Blog

Top Stories

Millions of MSME workers remain uninsured, reveals new data from NI-MSME

Mumbai: Despite employing over 110 million people across India, micro, small and medium enterprises (MSMEs) continue to fall short in providing basic health protection to their workforce. New data from the National Institute for Micro, Small and Medium Enterprises (NI-MSME) shows that fewer than one in 10 MSMEs offer group health insurance to employees, a figure that underscores a significant gap in workplace benefits across the sector.

The findings are particularly concerning given the scale of the MSME ecosystem, which comprises more than 63 million enterprises nationwide. While group health insurance is often the first and only form of coverage for salaried workers, most MSME employees remain uninsured, especially those in informal or unregistered businesses. This leaves millions vulnerable to medical emergencies without financial support from their employer.

The adoption of group health insurance is highest in urban, Tier 1 service sectors such as information technology and financial services. In contrast, industries with higher physical risk – including manufacturing, construction and retail – show markedly lower coverage rates. Micro and small enterprises are the least likely to offer any form of employee insurance, according to the NI-MSME data.

Several factors contribute to this low uptake. Cost remains a primary concern, with many small business owners assuming that group insurance is prohibitively expensive or only viable for larger firms. There is also a widespread lack of awareness about affordable, customisable plans now available in the market.

Digitisation plays a role too, MSMEs that operate offline are less likely to engage with digital insurance platforms that simplify enrolment and claims. Crucially, there is no regulatory mandate requiring MSMEs to provide group health insurance, unlike schemes such as the Employees’ State Insurance Corporation (ESIC) or Provident Fund.

However, the landscape is beginning to shift. Insurers and fintech companies have introduced bite-sized group health plans tailored for small teams, with premiums starting as low as ₹100 to ₹150 per employee per month. These plans often include features such as zero paperwork, instant onboarding, and optional add-ons like outpatient cover or teleconsultation services. The Insurance Regulatory and Development Authority of India (IRDAI) has also encouraged insurers to design simplified group products specifically for micro and small businesses.

Some state governments are exploring incentives to boost adoption, including GST waivers and partial premium contributions. These efforts aim to make health insurance more accessible and relevant for MSMEs, aligning with broader national goals around universal health coverage and financial inclusion.

The implications for workers are significant. Without employer-sponsored insurance, many MSME employees face delays in seeking treatment due to cost concerns. Group plans typically offer advantages such as no medical checks, maternity cover, mental health support and lower premiums compared to individual policies – benefits that are often out of reach for those without formal employment benefits.

According to industry estimates, only eight to 10 million MSME employees are currently covered by group health plans. This represents a small fraction of the total workforce, and highlights the urgency of expanding coverage across the sector. With roughly 90 per cent of MSMEs operating informally and outside the purview of labour regulations, the challenge is not only financial but structural.

As India continues to push for inclusive growth, the MSME sector remains a critical focus area. Addressing the health insurance gap will require coordinated efforts from policymakers, insurers and industry bodies. For employers, the availability of flexible, low-cost plans presents an opportunity to enhance workplace security. For employees, initiating conversations around coverage could be the first step toward better protection.

The data paints a clear picture that health insurance is no longer a corporate luxury but a workplace necessity. Bridging the coverage gap in MSMEs is not just a matter of policy, but of equity and resilience.

(Write to us at editorial@bombaychamber.com)

Union Cabinet approves ₹69,725 crore to revive shipbuilding sector

Union Cabinet approves ₹69,725 crore to revive shipbuilding sector

Mumbai: In a major policy move aimed at revitalising the country’s maritime capabilities, the Union Cabinet has approved a ₹69,725 crore package to strengthen India’s shipbuilding and maritime infrastructure. The decision marks one of the most substantial investments in the sector to date and reflects a strategic shift toward enhancing domestic capacity, long-term financing, and technical expertise.

The package is built around a four-pillar framework that includes extending financial assistance for shipbuilding, establishing dedicated maritime funds, expanding shipyard infrastructure, and implementing legal and policy reforms. At the heart of the initiative is the extension of the Shipbuilding Financial Assistance Scheme (SBFAS) until 31 March 2036, with a corpus of ₹24,736 crore. The scheme is designed to incentivise domestic shipbuilding and includes a ₹4,001 crore allocation for Shipbreaking Credit Notes, aimed at supporting environmentally responsible dismantling of vessels.

A National Shipbuilding Mission will be set up to oversee the implementation of these measures, ensuring coordination across ministries and stakeholders. The Cabinet also approved the creation of a Maritime Development Fund (MDF) with a total corpus of ₹25,000 crore. This includes a ₹20,000 crore Maritime Investment Fund, in which the government will hold a 49 per cent stake, and a ₹5,000 crore Interest Incentivisation Fund to reduce the cost of debt and improve the viability of maritime projects.

