also highlighted that MSMEs prefer hiring candidates who have completed 12th grade, and that most recruitment happens informally, through personal networks. With 41 percent of Maharashtra’s MSMEs located in the MMR, the findings underscored the urgent need for targeted job creation strategies and formalised skilling pathways.

Building on this, Shri Samant announced that the MSME sector in the MMR alone has the potential to create 80,000 jobs. He emphasised the state government’s commitment to supporting this vision through a series of robust initiatives. These include the allocation of ₹300 crore towards MSME development, the establishment of Smart MSME Hubs across all 36 districts with 20 percent land reserved exclusively for MSMEs, and the development of dedicated industrial clusters. Among the new developments are a tribal business cluster on 75 acres in Nashik, a pital metal cluster in Chandrapur, a mega textile hub in Amravati, and a women-led business cluster to encourage female entrepreneurship. The Minister also announced plans to assign chemical labs to MSMEs for product testing and quality certification.

Citing the transformation of Gadchiroli from a naxalite-affected region to an emerging industrial township, Shri Samant described the far-reaching impact of government-industry collaboration. He referenced upcoming infrastructure projects such as Wadhwan Port and the Chhatrapati Sambhaji Nagar Industrial Corridor as major catalysts for MSME growth. He called on businesses to work alongside the government to ensure that benefits reach the grassroots, noting that ₹9,500 crore in incentives have already been disbursed in the last three years, with MSMEs receiving top priority.

In her welcome address, Mehta reflected on the Bombay Chamber’s 189-year legacy of supporting India’s industrial and economic progress. Srinivasan set the tone for the conclave by emphasising the importance of preparing MSMEs for global supply chains and export readiness.

A high-impact session on Trade Finance and Factoring featured presentations by Ranveer Singh, MLP Head for Mumbai South at Union Bank of India; Manish Sinha, CEO of the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE); Harish G. Aldangadi, General Manager of Retail Credit and Retail SME Processing at SVC Co-Operative Bank and Arun Gopal, Assistant General Manager, along with Tania Das, Senior Manager at Bank of Baroda. These sessions explored practical financing solutions aimed at improving liquidity, supporting working capital, and scaling exports for MSMEs.

This was followed by a session on digitisation opportunities for MSMEs, led by Harish Narayanan, Chief Marketing and Digital Officer at HDFC Asset Management Company and Hareesh Tibrewala, CEO of Anhad Consultancy Services. The speakers discussed how digital tools and platforms can transform operational efficiency, customer outreach, and competitiveness for small and medium enterprises.

K. Ramesh, General Manager at New India Assurance delivered a presentation on comprehensive insurance solutions tailored to MSMEs under the Bima Sathi initiative, while Durgesh Srivastava, Vice President for Forex Settlement at CCIL, spoke on building secure, transparent, and efficient forex infrastructure for exporters.

The final segment of the conclave was a session on bilateral trade opportunities, featuring the diplomatic community. H.E. Mr. Gustavo González Zbinden, Consul General of Chile in Mumbai; Mary Overington, Trade and Investment Commissioner – South Asia at the Australian Trade and Investment Commission (Austrade); Tibor Kovács, Trade Attaché at the Consulate General of Hungary in Mumbai; and Eva Verstraelen, Trade and Investment Commissioner for Flanders (FIT) in Mumbai, each presented opportunities for MSMEs in their respective regions. The session explored areas such as sourcing, market representation, joint ventures, and strategic collaboration.

The event concluded with closing remarks and a vote of thanks by Rajan Raje, who reiterated the Bombay Chamber’s commitment to enabling access, information, and institutional support for MSMEs. He expressed confidence that the deliberations and insights shared during the conclave, especially those drawn from the Chamber’s survey, would spark actionable partnerships and policy alignment across Maharashtra and beyond.

