Blog

Top Stories

MSME Conclave 2025: Unlocking Global Opportunities for India’s MSMEs

January 15, 2025

The Bombay Chamber of Commerce and Industry (BCCI) hosted the MSME Conclave 2025: Global Opportunities for MSMEs on January 15, 2025, bringing together industry experts, policymakers, and international representatives to discuss strategies for empowering micro, small, and medium enterprises (MSMEs) through global market integration and export facilitation.

Setting the theme of the event, R. Srinivasan, Co-Chairperson of the MSME Forum and Director of AIRA Consulting Private, underscored the pivotal role of MSMEs in contributing 30% to India’s GDP and 40% to its exports. He highlighted the critical need to align MSMEs with the government’s ambitious vision of Viksit Bharat by 2047, emphasising on the importance of global market integration for sustained high growth.

The conclave featured three key sessions. The session on finance for exports featured presentations by prominent financial institutions. C. S. Arya, General Manager at IDBI Bank; Shirish Mathur, Head of SME Products & Digital Platforms at Aditya Birla Finance and Dhrubashish Bhattacharya, Head of MSME & Co-Lending at Bank of Baroda, elaborated on the services their banks were offering to MSMEs. Ratul Mukhopadhyay, Business Head of SEG Assets at Axis Bank and Vikas Kumar, Chief Manager at SBI SME Sakinaka Branch also highlighted customised banking solutions for exporters.

Addressing the session on Bilateral Growth: Advancing US-India Trade & Investment Potential, Joe Yang from U.S. Commercial Service, United States Consulate, Mumbai, detailed strategies for advancing US-India trade and investment ties, emphasising the potential of MSMEs in strengthening bilateral relations.

The session on bilateral trade opportunities included engaging presentations by consular experts. H. E. Adolfo Garcia Estrada, Consul General of Mexico, Eva Nilsson, Deputy Consul General of Finland, Dina Albahey, Vice Consul of Egypt and Viraj Kulkarni, Honorary Consul of the Republic of Cyprus.

The Conclave ended with a vote of thanks by Rajan Raje, Chairperson of the MSME Forum and CEO of Nichem Solutions. The event was supported by Aditya Birla Capital Ltd, Bank Of Baroda, Ashwin Sheth Group, Axis Mutual Fund and SBI Mutual Fund.

Process on PF transfer on change of employment simplified

Process on PF transfer on change of employment simplified

Process on PF transfer on change of employment simplified – need not be routed through present or past employer

EPFO circular attached.

Bombay Chamber seminar discusses recent amendments to LODR and issues with Related Party Transaction regime

Bombay Chamber seminar discusses recent amendments to LODR and issues

with Related Party Transaction regime

Mumbai

Corporate India has been faltering on Related Party Transaction (RPT) despite numerous amendments to the Listing Obligations and Disclosure Requirements (LODR) by the Securities and Exchange Board of India (SEBI). While the entire architecture of the LODR has been significantly revamped and tightened further over the past decade, amendments are being made continuously with the recent one being announced on December 12, 2024.

To discuss and understand these changes, the Bombay Chamber of Commerce & Industry (BCCI) held a seminar on January 15, 2025, which saw participation from corporate law professionals and legal/compliance officers from across industries.

Addressing the gathering, Bharat Vasani, Chairperson Legal Affairs & IPR Committee, Bombay Chamber of Commerce & Industry and Senior Advisor – Corporate Laws, Cyril Amarchand Mangaldas, said the corporate sector will see further tightening of LODR in 2025. “SEBI is working on this aggressively. Significant changes will be announced very soon and the reasons (for these changes) are not far to seek,” said Vasani.

While there are companies that are legally compliant with the letter of the law and spirit, there are exceptions as well, and SEBI goes by legislating for the exception. “If they (SEBI) find a very abusive RPT, they immediately try to identify the loophole being missed and corrective actions are taken. As a result, the entire regulatory architecture, after comparing it internationally with other jurisdictions, I’d say that our regime is the toughest and most comprehensive in terms of disclosures and approvals,” said Vasani adding that the regime has been tightened from April 2023 leaving no loopholes.

Experts from the legal fraternity are of the view that a significant widening of the definition of Related Party Transactions (RPTs) back in 2022, in a manner far beyond what was in Section 2(76) in the Companies Act, 2013, has at times made it very challenging for legal and compliance officials across listed entities to conduct day-to-day operations in their respective businesses. And SEBI has its reasons to do so because public money is at play and hence the need to be tightly regulated.