The Shipbuilding Development Scheme (SbDS), with an outlay of ₹19,989 crore, is expected to expand India’s shipbuilding capacity to 4.5 million Gross Tonnage annually. It will support the development of mega shipbuilding clusters, infrastructure upgrades, and the establishment of the India Ship Technology Centre under the Indian Maritime University. The scheme also includes provisions for insurance and risk coverage to support shipbuilding ventures.

Taken together, the measures are projected to generate nearly 30 lakh jobs and attract investments of approximately ₹4.5 lakh crore into the maritime sector. The government expects the initiative to enhance national, energy, and food security by strengthening supply chain resilience and maritime logistics. It also aims to bolster India’s strategic autonomy in the Indo-Pacific region, where maritime infrastructure plays a critical role in geopolitical stability.

India’s maritime sector currently handles about 95 per cent of the country’s trade by volume and 70 per cent by value. Despite this centrality, domestic shipbuilding has struggled to compete globally due to limited financing options, outdated infrastructure, and policy bottlenecks. The new package seeks to address these structural challenges by offering targeted financial support and institutional reforms.

The emphasis on long-term financing through the MDF and the Maritime Investment Fund is particularly significant. Historically, the lack of affordable credit has been a major impediment to shipyard expansion and fleet modernisation. By reducing the effective cost of debt, the government hopes to make Indian shipbuilding projects more bankable and attractive to private investors.

The establishment of the India Ship Technology Centre is another key element of the package. It is expected to serve as a hub for research, innovation, and skill development, helping to build a technically proficient workforce and promote indigenous design capabilities. This aligns with broader efforts to reduce reliance on foreign technology and improve the competitiveness of Indian shipyards.

The Cabinet’s decision comes at a time when global shipping is undergoing rapid transformation, driven by digitalisation, decarbonisation, and shifting trade routes. India’s ability to adapt to these changes and position itself as a reliable shipbuilding hub will be critical to the long-term viability of the sector.

(Write to us at editorial@bombaychamber.com)

Bombay Chamber Hosts MSME Conclave 2025 – 2.0

Bombay Chamber Hosts MSME Conclave 2025 – 2.0

Empowering India’s Growth Engines through Finance, Policy & Mediation

The Bombay Chamber of Commerce & Industry hosted the MSME Conclave 2025 – 2.0, themed Global Partnerships, Smart Finance & Dispute Resolution For MSME Growth. The conclave brought together policymakers, economists, international trade experts, mediators, industry leaders, and MSME representatives to deliberate on the challenges and opportunities shaping India’s micro, small, and medium enterprises (MSMEs).

With over 82.63 lakh MSME units in Maharashtra, contributing nearly 40% of the state’s Gross State Domestic Product and employing 1.3 crore people, the conclave underscored the sector’s critical role in driving inclusive growth, exports, and employment.

In his welcome address, Rajan Raje, Chairperson – MSME Forum, Bombay Chamber & CEO of Nichem Solutions, reflected on the Chamber’s 189-year-old legacy, and the role it has played in India’s development, serving as a bridge between regulatory bodies, industry, and society at large. This was followed by theme-setting remarks from Sunil Kumar Sharma, GM & Zonal Head, Bank of Baroda.

Setting the tone for the day, the Fireside Chat featured Beena Vaheed, Executive Director, Bank of Baroda, in conversation with Vishwanath Nair, Bureau Chief & Banking Editor, NDTV Profit. Addressing the common perception that banks have been hesitant to lend to MSMEs, Vaheed observed, “This is the opinion of the past. In 2025 alone, Bank of Baroda registered a 15% growth in credit to MSMEs. Digital lending has revolutionised the process—today MSMEs don’t need to walk into branches, paperwork has been simplified, and banks are moving towards cash-flow-based lending models.” On the subject of supply chain financing, she emphasised its centrality to the bank’s strategy, noting that “it has been a strategic growth engine for us. With deep relationships across PSUs and corporates, we have been able to act as a platform for ecosystem financing. This lowers transaction costs, reduces risk, and today nearly 60% of our MSME portfolio runs through supply chain financing.”

She further explained how digitalisation has accelerated credit delivery: “What used to take 59 minutes earlier, today even loans of ₹5 crore can be processed in 10–15 minutes, thanks to full back-end integration. We have already discounted 1.89 crore invoices amounting to ₹6.49 lakh crore.” Concluding the session, she underscored the bank’s role as a partner, not just a lender: “Our approach is not just to lend but to advise MSMEs—partnering with them and helping transform them into tomorrow’s large corporates.”

This was followed by presentations from Sandeep Prakash, Zonal Sales Manager, and Tania Das, Senior Manager Forex, both from Bank of Baroda, who outlined tailored financial solutions for MSMEs, and a presentation by Uma Iyer, DGM, New India Assurance Company Limited, who highlighted insurance as a vital safeguard for small enterprises.