Bombay Chamber DEI Awards 2025 winners announced; DEI Forum drives dialogue on inclusive growth in Corporate India

Bombay Chamber DEI Awards 2025 winners announced; DEI Forum drives

dialogue on inclusive growth in Corporate India

The Bombay Chamber of Commerce and Industry successfully hosted the third edition of its flagship DEI Forum & Awards 2025 on June 18, 2025, in Mumbai, reinforcing its continued commitment to fostering a culture of diversity, equity, and inclusion within corporate India. The winners of the awards were announced at a glittering ceremony at the Taj Santacruz Mumbai. The awards ceremony, which recognised outstanding contributions to DEI across six categories, was underpinned by a transparent and unbiased evaluation process.The event brought together prominent industry leaders, DEI champions, and stakeholders for an engaging and reflective evening focused on inclusive growth and transformative practices.

In her Welcome Address, Pinky Mehta, President, Bombay Chamber and CFO, Aditya Birla Capital said, “As we stand in 2025, India finds itself at a pivotal juncture, where the ideals of inclusivity are not just aspirational but are actively shaping our institutions, workplaces, and communities. It is time now to operationalise DEI beyond policy and poster walls — embedding it into every function, decision and layer of leadership.”

One of the evening’s most engaging moments was a Fireside Chat on the theme “Inclusive Leadership: What Does It Really Look Like?” The panel featured four powerhouse leaders Arundhati Bhattacharya, President and CEO of Salesforce South Asia; Dr. Indu Shahani, Founding President and Chancellor of ATLAS SkillTech University; and Mansi Madan Tripathy, Chairperson of the Shell Group of Companies in India and Senior Vice President of Shell Lubricants, APAC and moderator Meenakshi Priyam, Chair, D&I Committee, Bombay Chamber and Sr VP & HR Head – Automotive Sector, Mahindra & Mahindra.

Welcoming delegates to the Bombay Chamber DEI Forum which was held prior to the Awards, Sandeep Khosla, Director General, Bombay Chamber focused on the Chamber’s rich 189 year history and how it is helping build bridges across industry.

Setting the theme for the Forum, Nikhil Kolur, Partner, Human Capital, Deloitte, said, “Inclusion isn’t policy, it’s muscle memory. Built in small moments, until it becomes who we are.” He spoke about how DEI spends in India’s corporate world have increased by 70%, but that is just 18% of the workspace.

A key segment of the Forum, titled “The Exchange – Part 1,” featured former DEI Award winners – Shell India, Tata Communications and NICHEM Solutions, who shared candid insights into their DEI journeys, outlining both achievements and ongoing challenges in creating inclusive workplaces. The presentations were followed by a participatory group activity where attendees discussed the core enablers of DEI success and the barriers that continue to persist.

The Forum also celebrated the participants of the Chamber’s Mentoring for Enrichment Program 2025, with certificates awarded to both mentors and mentees in recognition of their dedication to fostering inclusive leadership development.

Later in the evening, attendees experienced “Portraits of Progress”, an immersive DEI Gallery Walk that offered reflective installations, storytelling exhibits, and interactive displays designed to prompt dialogue on the evolving nature of work through a DEI lens.

In the session titled “The Exchange – Part 2,” participants came together once more to share their insights from the Gallery Walk and earlier discussions, culminating in the identification of one actionable idea to take back to their own organisations. This session also encouraged peer commitments for continued collaboration and knowledge exchange, ensuring that the day’s conversations would translate into tangible action.

Closing the Forum, Meenakshi Priyam, Chair of the Chamber’s D&I Committee and Head of HR – Automotive Sector, Mahindra & Mahindra, offered a powerful reflection: “One of our goals with the DEI Committee was to celebrate progress while also tapping into the collective energy of those driving change. We aimed to create a space where people passionate about DEI could connect and collaborate. Today, we need to reframe the conversation — this isn’t about the cost of DEI, but about the value of inclusive opportunity. While attention to DEI is waning in many parts of the world, Indian corporations are stepping up. Still, challenges remain — especially for MSMEs, who struggle with the resources to implement initiatives like extended maternity leave. We’re trying to build a community of committed individuals who will keep the conversation alive and move the needle in the right direction, because inclusive leadership is not a choice, it’s a necessity.”