Highlighting the key amendments (SEBI notification, effective December 12, 2024) to the provisions concerning RPTs Geetika Anand, Joint President, Company Secretary and Compliance Officer, Hindalco Industries (Aditya Birla Group), said there are five areas primarily that need to be looked at in particular. “Specific exclusions from the definition of RPT, current/saving account approval for RPTs for remuneration and sitting fees, ratification of RPTs, omnibus approval for subsidiary’s RPTs and finally exemption from approval requirements, these are quick five major RPT amendments,” said Anand while also explaining the rationale behind each of the amendments.

This was followed by an engaging discussion between the panel members and legal industry professionals in the audience.

Majority of the queries revolved around 2024 amendments made in December 2024, particularly on the ratification of transactions by the audit committee, concerning missing approvals for transactions above Rs 1 crore and refusal by the audit committee to ratify it. Responding to the queries Rajendra Chopra, Company Secretary/Compliance Officer, Cipla, said, the provision of Section 22F regarding ratification, says that the audit committee may ratify the transaction.

Explaining further, Chopra talked about two scenarios viz. transaction being executed with approval and a second transaction is approved by the audit committee but the amount of transaction was more than what was being approved.

“Can we call both transactions as ratification or just the transaction that wasn’t approved at all, as ratification? In my opinion, as long as the transaction is approved by the audit committee but the amount has incidentally exceeded, I will not qualify that as ratification. However, if the transaction was not approved at all, I will consider that as ratification. That’s my personal view / interpretation of the scenario,” said Chopra.

On possible violations in the aforesaid scenario, Chopra said it’s not a ratification if the audit committee has already approved the transaction and the company executes it despite transaction exceeding the approved amount. “In my opinion, the transaction is already got comprehensive approval from the audit committee and it’s only the amount (just one of the components) that’s changed. So I’ll not categorise it as ratification. Having said that, the audit committee enjoys all inherent power and is free to reject the transaction and levy a penalty as per internal guidelines,” said Chopra.

In her closing remarks, Attreyi Mukherjee, Co-Chair of Legal Affairs and IPR Committee at the Bombay Chamber of Commerce and Industry and General Counsel, Tata Industries Ltd, said it was a very interactive and engaging session. “For the various nuances this subject has, especially given the recent amendments whether it was the topic of ratification or calculation of royalty payments, which I think sparked a very lively debate and deliberation,” said Mukherjee.

Banking Conclave 2025 Shines Spotlight on Role of Credit for a USD 5 Trillion Economy

Banking Conclave 2025 Shines Spotlight on Role of Credit for a USD 5 Trillion Economy

January 15, 2025

The Banking Conclave 2025, organised by the Bombay Chamber, brought together industry leaders, policymakers, and experts to discuss the transformative role of credit in achieving India’s ambitious $5 trillion economy goal. The Conclave featured thought-provoking discussions, keynote addresses, and insightful panels, focusing on pressing issues in the banking and financial sectors.

In her welcome address, Pinky Mehta, President of the Bombay Chamber and CFO of Aditya Birla Capital Ltd, emphasised the importance of fostering financial literacy, developing innovative products such as green bonds and social impact bonds, and maintaining a conducive regulatory environment. “By addressing these challenges, we can ensure that credit plays a transformative role in shaping India’s economic growth. This will create a more inclusive, resilient, and sustainable economy capable of achieving the $5 trillion milestone and beyond,” she stated.

Delivering the Theme Setting note, Rajiv Anand, Senior Vice President of the Bombay Chamber and Deputy Managing Director of Axis Bank, highlighted the integral role of credit in India’s growth journey.

He stressed the need to balance financial innovation with regulatory prudence to ensure sustainable economic development. As the world grapples with geopolitical uncertainties, Anand underscored the importance of maintaining a resilient banking system capable of absorbing global shocks. He also called for a renewed focus on digitisation and financial inclusion, describing them as pivotal in democratising access to credit and fueling the aspirations of India’s burgeoning entrepreneurial ecosystem.