The first panel discussion was moderated by R. Srinivasan, Co-Chairperson – MSME Forum, Bombay Chamber and Director, AIRA Consulting Pvt. Ltd., and featured Madan Sabnavis, Chief Economist at Bank of Baroda, Rishi Kant Tiwari, Joint Director (Regional Head) of FIEO (Western Region), and Namrata Jage, Founder of BharatFi. The session examined the impact of tariff escalations on MSMEs, with particular attention to exporters in sectors such as textiles, auto components, and engineering goods. The panellists discussed the rising cost pressures faced by enterprises, the need for diversifying markets to reduce vulnerabilities, and the importance of responsive policy and financial support to help MSMEs manage shrinking margins, delayed payments, and liquidity challenges.

The second panel discussion, “Unlocking Growth through Mediation – A New Era for MSMEs,” was introduced by Ashok Barat, Past President & Mentor – Dispute Resolution, Bombay Chamber and Director, Bata India Ltd., and moderated by Sandeep Khosla, Director General of the Bombay Chamber and Member of the Micro, Small Enterprises Facilitation Council (MSEFC). The panellists included Manissh Assarkar, Advocate, Corporate Lawyer & Mediator at Assarkar & Co.; Hasit B. Seth, Independent Counsel, Arbitrator & Mediator at HLaw Chambers; and Rajesh Doiphode, Former Industries Officer – MSEFC Konkan Thane, Government of Maharashtra.

The discussion broadly focused on the challenges MSMEs face with contractual disputes, the benefits of mediation as a cost- and time-efficient resolution method, and the importance of preventive legal practices. The panellists also explored the role of Micro, Small Enterprises Facilitation Councils, the need for stronger collaboration between chambers, facilitation councils, and government bodies, and the potential of digital platforms to make dispute resolution faster and more transparent.

In the sessions that followed, the focus shifted to international opportunities. Khosla introduced a business delegation to Cyprus. The discussions then expanded to a global canvas with Cristina Chiriboga, Chief Trade & Investment Officer of the Republic of Ecuador, sharing strategies to connect Indian MSMEs with Latin American markets; G Labane, Consul General of the Republic of South Africa, highlighting the country’s growing opportunities; and Vicente Gomis Ruiz, Economic & Commercial Counsellor at the Consulate General of Spain in Mumbai, presenting opportunities for collaboration in technology and green industries.

The conclave concluded with a strong call for greater collaboration between financial institutions, government, and industry bodies to build an enabling ecosystem that empowers MSMEs to scale globally and contribute significantly to India’s vision of self-reliance and sustainable growth. The MSME Conclave 2025 – 2.0 was supported by Bank of Baroda and New India Assurance Company Limited.

Bombay Chamber panel urges stable trade policy and credit support amid tariff strain

Bombay Chamber panel urges stable trade policy and credit support amid tariff strain

Mumbai: The Bombay Chamber of Commerce and Industry convened a high-level panel discussion titled ‘Tariffs, Trade and India’s Economic Future’, bringing together sectoral leaders to assess the impact of recent US tariff measures on Indian exports. The consensus was clear: while diversification and long-term reform are essential, immediate government intervention is critical to prevent lasting damage to employment and industry.

In his welcome address, Sandeep Khosla, Director General, Bombay Chamber, underscored the timeliness of the panel amid ongoing volatility surrounding US tariffs on Indian exports. He noted the pace at which the situation continues to evolve, marked by frequent developments and high-level diplomatic exchanges. This climate of uncertainty, he said, has made forward planning increasingly difficult for businesses. Against this backdrop, the panel aimed to examine the wide-ranging impact on Indian industries, particularly MSMEs, and highlight the importance of vigilance and adaptability in navigating the challenges ahead.

Moderating the panel, R. Srinivasan, Co-Chairperson of the MSME Forum at the Bombay Chamber and Director at AIRA Consulting, opened the discussion with a central question: Why is the United States such a crucial market for India, and how will the tariffs affect various sectors?

Elizabeth Master, Associate Director at Crisil Intelligence, responded by framing the US as a cornerstone of India’s export economy. “The US remains our most significant trading partner across various industries, especially in IT services. The new tariffs will have a measurable impact on India’s overall economic growth, even after accounting for recent Goods and Services Tax (GST) reductions,” she said. The effects, she added, ripple beyond the obvious sectors, noting that even IT services – initially considered resilient – have experienced project delays and revenue slowdowns due to broader economic uncertainty.

The gems and jewellery sector, according to Shaunak Parikh, Director at Mahendra Brothers Group and Vice Chairman of the Gem & Jewellery Export Promotion Council (GJEPC), faces acute challenges. “One-third of our exports go directly to the US,” Parikh said. “Front-loading shipments offered temporary relief, but the long-term threat is real. Competing countries are already positioning themselves to take our market share.” He emphasised the human cost, pointing out that the industry employs millions with highly specialised skills. “These are not easily transferable jobs. Layoffs here mean irreversible damage to livelihoods,” he said.