The winners of the Bombay Chamber DEI Awards 2025 across the categories were:

Disability Confidence & Inclusion Award

Winner: Capgemini Technology Services India Limited

1st Runner up: Godrej Capital

2nd Runner up: Future Generali India Insurance Company Limited

LGBTQIA+ Inclusion Award

Winner: Godrej Properties Limited

1st Runner up: Deutsche Bank Group

1st Runner up: Axis Bank

Special Mention: Asian Paints Limited

Gender Equality Champion Award

Winner: Novo Nordisk India Pvt. Ltd.

1st Runner up: Godrej Properties Limited

2nd Runner up: Nestlé India Limited

Special Mention: GIA India Laboratory Pvt Ltd.

Impactful DEI Program Award

Winner: InterGlobe Aviation Limited (IndiGo)

1st Runner up: HDFC ERGO General Insurance Company Limited

2nd Runner up: Capgemini Technology Services India Limited

Special Award for MSME

Winner: HAB Pharmaceutical & Research Ltd.

1st Runner up: Harkesh Rubber LLP

DEI Champion Award

Winner: Godrej Properties Limited

1st Runner up: Capgemini Technology Services India Limited

2nd Runner up: HDFC Life Insurance Company Limited

2nd Runner up: Indian Hotels Company Limited

Union Commerce and Industry Minister Shri Piyush Goyal Advances India–Sweden Collaboration Through Comprehensive Government and Industry Dialogues

Union Commerce and Industry Minister Shri Piyush Goyal Advances India–Sweden Collaboration Through Comprehensive Government and Industry Dialogues

Union Minister of Commerce and Industry, Shri Piyush Goyal held a series of substantive engagements with senior members of the Swedish government and industry leaders on day one of his two-day official visit to Stockholm. The visit aimed at further deepening the bilateral economic relationship, enhancing trade and investment flows, and exploring new avenues of cooperation in emerging sectors.

In his official interactions, Shri Goyal met with H.E. Mr. Benjamin Dousa, Minister for International Development Cooperation and Foreign Trade, and H.E. Mr. Håkan Jevrell, State Secretary for Foreign Trade. Discussions focused on expanding the scope of India–Sweden trade and investment partnership, facilitating sustainable industrial collaboration, and identifying key areas for technology and innovation-driven growth.

The 21st session of the India–Sweden Joint Commission for Economic, Industrial and Scientific Cooperation was held during the visit. The session was co-chaired by H.E. Mr. Håkan Jevrell, State Secretary for Foreign Trade, Joint Secretary from the Department for Promotion of Industry and Internal Trade (DPIIT), Shri Sanjiv and Joint Secretary from the Department of Commerce, Shri Saket Kumar,. The agenda included strategic cooperation in innovation and research and a roundtable discussion on strengthening the India–Sweden economic partnership. The meeting witnessed participation from key Swedish institutions including LeadIT, Vinnova, the Swedish Energy Agency, the Swedish National Space Agency, the National Board of Trade, the Swedish Export Credit Agency, Business Sweden, and the Swedish Chamber of Commerce in India. Both sides underscored their shared commitment to advancing joint projects in green transition, advanced technologies, and resilient supply chains.

Shri Goyal also addressed the India–Sweden Business Leaders’ Roundtable, where he interacted with key members of Swedish industry. He invited companies to enhance their footprint in India by taking advantage of the country’s enabling regulatory environment, growing consumer base, skilled talent pool, and well-developed industrial infrastructure. The Roundtable served as a platform for strengthening private-sector collaboration in clean energy, smart manufacturing, mobility, life sciences, and digital technologies.

The Minister participated in the India–Sweden High-Level Trade and Investment Policy Forum at the Confederation of Swedish Enterprise. The Forum brought together business leaders and policy-makers from both sides to discuss the evolving trade architecture and opportunities under the proposed India–EU Free Trade Agreement. Presentations were made by CII and the Confederation of Swedish Enterprise. CEOs from leading companies shared their views on enhancing value-chain partnerships, technology transfers, and investment facilitation.

A number of one-on-one meetings were held with Swedish companies from sectors such as automation, renewable energy, sustainable food systems, maritime technology, and advanced materials. Several companies conveyed strong confidence in the Indian economy and expressed intent to scale their presence through new investments, capacity expansion, and deeper localisation. Areas of support discussed included facilitation in land access, skilling partnerships, and fast-track clearances.