N. S. Vishwanathan, Former Deputy Governor of the Reserve Bank of India and current Independent Director & Non-Executive (Part-time) Chairman of Axis Bank, delivered the Keynote Address. He spoke about the critical role of regulatory frameworks and financial innovation in fostering economic growth. Discussing India’s economic trajectory, Vishwanathan noted that the GDP for FY 2024-25 is estimated at $4.27 trillion, leaving a $730 billion gap to achieve the $5 trillion milestone by 2027-28. “This journey requires more than just ambition; it demands strategic investments and a resilient financial system,” he remarked.

Vishwanathan highlighted the financial health of India’s banking sector, citing strong indicators like a 26% Capital to Risk-weighted Assets Ratio (CRAR) and a Net Interest Margin (NIM) of 5.1%. However, he acknowledged challenges such as rising costs of funds, narrowing gaps between deposit and loan growth, and increasing reliance on high-cost funding. He emphasised the need for innovative financing in agriculture to boost productivity and inclusion, as well as renewed private-sector capital expenditure with a focus on sustainability. “Banks must embrace watchful risk-taking to ensure credit growth does not compromise asset quality. Lessons from past episodes of high NPAs remind us that unbridled credit growth can strain the system, but with a disciplined approach, we can foster a robust credit culture,” he stated.

The event also featured a presentation on Global Trends in Banking by Joydeep Sengupta, Senior Partner and Leader of the McKinsey Center for CEO Excellence at McKinsey & Company. Drawing on McKinsey’s extensive research, Sen Gupta highlighted the pivotal role of the banking industry, which generated $1.15 trillion in net income in 2023—equal to the combined net income of the next two largest industries. He discussed the sector’s resilience, evidenced by sustained growth in return on tangible equity and healthy capital levels, while cautioning against rising regulatory pressures and evolving customer expectations.

Sengupta described the transformation underway in the banking sector, fueled by digitisation, artificial intelligence, and shifting customer behavior. “The global financial system intermediated $410 trillion in assets last year, underscoring its immense scale and responsibility,” he stated. However, he noted that despite strong financial performance, the banking industry remains undervalued, with skepticism about its long-term ability to innovate and create value.

Two panel discussions explored critical topics. The first, on Managing Balance Sheets in a Changing Geopolitical Environment, was moderated by Latha Venkatesh, Executive Editor of CNBC TV18. It featured panelists Rajiv Anand, Senior Vice President, Bombay Chamber & Deputy Managing Director, Axis Bank; R. Govindan, Senior Vice President Corporate Finance & Chief Risk Officer, L&T; Amit Agarwal, President & Head – Private Credit, Edelweiss Alternatives; Rakesh Singh, MD & CEO, Aditya Birla Finance; and Rajiv Sabharwal, MD & CEO, Tata Capital. The discussion delved into the multifaceted impact of geopolitics on growth and financial stability. Panelists discussed the rupee’s depreciation and its effect on credit quality, corporate margins, and the challenges of raising dollar funds in a volatile global landscape.

The second panel, on Climate Finance, was moderated by Lavanya Ashok, Partner – Growth Equity at Trifecta Capital. Panelists included Namrata Rana, Partner and National Head ESG, KPMG; Neville Dumasia, Leader – Industrials & Energy, EY India; and Dhanpal Jhaveri, Vice Chairman – Everstone Group & CEO – Eversource Capital. This panel explored the role of innovative financing models, such as blended finance, in scaling climate technologies, and highlighted opportunities in emerging sectors like sustainable agriculture and battery storage.

The conclave concluded with a Vote of Thanks by Abizer Diwanji, Founder of NeoStrat Advisors LLP. Aditya Birla Capital Ltd, Bank Of Baroda & Ashwin Sheth Group were the co-sponsors of the Conclave, while the Associate Sponsor was Axis Mutual Fund.

Invitation for Bid – Sri Lankan Catering Ltd Ref No. SLC/DPC/GOODS/2024/066

Invitation for Bid – Sri Lankan Catering Ltd Ref No. SLC/DPC/GOODS/2024/066

We wish to inform you that, the Sri Lankan Catering Ltd. has invited sealed bids for the following.

| No. | Bid Number | Procurement Name | Closing Date |

| 01 | SLC/DPC/GOODS/2024/066 | Invitation for Submission of Bids for Supply of Special Fruits & Vegetables (1st March 2025 to 31st August 2025) | 14th January 2025 at 11.00 am (Sri Lanka local time GMT+5:30). |

Please find attached herewith a copy of the procurement notice of the above.