Samir Bhuta, Partner at Shreeji Exim Works LLP and member of the Apparel Export Promotion Council (AEPC), described the situation in the textiles and apparel sector as ‘COVID-like’. “Factories are running at half capacity. Workers are being laid off. The ecosystem – from suppliers to transporters – is collapsing,” he said. On the likelihood of US buyers lobbying on India’s behalf, Bhuta expressed scepticism saying, “They have alternatives. They are already shifting orders and demanding price cuts. Our margins are being squeezed to the bone.”

In contrast, Rajan Raje, Chairperson – MSME Forum, Bombay Chamber & CEO of Nichem Solutions, offered a more tempered view from the chemical industry. “Our exposure to the US is relatively limited,” he said. “Specialty chemicals may adapt better, provided there is support from both buyers and the government.” Raje also highlighted the burden of non-tariff barriers in the European Union, such as the REACH certification, which disproportionately affects MSMEs. “These are costly and time-consuming. We need to explore new markets in Africa and Latin America, possibly using gateway countries like Mexico and Egypt,” said Raje.

Agriculture presented a mixed picture. Abhay Dandwate, Chief Risk Officer and Head of Strategy at the National Bulk Handling Corporation, noted that while marine exports like shrimp are vulnerable, most Indian farmers – engaged in cereals, pulses and edible oils – are less exposed. “Export volumes had actually increased prior to the tariff announcement, but that growth is likely to stall,” he said. Dandwate cautioned against liberalising imports of genetically modified (GM) crops and dairy products from the US, citing political sensitivities and the potential impact on domestic prices.

Steering the conversation towards policy solutions, Srinivasan invited panellists to share their expectations from the government. He urged them to consider both immediate and long-term measures, including liquidity support, easing customs procedures and regulatory compliance, and structural reforms to improve competitiveness.

Bhuta reinforced the need for a pragmatic outlook. “Even with robust government efforts, ratifying and implementing trade agreements is a lengthy process, and that delay does little to support Indian businesses in the short term,” he said, adding that export volumes from alternative markets fall far short of those achievable in the US.

Parikh outlined the industry’s outreach to government authorities, advocating for measures reminiscent of the COVID-19 response. “We need interest equalisation schemes extended, packing credit deferred, and overdraft facilities made available,” he said. He also proposed allowing Special Economic Zone (SEZ) units to sell excess inventory locally under duty, and called for state-level support such as EMI restructuring and enhanced medical insurance for workers.

Stressing on the importance of consistent policy, Bhuta said, “We cannot operate under schemes that change every few months. We need long-term clarity.” He also called for baseline subsidies across textile-producing states and greater support for transitioning to manmade fibres and sustainable practices. “Global markets, especially Europe, will soon demand higher sustainability standards. We must be ready,” he pointed.

Rajan Raje questioned India’s reluctance to pursue a free trade agreement with the US, attributing the delay to political and emotional considerations. “We need a practical, forward-looking approach. Opening up agriculture to competition could prove beneficial in the long run, as demonstrated during earlier phases of liberalisation,” he said.

Dandwate returned to the theme of financial support, calling for emergency credit arrangements similar to those provided during the pandemic. “Policy consistency is essential – not just for farmers, but for traders and allied sectors,” he said.

Master summarised the industry’s predicament saying the current tariff situation is unviable. “Even a reduction to 20 per cent would offer some relief. Diversification is necessary, but we must first address the immediate pain points. With timely action, this crisis could become a catalyst for structural reform,” she said

The panel discussion was followed by an insightful presentation by Shri Vishwajeet G. Chimankar, Deputy Director General of Foreign Trade (DGFT), Ministry of Commerce and Industry, Government of India.

India’s trade strategy for 2025, as outlined by the DGFT, centres on responding to global tariff shifts and expanding export opportunities. “Following steep US tariffs on key Indian goods, the government resumed trade talks with major partners and signed a landmark agreement with the UK. The India–UK CETA eliminates duties on 99 per cent of Indian exports and facilitates professional mobility through simplified visa processes and dedicated quotas,” said Chimankar.

To reduce reliance on the US market, India has launched a Market Diversification Mission targeting 40 countries with high demand for textiles and apparel. Meanwhile, the DGFT’s Trade Connect platform, linked with ONDC and GeM, offers support to MSMEs and artisans in accessing global e-commerce platforms. Exporters are increasingly using platforms like Amazon and Alibaba, alongside digital marketing and virtual trade fairs, to promote their offerings. “These combined efforts aim to strengthen India’s trade balance, attract foreign investment, and lower export costs through regulatory cooperation and streamlined customs procedures,” Chimankar added.

Sandeep Khosla closed the session with a vote of thanks, reflecting on the depth and relevance of the discussion. He noted that the panel had shed light on the multifaceted challenges arising from recent tariff changes, while also underscoring the resilience of Indian industry. Despite concerns over immediate disruptions, speakers agreed that a swift reconfiguration of production capacity was unlikely. There was cautious optimism, he said, around the prospect of remedial measures by November or December, suggesting that the economic fallout may be less severe than initially anticipated. Khosla concluded by thanking all participants for their thoughtful contributions and reaffirmed the Chamber’s commitment to supporting industry through the evolving trade landscape.