The Embassy of India and the Sweden–India Business Council co-hosted a Roundtable Reception in the evening with business stakeholders, thought leaders, and government representatives. Shri Goyal reiterated India’s vision of becoming a global manufacturing and innovation hub and called for sustained partnership with Sweden in critical sectors such as green technologies, innovation-led growth, and digital public infrastructure.

The engagements in Stockholm reflect the continued momentum in the India–Sweden strategic partnership and reaffirm the shared ambition to collaborate on high-impact, future-oriented initiatives.

Maharashtra to transform farming with Rs 300 crore ‘Clean Plant’ projects guaranteeing disease-free crops

Maharashtra to transform farming with Rs 300 crore ‘Clean Plant’ projects guaranteeing disease-free crops

Union Minister for Agriculture and Farmers Welfare, Shri. Shivraj Singh Chouhan speaking at India’s first International Agri Hackathon in Pune. Image Courtesy: Press Information Bureau – pib.gov.in.

Mumbai: Maharashtra is set to witness a significant advancement in its horticulture sector with the launch of the Central Government’s ‘Clean Plant’ programme, an initiative designed to ensure disease-free cultivation and enhance agricultural productivity.

“In all 9 ‘Clean Plant’ projects will be started across the country, out of which three projects will be set up in Maharashtra,” said Union Minister for Agriculture and Farmers Welfare, Shri Shivraj Singh Chouhan. He also reaffirmed the Government’s commitment to strengthening India’s agricultural foundations and ensuring its global competitiveness.

Announced during the concluding session of India’s first International Agri Hackathon in Pune, the programme aims to transform the availability and quality of plants for farmers through advanced technology and strategic global partnerships.

With a total investment of Rs 300 crore, the three specialised ‘Clean Plant’ projects to be established in Maharashtra will come up in Pune for grapes, Nagpur for oranges, and Solapur for pomegranates. These centres will provide disease-free plants to farmers, addressing one of the most pressing concerns in horticulture.

Complementing these efforts, modern nurseries will also be established, offering technology-driven support to agricultural stakeholders. Large nurseries will receive Rs 3 crore in funding, while medium-sized ones will be allocated Rs 1.5 crore, with a target of supplying eight crore disease-free seedlings annually.

Shri Chouhan emphasised Maharashtra’s pivotal role in shaping India’s horticultural landscape, lauding its record production of grapes, pomegranates, oranges, chickpeas, and various vegetables. He expressed confidence that the state’s horticulture industry will soon compete on an international scale. He also highlighted that global expertise, including collaboration with Israel and the Netherlands, would be leveraged to implement the programme effectively.

Chief Minister of Maharashtra, Shri Devendra Fadnavis, underscored the need to integrate modern technology into agriculture, citing climate change-induced challenges. He stressed that initiatives such as the Pune Agri Hackathon will be instrumental in incubating viable solutions that can be directly transferred to farmers, ultimately boosting productivity.

The Union Minister further reiterated that a developed India hinges on prosperous farmers and a robust agricultural framework. He announced a concerted effort to bridge the gap between scientific research and its application, through the ‘Lab to Land’ programme. As part of this initiative, sixteen thousand scientists will collaborate directly with farmers to enhance yield, reduce costs, and optimise market linkages.

The event also recognised and awarded outstanding contributions from startups, agri-innovators, and enterprising farmers across several categories, including Artificial Intelligence in Agriculture, Soil and Irrigation Management, and Post-Harvest Technologies. As Maharashtra embarks on this transformative journey, the Clean Plant programme stands as a testament to the Government’s dedication to agricultural excellence and food security.

(Write to us at editorial@bombaychamber.com)

NITI Aayog unveils strategic roadmap to unlock the potential of medium enterprises

NITI Aayog unveils strategic roadmap to unlock the potential of medium enterprises

Mumbai: NITI Aayog in a recent report titled ‘Designing a Policy for Medium Enterprises’ outlined a strategic roadmap to harness the untapped potential of medium-sized businesses as key drivers of India’s economic growth. The report, launched by Shri Suman Bery, Vice Chairman of NITI Aayog, in the presence of Dr. V.K. Saraswat and Dr. Arvind Virmani, Members of NITI Aayog, underscores the significant yet underutilised role of medium enterprises in the country’s industrial landscape.