Thank you.

With warm regards,

Shirani Ariyarathne, Actg. Consul General

Minister (Commercial), Consulate General of Sri Lanka

34, Homi Mody Street, Fort, Mumbai 400001.

Tel: (+ 91 22 )22045861/22048303, Fax: (+ 91 22) 22876132

E -mail: slcg.mumbai@mfa.gov.lk

Expression of Interest for partnership with Colombo Dockyard PLC

Expression of Interest for partnership with Colombo Dockyard PLC

Expression of Interest for partnership with Colombo Dockyard PLC

i. The Mission wishes to highlight a promising investment opportunity in Colombo Dockyard PLC (CDPLC), a leading player in the maritime industry, located at the strategic Port of Colombo, one of the busiest and most significant shipping hubs in the world.

ii. CDPLC is Sri Lanka’s leading ship repairing, shipbuilding, and heavy engineering facility, offering products and services to international quality standards at a competitive price and lower turnaround time.

iii. CDPLC is a globally recognized player in the ship building and ship repairing segment and has integrated advanced technologies and operational expertise, complemented by a highly skilled and trained Sri Lankan workforce.

iv. CDPLC is specialized in the building of Cable Laying Vessels, Offshore Support Vessels, Eco Bulk Carriers, Passenger Vessels, Harbour Tugs, Work Boats to name a few.

v. In Ship repairs, CDPLC having 4 graving docks with a maximum dry dock capacity of 125,000DWT provides services for routine dry-docking repairs, major layup repairs, collision damage repairs, conversions and retrofits.

vi. With long-standing business relationships with its global clientele, it ensures a continued business stability and growth potential in all its business sectors.

vii. Considering the financial distress CDPLC is facing currently, CDPLC is seeking potential investors who can revitalize the Company and ensure long-term sustainability, and invites those interested parties to initiate direct discussions with the management.

Attached herewith Introductory report on CDPLC and contact details of CDPLC to submit expression of interest. The timeline for expression of interest is 15th January 2025.

Appreciate your cooperation in disseminating the above information among your esteemed members on the above.

Regards,

Shirani Ariyarathne

Actg. Consul General

Consulate General of Sri Lanka

34, Homi Mody Street, Fort

Mumbai 400001

Tel: (+ 91 22 )22045861/22048303

Fax: (+ 91 22) 22876132

E -mail: slcg.mumbai@mfa.gov.lk

2025 Select USA Investment Summit

2025 Select USA Investment Summit

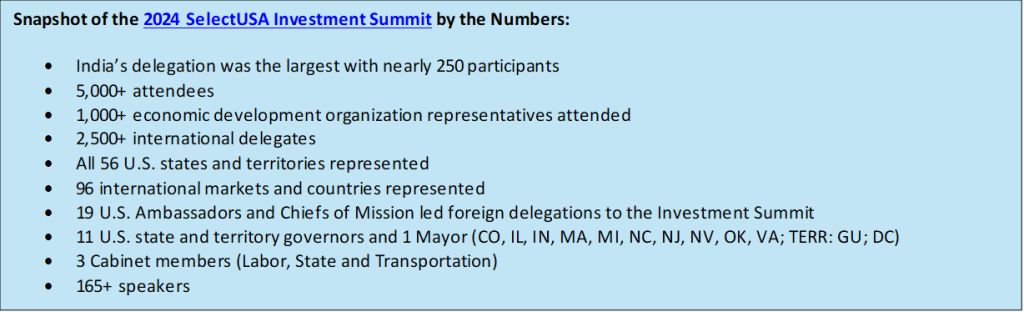

SelectUSA is the U.S. federal government program dedicated to attracting and retaining investment in the U.S. economy. This program is dedicated to facilitating and promoting impactful business investment into the United States to create jobs, spur economic growth, and promote U.S. competitiveness.

Since its inception, SelectUSA has assisted thousands of clients, including economic development organizations (EDOs), domestic firms, and international companies, facilitating over $200 billion in client-verified investment, supporting more than 200,000 jobs across the United States and its territories.

Every year, the U.S. Department of Commerce hosts its Annual Investment Summit. The 2025 SelectUSA Investment Summit will take place May 11-14, at the Gaylord National Resort and Convention Center in National Harbor, MD.