(Write to us at editorial@bombaychamber.com)

CSR pioneer Dr Bhaskar Chatterjee lauds Bombay Chamber’s role at its CSR Conclave themed Beyond Giving: Responsible CSR and Due Diligence

CSR pioneer Dr Bhaskar Chatterjee lauds Bombay Chamber’s role at its CSR Conclave themed Beyond Giving: Responsible CSR and Due Diligence

Mumbai:

At the recent CSR Conclave 2025 organised by the Bombay Chamber of Commerce & Industry, Dr Bhaskar Chatterjee, former Secretary to the Government of India and currently Senior Advisor at Deloitte India and Dua Consulting, delivered a compelling address on the evolution and future of Corporate Social Responsibility (CSR) in India. The Conclave was themed Beyond Giving: Responsible CSR and Due Diligence.

Widely regarded as one of the architects of India’s CSR framework, Dr Chatterjee, who was the Guest of Honour at the Conclave, reflected on the past decade of progress and the road ahead. He began by acknowledging the Chamber’s role in fostering dialogue around CSR and revisited the origins of India’s CSR legislation.

Unlike its Western counterparts, India’s approach was shaped by a distinctly Bharatiya ethos, one that embedded social responsibility into the corporate fabric through legal mandates. Dr Chatterjee questioned the initial scepticism surrounding the legislation and highlighted how its unique features, such as board-level oversight and the requirement to allocate a percentage of profits (PoP) to CSR activities, have helped institutionalise the practice.

A key theme of his speech was the importance of linking CSR spending to profitability, thereby ensuring that companies contribute meaningfully without compromising financial stability. He emphasised the role of India’s vast network of non-governmental organisations (NGOs) and civil society organisations in executing CSR programmes, noting that their involvement has been instrumental in reaching underserved communities. Transparency and accountability, he argued, must remain central to CSR efforts, with companies publicly declaring their initiatives and outcomes.

Dr Chatterjee outlined the project-based approach that has become standard in Indian CSR –beginning with baseline surveys and need assessments, followed by structured funding, documentation, monitoring and social impact evaluation. This method, he said, has enabled companies to measure outcomes more effectively and align their efforts with community needs.

The growth of CSR in India has been significant. From just 8,000 companies participating a decade ago, the number has surged to over 28,000. Correspondingly, annual CSR spending has risen from ₹10,000 crore to ₹36,000 crore. Dr Chatterjee projected that this figure could reach ₹50,000 crore by 2030, provided the sector continues to innovate and expand its reach. He noted the emergence of academic programmes and professional courses in CSR as a positive sign of its growing legitimacy and impact.

In his welcome address, Rajiv Anand, President, Bombay Chamber, President, Bombay Chamber and MD & CEO, IndusInd Bank said, “Maharashtra has always been a land of enterprise, innovation, and social consciousness. The state’s growth story has been defined not only by industrial progress but also by its commitment to inclusive and sustainable development. And CSR has played a pivotal role in this journey, complementing government efforts and strengthening communities across the state. “

He added, “Despite progress, several challenges remain like the uneven distribution of CSR funds, with urban and already-developed states receiving more. Inadequate focus on outcome vs. output; underutilisation of funds by many eligible companies and limited capacity of smaller NGOs to meet compliance requirements.”

The highlight of the Conclave was the release of the Chamber’s first edition of the CSR Year Book which featured CSR case studies of 12 projects of leading corporates including Aditya Birla Capital Foundation, Ambuja Foundation, Axis Bank, Deutsche Bank AG, Godrej Consumer Products, Hindustan Unilever Limited, HSBC India, IndusInd Bank, Kotak Mahindra Group, Larsen & Toubro, Mahindra and Mahindra and Siemens.

The Conclave saw an reputed line up of speakers and thought leaders. A Fireside Chat between Luis Miranda, Chairperson and Co-Founder, Indian School of Public Policy and Chairperson, CORO India; Dr. Anand Bang, Advisor to CM, Govt. of Maharashtra and Jayant Rastogi, Global CEO, Magic Bus India Foundation focused on Aligning Purpose with Practice: CSR and Due Diligence. They outlined what corporates should do to be compliant and transformative and stressed on the need to encourage grassroots organisations.

There were also two panel discussions. The panel on Risk Assessment and Grantee/Partner Selection was moderated by Romit Sen, Senior Vice President, Sustainability, HSBC India and the panelists included Abhejit Agarwal, Senior Vice President & Head – Sustainability and CSR, Axis Bank; Avilash Dwivedi, CSR Head, Mahindra & Mahindra (Automotive and farm Sector); Savita Mundhe, Head – CSR School Education, JSW Foundation and Ahona Ghosh, General Manager – Sustainability, Godrej Consumer Products.