Despite contributing nearly 40% of micro, small and medium enterprises (MSME) exports, medium enterprises form only 0.3% of the registered MSME sector, which itself accounts for approximately 29% of India’s gross domestic product (GDP), 40% of exports, and more than 60% of employment. This structural imbalance, where 97% of MSMEs are micro enterprises and only 2.7% are small enterprises, has limited the ability of medium-sized businesses to scale, innovate, and compete globally.

The report identifies several critical challenges hindering the growth of medium enterprises, including restricted access to customised financial products, limited technological adoption, insufficient research and development (R&D) support, inadequate sector-specific testing infrastructure, and misalignment between training programmes and business needs. To overcome these barriers, NITI Aayog has proposed a comprehensive policy framework focusing on six priority areas.

Among its key recommendations is the introduction of tailored financial solutions, including a working capital financing scheme linked to enterprise turnover, a ₹5 crore credit card facility at market rates, and streamlined fund disbursal mechanisms through retail banks. Technology integration is also emphasised, with plans to upgrade existing Technology Centers into India SME 4.0 Competence Centers designed to accelerate the adoption of advanced industrial solutions. The report further calls for the establishment of a dedicated R&D cell within the Ministry of MSME, leveraging the Self-Reliant India Fund for cluster-based projects of national importance.

In addition, the framework advocates for the creation of sector-focused testing and certification facilities to ease compliance burdens and improve product quality. Recognising the need for specialised skill development, the report recommends aligning training programmes with enterprise-specific requirements and incorporating medium enterprise-centric modules into Entrepreneurship and Skill Development Programmes (ESDPs). To enhance accessibility, a dedicated sub-portal within the Udyam platform is proposed, offering scheme discovery tools, compliance guidance, and artificial intelligence-driven assistance.

NITI Aayog stresses that empowering medium enterprises through inclusive policy design and collaborative governance is essential to unlocking their full potential. With strategic interventions across finance, technology, infrastructure, skilling, and digital access, medium enterprises are poised to emerge as vital engines of innovation, employment generation, and export growth. This transformation is crucial for India’s long-term industrial competitiveness and aligns with the broader vision of Viksit Bharat @2047.

Key Highlights

- Medium enterprises are the future large enterprises and the drivers of Viksit Bharat @2047

- The MSME sector contributes 29% to India’s GDP and employs over 60% of the workforce

- Medium enterprises, though only 0.3% of MSMEs, contribute 40% of MSME exports, showcasing immense untapped potential

- Focus on tailored financial tools, Technology Integration and Industry 4.0, Cluster-Based Testing Facilities, R&D, Skill Development, and a Centralised Digital Portal

(Write to us at editorial@bombaychamber.com)

47 New National Waterways (NWs) to be operational by 2027; Cargo volume to rise up to 156 MTPA by 2026”: Sarbananda Sonowal

47 New National Waterways (NWs) to be operational by 2027; Cargo volume to rise up to 156 MTPA by 2026”: Sarbananda Sonowal

Union Minister of Ports, Shipping & Waterways, Shri Sarbananda Sonowal, today chaired a meeting of the Consultative Committee on Inland Waterways Transport in Mumbai, where it was revealed that 76 waterways are targeted to be made operational by 2027, with cargo volume expected to surge by 156 million tonnes per annum (MTPA) by end of FY 2026. The Inland Waterways Authority of India (IWAI), the nodal agency under the Ministry, presented a comprehensive review of major projects, future projections, and the roadmap ahead. Members of Parliament attending the meeting acknowledged and appreciated the progress made and supported increased budgetary allocations to boost the sector’s growth.