The SelectUSA Investment Summit is the premier event in the United States for FDI promotion. Investment Summit attendees can expect to:

- Forge partnerships and connect with economic developers from 50+ states and territories, companies from 90+ markets, speakers, government officials and more; set up one-on-one or group meetings and make your investment deals happen.

- Gain advice and information from policy and industry experts in more than 50 sessions providing you with actionable instruction on everything from developing a workforce to understanding incentives.

- Explore the Exhibition Hall featuring economic development organizations, service providers, industry experts, and international tech startups.

The SelectUSA Investment Summit draws more than 5,000 attendees! You can expect to meet EDOs representing the U.S. states and territories, more than 2,500 business investors with representation from 90+ international markets, and industry experts who will provide insight and advice on how to make your move to the U.S.!

We hope you will consider joining the 2025 Investment Summit and take advantage of year’s event the best yet!

APPLY NOW to attend the biggest FDI event of 2025 : www.selectusasummit.us

Industrial Disputes Act does not allow Labour Courts to pass any interim injunctions – Kerala High Court

Industrial Disputes Act does not allow Labour Courts to pass any interim injunctions – Kerala High Court

Industrial Disputes Act does not allow Labour Courts to pass any interim injunctions.

Copy of judgement attached.

Sustainability Conclave: Green Growth for a Viksit Bharat

Sustainability Conclave: Green Growth for a Viksit Bharat

As India moves toward its vision of Viksit Bharat by 2047, Green Growth has become essential to achieving sustainable and inclusive development. It promotes economic progress while safeguarding the environment, emphasising clean energy, resource efficiency, and innovation. Green growth not only addresses climate change but also fosters job creation, sustainable industries, and resilient ecosystems. By embracing this approach, India can ensure that its journey toward becoming a developed nation is both environmentally responsible and future-ready.

Keeping this context in mind, Bombay Chamber, under the aegis of its Sustainability Committee, organised its Annual Sustainability Conclave themed Green Growth for a Viksit Bharat on December 13th, 2024, at the St. Regis Hotel, Mumbai. Over 85 delegates attended the Sustainability Conclave, including a dynamic lineup of Directors, CXOs, CSOs, Managing Directors, and CEOs, making it a power-packed gathering of industry leaders.

The conclave opened with remarks by Pinky Mehta, President of the Bombay Chamber and CFO of Aditya Birla Capital Ltd., followed by a keynote address by Lt. Gen. Pawan Chadha, VSM, General Officer Commanding (Maharashtra, Gujarat & Goa Area), who provided valuable insights into India’s sustainable development journey and how the armed forces is working towards a sustainable army.

The first panel discussion, moderated by Sachin Jain, CEO India and Southeast Asia of Cleantech Renewable Assets, explored business opportunities for green growth. The panel included distinguished speakers such as Anjali Bansal, Founder of Avaana Capital; Amit Kumar Sinha, MD & CEO of Mahindra Lifespace Developers; Vineet Rai, Founder of Aavishkaar Group; and Deepesh Nanda, President of Renewables at Tata Power and MD & CEO of Tata Power Renewable Energy Limited.

A fireside chat on the topic Carbon Credits: The India Story featured Anirban Ghosh, Chairperson of the Sustainability Committee of the Bombay Chamber and Head of the Centre for Sustainability at Mahindra University, in conversation with Dr. Rambabu Paravastu, Advisor to Greenko Group and the World Bank Group, and GC Advisory Chairperson of the Forum for Sustainable Enterprises.

The second panel discussion focused on navigating an evolving BRSR landscape. Moderated by Smitha Hari, President (India) of auctusESG, the session featured prominent panelists including Anirban Ghosh, Chairperson of the Sustainability Committee of the Bombay Chamber and Head of the Centre for Sustainability at Mahindra University; S Lakshminarayanan, Executive Director (Sustainable Development) of Indian Oil Corporation; and Santosh Kumar Singh, Chief Sustainability Officer of Larsen & Toubro.

The conclave concluded with a vote of thanks delivered by Sandeep Khosla, Director General of the Bombay Chamber.

Employers must be heard before fixing/revising Minimum Wages – Karnataka HC

Employers must be heard before fixing/revising Minimum Wages – Karnataka HC

Employers must be heard before fixing/revising Minimum Wages

Copy of judgement attached

It is a long established fact that a reader will be distracted by the readable content of a page when lookin