The second panel was on Call for a Robust Monitoring & Evaluation System for CSR Projects saw panelists Ruchi Khemka, CSR Head, Deutsche Bank AG; Anagha Mahajani, Chief Impact Officer, Ambuja Foundation; Prachi Nautiyal – Vice President, Grant Management, Workplace Campaigns, Impact Assessment, United Way of Mumbai; Saloni Gupta, Regional Head (Corporate Advisory), Sattva and Manish Kumar, Head – ESG & CSR, ICICI Bank. The moderator was Dr Anantharaman Subramaniyan, Vice President – Head of Strategy, Sustainability, CSR at Siemens, Executive Coach & Mentor.

India’s manufacturing momentum signals deeper economic resilience

India’s manufacturing momentum signals deeper economic resilience

Mumbai: India’s manufacturing sector has reached a significant milestone, with the Purchasing Managers’ Index (PMI) hitting a 17.5-year high. This development, highlighted by Commerce and Industry Minister Piyush Goyal at the 21st Annual Global Investor Conference, reflects a broader economic resurgence underpinned by robust infrastructure investment and policy reforms.

The PMI, a key indicator of industrial activity, suggests strong expansion in manufacturing output, new orders and employment. While the precise PMI figure was not disclosed, its historical peak underscores renewed confidence among producers and investors. This momentum coincides with India’s first-quarter gross domestic product (GDP) growth of 7.8% in the financial year (FY) 2025, the fastest quarterly growth in five years, and a 66% rise in private capital expenditure, signalling a broad-based recovery across sectors.

Infrastructure has played a pivotal role in this resurgence. Referred as a ‘force multiplier’, infrastructure investment has stimulated consumption and catalysed economic activity. The government’s emphasis on transport, logistics and digital connectivity has improved supply chain efficiency and market access, particularly for small and medium enterprises (SMEs). These improvements have helped manufacturers scale operations and respond more effectively to domestic and global demand.

The Make in India initiative, now entering a more mature phase, continues to attract investment in high-value sectors such as semiconductors, drones and electrical steel. The government’s push for domestic sourcing and resilient supply chains, without disengaging from global trade, reflects a pragmatic approach to industrial policy. This is further supported by ongoing trade negotiations with key partners including the European Union (EU), EFTA bloc and the United States, aimed at expanding market access and diversifying export destinations.

Macroeconomic indicators reinforce the narrative of stability. Consumer price inflation is at its lowest in years, and foreign direct investment has risen by 14%. The banking sector has shown strong performance, contributing to financial stability and credit availability. India’s sovereign rating upgrade from BBB– to BBB with a stable outlook reflects international recognition of its economic fundamentals.

Policy reforms have also contributed to the improved business climate. The government’s efforts to deregulate, simplify procedures and decriminalise business laws have reduced compliance burdens. Anticipated GST 2.0 reforms are expected to further streamline taxation and enhance consumer sentiment. Tax rate reductions and accommodative monetary policy, including lower repo and cash reserve rates, have supported investment and spending without compromising inflation control.

While these developments are encouraging, sustaining manufacturing growth will require continued investment in infrastructure and industrial capacity. The government’s call for industry participation in shaping Viksit Bharat 2047 – a long-term vision for a developed India – underscores the need for collaborative effort. The emphasis on quality manufacturing, energy efficiency and ethical business practices reflects a broader commitment to sustainable and inclusive growth.

India’s ability to convert adversity into opportunity has been tested and proven in past crises, from the 1991 reforms to the post-pandemic recovery. The current manufacturing upswing, supported by infrastructure and policy alignment, suggests that the country is once again poised to leverage its strengths for long-term economic transformation.

(Write to us at editorial@bombaychamber.com)

Government’s export obligation extension offers relief to chemical exporters

Government’s export obligation extension offers relief to chemical exporters

Mumbai: India’s chemical sector has received a significant policy reprieve with the extension of the export obligation period under the Advance Authorisation scheme from 6 months to 18 months for products covered by Quality Control Orders (QCOs). The change, formalised through Notification No. 28 dated May 28, 2025, by the Directorate General of Foreign Trade (DGFT), follows recommendations from the Department of Chemicals and Petrochemicals (DCPC) and mirrors similar adjustments made for other sectors such as textiles.

The timing of this decision is notable. In the financial year 2024–25, chemical exports reached $46.4 billion, accounting for 10.6% of India’s total export value. The sector’s scale and complexity make it particularly sensitive to regulatory timelines and input cost fluctuations. By extending the export obligation period, the government has effectively reduced pressure on exporters to meet tight deadlines, allowing greater flexibility in procurement, production and shipment planning.

Under the Advance Authorisation scheme, importers are permitted to bring in duty-free raw materials for export production. While these inputs are exempt from QCO compliance, the finished products must adhere to the relevant standards. The extended timeline provides exporters with a wider operational window to meet these requirements without compromising on quality or delivery commitments.