The footprint of inland water transport is expected to expand significantly—from 11 states in FY 2024 to 23 states and 4 Union Territories by FY 2027. To support this growth, projects worth ₹1,400 crore were launched or announced during the Inland Waterways Development Council (IWDC) meeting held on January 10, 2025. Additionally, the Inland Waterways Authority of India (IWAI) is conducting 10,000 km of longitudinal survey each month to assess Least Available Depth (LAD) for improved navigability. Cargo Volume is likely to make an incremental growth up to 156 MTPA by March, 2026 inching closer towards the Maritime India Vision 2030 target of 200 MTPA.

Speaking on the occasion, the Union Minister Shri Sarbananda Sonowal said, “Inland waterways are emerging as the watershed moment in India’s logistics and transport ecosystem. Under the visionary leadership of Prime Minister Narendra Modi ji, we are witnessing a transformational shift with policy interventions like the National Waterways Act, 2016, the Inland Vessels Act, 2021 and supplemented by multiple programmes like Jal Marg Vikas Project, Arth Ganga, Jalvahak scheme, Jal Samriddhi scheme, Jalyan & Navic among others. Through Maritime India Vision 2030 and the Maritime Amrit Kaal Vision 2047. These roadmaps are not just policy documents—they are catalysts driving India toward becoming a global maritime powerhouse. Today’s meeting with esteemed Members of Parliament reflects a unified commitment to boost infrastructure and unlock the immense economic potential of our rivers and coasts. With enhanced budgetary support and cooperative federalism, we are building a greener, more efficient, and future-ready waterway network across the country.”

The Regional Waterways Grid aims to boost economic activity by ensuring seamless vessel movement from Varanasi to Dibrugarh, Karimganj, and Badarpur via the IBP route, creating a 4,067 km economic corridor. A traffic study and DPR for renovating the Jangipur navigation lock are underway. The project’s cargo potential is estimated at 32.2 MMTPA by 2033.

On NW 1 (Ganga), a dedicated waterway corridor spanning 1,390 km is being developed to enable seamless movement of vessels, enhancing the efficiency of inland transport. As part of this initiative, capacity augmentation of NW-1 is underway to support the navigation of 1,500–2,000 DWT vessels, alongside the creation of key cargo handling facilities at Varanasi (MMT), Kalughat (IMT), Sahibganj (MMT), and Haldia (MMT).

Inland Waterways has major projects in the Northeast. A ₹5,000 crore roadmap is planned over the next five years. On NW-2 (Brahmaputra), four permanent terminals—Dhubri, Jogighopa, Pandu, and Bogibeel—and 13 floating terminals are supported by fairway and navigation upgrades. A ₹208 crore ship repair facility at Pandu and a ₹180 crore alternative road are set for completion by 2026 and 2025, respectively. On NW-16 (Barak), terminals at Karimganj and Badarpur are active, while NW-31 (Dhansiri) is being developed to support NRL’s expansion.

Adding further, Shri Sarbananda Sonowal said, “In line with the Harit Nauka Guidelines, the Inland Waterways Authority is committed to green and sustainable transport solutions, including the procurement of electric catamarans and hydrogen fuel cell-powered vessels. By strengthening urban water transport through water metro projects and promoting eco-friendly cruise tourism, we are paving the way for a cleaner, greener future in inland waterways transportation. The Regional Waterways Grid aims to seamlessly connect Assam and the Northeast with the rest of India through an integrated network of inland waterways. This will boost regional trade, tourism, and connectivity while unlocking economic potential across the Brahmaputra and Barak River systems. Government is also working on a ₹5,000 crore roadmap for Inland Waterways Development in Northeast Over Next 5 Years.”

The committee also reviewed the ongoing works on NW -1 (river Ganga), NW 2 (Brahmaputra) among other states like Odisha, Jammu & Kashmir, Goa, Kerala, Maharashtra, Andhra Pradesh, Gujarat, Madhya Pradesh, Karnataka, and Tamil Nadu.

India’s river cruise tourism is witnessing robust growth, with 15 river cruise circuits now operational across 13 National Waterways (NWs) spanning nine states. The number of NWs supporting river cruises has risen from just three in 2013-14 to 13 in 2024-25, while luxury river cruise vessels have increased significantly from three to 25 during the same period. To further boost inland water-based tourism, 51 additional cruise circuits have been identified on 47 NWs for development by 2027. Three World class river cruise terminals are also planned, with construction underway at Kolkata. Feasibility studies for terminals at Varanasi and Guwahati are being conducted by IIT Madras, while four more terminals at Silghat, Bishwanath Ghat, Neamati, and Guijan are set to be developed by 2027.