Industry stakeholders have welcomed the move as a practical step that aligns regulatory compliance with commercial realities. The chemical sector, which includes a broad array of petrochemicals, industrial chemicals and specialty compounds, often faces logistical and supply chain challenges that are exacerbated by short export obligation periods. The new 18-month window is expected to ease working capital constraints and reduce the risk of penalties or lapses due to unforeseen delays.

This policy shift also has implications for India’s positioning in global markets. With more time to fulfil export obligations, companies may be better equipped to compete on quality and reliability – factors that are increasingly critical in international trade. While the government has framed the extension as part of its broader strategy to support the chemicals and petrochemicals industry, the measure stands out for its immediate operational impact rather than aspirational rhetoric.

(Write to us at editorial@bombaychamber.com)

Steep US tariffs to slash India’s shrimp exports by 15–18%; Domestic market and new export destinations in spotlight

Steep US tariffs to slash India’s shrimp exports by 15–18%; Domestic market and new export destinations in spotlight

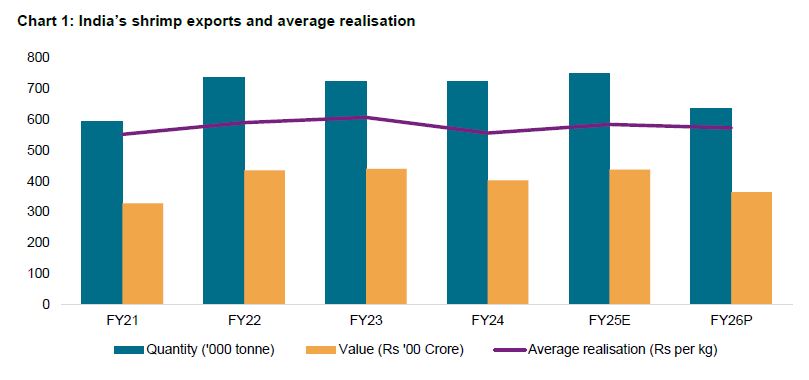

Mumbai: India’s shrimp export volume is expected to fall by 15–18% in the current fiscal year following a sharp increase in tariffs imposed by the United States, according to a report released by Crisil Ratings. The new tariff rate of 58.26%, which includes countervailing and anti-dumping duties, came into effect on August 27, 2025, and has rendered exports to the US market economically unviable for most Indian processors.

The US accounted for nearly 48% of India’s $5 billion shrimp exports in fiscal 2025, making it the largest destination for Indian seafood. Crisil Ratings noted that while exporters had anticipated the tariff hike and front-loaded shipments in the first quarter, overall revenues are still projected to decline by 18–20% year-on-year. The inability to pass on the increased costs to buyers has led to a projected erosion of operating profit margins by 150–200 basis points, pushing margins to a decade-low of 5.0–5.5%.

Rahul Guha, senior director, Crisil Ratings, said the tariff shock would have cascading effects across the value chain as the headwinds will impact processors and discourage farmers from continuing to invest in shrimp culture. “Farmers incur upfront costs for land lease, seed and feed. Additionally, investments in equipment for aeration, electricity and overall pond management and biosecurity have substantially raised the production cost. To boot, the risk of diseases, reduced harvests and unprofitable global prices have been forcing farmers to look at alternative cultures that entail lower investments and limited risks,” he said.

The report highlights that India’s competitive position has weakened significantly compared to other major shrimp-exporting countries such as Ecuador, Vietnam, Indonesia and Thailand, which face substantially lower tariffs in the US market. Despite India’s well-developed domestic infrastructure and strong distribution networks in the US, the steep tariff hike has tilted the playing field.

Crisil Ratings analysed 63 shrimp exporters, representing approximately 55% of industry revenues, and found that their credit profiles are likely to deteriorate. Interest coverage ratios are expected to moderate to around 3.3 times this fiscal from 4.8 times last year, reflecting the pressure on profitability. Himank Sharma, director, Crisil Ratings, noted that the credit profiles of shrimp exporters focused on the US market will face further challenges after two sluggish years.

The decline in export volume is also expected to reduce capacity utilisation and shrink sales of value-added and large-sized shrimp, which were primarily destined for the US and commanded higher margins. While working capital debt may ease due to lower business volumes, the overall debt protection metrics are set to weaken.

Indian shrimp processors are understood to be exploring alternative markets such as the United Kingdom – aided by the India–UK free trade agreement – as well as China and Russia. These efforts may provide partial relief in the second half of the fiscal year, but are unlikely to fully offset the loss of US-bound shipments.

Responding to the mounting trade challenges, the Indian government has launched a strategic initiative to bolster the domestic shrimp market. A dedicated committee has reportedly been formed under the National Fisheries Development Board (NFDB) to chart a roadmap for building a resilient local ecosystem for shrimp consumption. This multi-stakeholder body comprises representatives from farming communities, feed manufacturers, and the Marine Product Export Development Authority (MPEDA), which plays a key role in export market development.

As part of this initiative, efforts are underway to raise public awareness about the nutritional benefits of shrimp. Proposals include setting up promotional stalls across key urban centres to educate consumers and encourage greater uptake. With India’s per capita shrimp consumption currently lagging behind countries like Japan, there is considerable scope to expand domestic demand.