Speaking on the occasion, Minister of State for Ports, Shipping and Waterways, Shri Shantanu Thakur said, “Special efforts are underway to advance river cruise tourism across India by developing modern cruise terminals and related infrastructure. Through strategic partnerships and MoUs with private enterprises, we are boosting luxury river cruises on the Ganga and Brahmaputra, while also expanding cruise tourism on the Yamuna, Narmada, and key rivers in Jammu & Kashmir. These initiatives not only promote tourism but also contribute to sustainable economic growth in the regions we serve.”

The Consultative Committee meeting was chaired by the Union Minister of Ports, Shipping & Waterways, Shri Sarbananda Sonowal while Minister of State for Ports, Shipping & Waterways, Shri Shantanu Thakur was also present. The meeting was attended by Shatrughan Prasad Sinha, Lok Sabha MP (Asansol, West Bengal), Bibhu Prasad Tarai, Lok Sabha MP (Jagdispur, Odisha), Hibi Eden, Lok Sabha MP (Ernakulum, Kerala), M.K. Raghavan, Lok Sabha MP (Kozhikode, Kerala), Naba Charan Majhi, Lok Sabha MP (Mayurbhanj, Odisha), Abhimanyu Sethi, Lok Sabha MP (Odisha) and Seema Dwivedi (Rajya Sabha MP from Uttar Pradesh).

MSME credit growth in India soars to ₹35.2 lakh crore amid financial resilience

MSME credit growth in India soars to ₹35.2 lakh crore amid financial resilience

India’s Micro, Small and Medium Enterprises (MSME) sector has seen robust growth in its commercial credit portfolio, rising by 13% year-over-year (YoY) as the total credit exposure reached Rs 35.2 lakh crore by the end of March 2025. This surge has primarily been attributed to an increased supply of credit to existing borrowers, as outlined in the latest MSME Pulse Report from TransUnion CIBIL and the Small Industries Development Bank of India (SIDBI). The MSME sector includes borrowers with credit exposures up to Rs 50 crore.

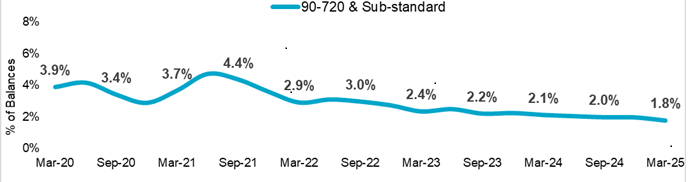

Alongside this expansion in credit, the sector has witnessed a notable improvement in balance-level serious delinquencies — measured as 90 to 720 days past due (DPD) and reported as ‘sub-standard’, which dropped to a five-year low of 1.8%. This improvement, particularly among borrowers with exposures ranging from Rs 50 lakh to Rs 50 crore, marked a 35 basis points decline from the previous year. In contrast, borrowers with exposures of up to Rs 10 lakh saw a slight deterioration, with delinquency levels climbing to 5.8% from 5.1% a year earlier. Similarly, delinquency rates among those with exposures between Rs 10 lakh and Rs 50 lakh rose marginally to 2.9%.

Highlighting the significance of MSMEs to the economy, Manoj Mittal, Chairman and Managing Director of SIDBI, noted that the sector plays a vital role in employment generation and export growth. “Though the credit flow to the sector has improved over the years, the sector still has an addressable credit gap. Providing support to MSMEs can help the sector’s growth and aid the overall economic growth of our country,” he said, underscoring the need for continued efforts to foster innovation, enhance skill development and improve access to financial resources.

While demand for commercial credit grew by 11% year-over-year in the quarter ending March 2025, supply increased at a slower pace, rising by just 3% YoY in the financial year 2024-25. The last quarter of the fiscal year, however, saw an 11% decline in credit supply, possibly due to heightened caution among lenders in response to external economic uncertainties. Nevertheless, credit extended through new cash credit facilities demonstrated resilience, posting a 7% YoY increase. The share of New-to-Credit (NTC) MSME borrowers among total loan originations remained significant at 47%, although lower than the 51% recorded a year earlier.

Public sector banks played a key role in supporting new borrowers, accounting for 60% of NTC loan originations in the quarter ending March 2025. The trade sector contributed the largest proportion of NTC borrowers at 53%, while the manufacturing sector recorded the highest year-over-year growth at 70% in the number of new MSME borrowers securing commercial loans.

Bhavesh Jain, MD and CEO of TransUnion CIBIL, asserted that MSMEs require assistance in accessing formal credit and managing debt effectively. “Fluctuations in the business cycle affect these enterprises disproportionately, as they often lack the financial reserves or support necessary to navigate adverse conditions. Therefore, it is crucial to extend support to this sector and equip them with tools for effective financial management,” he said.

Despite representing only 23% of total loan originations, the manufacturing sector commanded a greater share of the origination value at 34%. However, its share of loan originations by value has steadily declined over the last two years, shifting towards professionals, other services and other industries, which now account for 36% of new loan disbursements –– an increase of five percentage points over the past four years.

Geographically, Maharashtra, Gujarat, Tamil Nadu, Uttar Pradesh and Delhi continued to lead in commercial lending, collectively accounting for 48% of overall originations in the quarter ending March 2025. While the manufacturing sector dominated originations in Maharashtra, Gujarat, Tamil Nadu and Delhi, Uttar Pradesh saw the highest number of loans granted to the trade sector.

(Write to us at editorial@bombaychamber.com)

India Participates in 9th BRICS Industry Ministers’ Meeting in Brasília

India Participates in 9th BRICS Industry Ministers’ Meeting in Brasília

India participated in the 9th BRICS Industry Ministers’ Meeting held under the Chairship of Brazil on 21st May 2025 at the Itamaraty Palace, Brasília – Federal District. The overarching theme of the meeting was “Strengthening Global South Cooperation for More Inclusive and Sustainable Governance”.

The meeting witnessed the presence of Industry Ministers and representatives from all BRICS member countries including Brazil, Russia, India, China, South Africa, as well as newly inducted members Egypt, Ethiopia, Iran, Indonesia, Saudi Arabia, and the United Arab Emirates. The Joint Declaration adopted at the meeting reaffirmed the collective commitment to fostering an open, fair, and resilient global environment, strengthening the multilateral system, and enhancing economic and social resilience amid rapid global transformations.

As a key initiative, India launched the BRICS Startup Knowledge Hub on 31st January 2025, under the aegis of the BRICS Start-Up Forum. This is the first-of-its-kind dedicated platform for BRICS nations, aimed at enhancing cross-border collaboration and strengthening startup ecosystems across member countries. India extended an invitation to all BRICS nations to contribute to and derive benefits from this platform through the exchange of policy insights, innovations, and best practices.

In line with the Joint Declaration, India also emphasized the critical role of Micro, Small, and Medium Enterprises (MSMEs) in the national and global economy. India highlighted that with 5.93 crore registered MSMEs employing more than 25 crore individuals, the sector contributed 45.73% of the country’s total exports in 2023–24.

The Ministers underscored the need to deepen industrial cooperation and promote sustainable and inclusive growth across BRICS nations. The Joint Declaration emphasized the pivotal role of innovation and digital technologies under Industry 4.0 as key drivers of sustainable development. India, in its intervention, articulated its vision for a future-ready industry that is inclusive, innovative, and digitally empowered, aligning with the objectives of the Fourth Industrial Revolution.

It was noted that India’s Digital India campaign has transformed the country into the world’s largest digitally connected democracy. The number of internet users in India increased significantly from 251.59 million in 2014 to 954.40 million as of March 2024.

India concluded its remarks by calling upon BRICS members to be guided by the principles of Sahyog (Collaboration), Samanjasya (Harmony), Samagrata (Inclusiveness), and Sarvasammati (Consensus) in all cooperative endeavours going forward.

It is a long established fact that a reader will be distracted by the readable content of a page when lookin