To bridge this gap and cushion the impact of recent export disruptions, shrimp producers have proposed a range of innovative solutions. These include pioneering methods for transporting live shrimp without water and establishing interactive experience centres to engage and inform consumers.

Developing a strong domestic market is increasingly seen as essential for ensuring fair returns to producers and reducing dependence on unpredictable global trade dynamics. Expanding internal demand would also give Indian consumers access to premium-quality shrimp, much of which has traditionally been reserved for export.

The long-term viability of shrimp farming will depend not only on diversifying export destinations but also on significantly boosting domestic consumption. With the sector at a critical juncture, both processors and farmers must adapt to a more uncertain global trade environment while tapping into the untapped potential of the Indian consumer base.

(Write to us at editorial@bombaychamber.com)

Micro food units gain traction under Government’s demand-led scheme

Micro food units gain traction under Government’s demand-led scheme

Mumbai: The food processing sector in India is seeing steady traction among micro enterprises, with over 1.44 lakh units approved for support under the PM Formalisation of Micro Food Processing Enterprises (PMFME) scheme as of 30 June 2025. The scheme, administered by the Ministry of Food Processing Industries, is centrally sponsored and demand-driven — allowing eligible applicants across states to seek financial, technical and business support without regional restrictions.

The PMFME scheme offers a credit-linked capital subsidy of 35% of the eligible project cost, capped at ₹10 lakh per unit. This support is targeted at individual micro enterprises seeking to upgrade or set up food processing operations. The scheme is part of a broader effort to accelerate micro, small and medium enterprises (MSME) growth in the sector, alongside the Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) and the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI), both of which also include MSME participation.

Training and capacity building form a significant component of the PMFME programme. As of the latest update, over 1.16 lakh beneficiaries have received skilling support under the scheme. This includes entrepreneurship development, product-specific training, and support for district-level resource persons and trainers. The aim is to equip micro operators with the skills required to meet industry standards and improve operational efficiency.

The scheme’s demand-led structure has enabled wide geographic coverage. In Bihar, for instance, 25,349 proposals have been approved under PMFME, in addition to 13 projects under PMKSY and seven under PLISFPI. The figures reflect the scheme’s reach across both high-growth and underserved regions, with approvals based on applicant readiness rather than location.

The government’s approach to food processing sector development appears to prioritise decentralised growth, with MSMEs positioned as key drivers of employment and value addition. By offering targeted incentives and skilling support, the PMFME scheme seeks to formalise and scale micro operations that have traditionally operated outside the organised sector.

(Write to us at editorial@bombaychamber.com)

Battery recycling clusters to reshape India’s informal trade

Battery recycling clusters to reshape India’s informal trade

Mumbai: India’s battery recycling ecosystem is undergoing a structural shift, with the government initiating steps to integrate informal operators into the formal value chain. The Ministry of Environment, Forest and Climate Change (MoEF&CC) has stated that the Extended Producer Responsibility (EPR) framework under the Battery Waste Management Rules, 2022 is designed to incentivise formalisation by linking revenue generation to certified recycling activity. This includes the exchange of EPR certificates between producers and registered recyclers — a mechanism that excludes unregistered entities and encourages them to enter the formal system.

To support this transition, a dedicated project has been launched under the Micro & Small Enterprises Cluster Development Programme (MSE-CDP) of the Ministry of Micro, Small and Medium Enterprises. The initiative aims to build capacity and upgrade informal sector operations by forming recycling clusters, thereby enabling small-scale recyclers to access technology, infrastructure and formal market linkages. The programme is expected to reduce fragmentation in the sector and improve traceability of recycled materials, particularly in the context of lithium-ion batteries.

Technology transfer is a key component of the formalisation effort. The Centre for Materials for Electronics Technology (C-MET) has developed a cost-effective lithium-ion battery recycling process, which has been transferred to several recycling firms and start-ups. This move is aligned with the government’s broader circularity goals under Mission LiFE and is intended to improve domestic recovery of critical minerals while reducing dependence on imported raw materials.

The EPR portal developed by the ministry has registered over 3,600 producers and 442 recyclers to date. Producers have procured EPR certificates for 7.29 lakh metric tonnes of key battery metals, against a target of 10.96 lakh metric tonnes. Only certificates issued by registered recyclers are recognised under the rules, reinforcing the need for informal operators to formalise in order to participate in the regulated trade of recycled materials.

The formalisation push is also expected to complement the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery storage, which has attracted significant investment in domestic cell manufacturing. With over 100-Gigawatt hour (GWh) of additional capacity announced beyond the PLI beneficiaries, the demand for recycled inputs is likely to rise — making the integration of informal recyclers into certified clusters both a commercial and regulatory imperative.

(Write to us at editorial@bombaychamber.com)

It is a long established fact that a reader will be distracted by the readable content of a page when lookin