Blog

Top Stories

National Academy of Customs, Indirect Taxes, and Narcotics (NACIN) and Indian Maritime University (IMU) sign MoU for strategic knowledge partnership

A Memorandum of Understanding (MoU) was signed between the National Academy of Customs, Indirect Taxes, and Narcotics (NACIN) and the Indian Maritime University (IMU) in Chennai, today. This collaboration aims to strengthen the Marine Customs Training Centre by enhancing the maritime enforcement and operational capabilities of CBIC officers, while also creating a platform for mutual learning and institutional synergy between NACIN and IMU.

The MoU was signed by Shri Gaigongdin Panmei, Principal Director General for NACIN, and Dr. Rajoo Balaji, Pro Vice-Chancellor for IMU (representing the Vice Chancellor), in the presence of Smt. Aruna Narayan Gupta, Member, Central Board of Indirect Tax and Customs, and, Additional Director Generals, Dr. M.G. Thamizh Valavan and Dr. Ezhilmathi K, along with Shri K. Saravanan, Registrar, IMU, and Dr. P.J. Rangachari, Director, IMU Chennai Campus, among other senior officials from both institutions

Addressing the esteemed dignitaries and officials present, Smt. Gupta stated that the collaboration marks a significant step towards enhancing the capabilities of CBIC officers engaged in marine preventive work, thereby strengthening collective efforts in safeguarding national security.

This MoU between NACIN and IMU establishes a collaborative framework for the training of CBIC officers involved in marine operations. It outlines the development of a comprehensive training programme aimed at bridging existing knowledge gaps in maritime enforcement and operational practices. The curriculum will be enriched by incorporating both domestic and international perspectives. The collaboration seeks to mutually benefit both institutions—leveraging IMU’s academic and technical expertise and NACIN’s enforcement experience.

For CBIC, the collaboration significantly strengthens its marine enforcement capabilities by providing officers with specialized, hands-on training in advanced maritime technologies, aligned with global best practices. For IMU, this partnership offers a valuable opportunity to extend its academic reach into the domain of maritime enforcement, enhance the practical application of its training modules, and engage in collaborative research on emerging technologies such as drone surveillance and recent advancements in the maritime sector.

Furthermore, the MoU paves the way for the inclusion of personnel from other departments and international participants, underscoring the global relevance and strategic scope of this initiative.

The collaboration with IMU will further elevate NACIN’s capabilities by integrating academic excellence, cutting-edge technology, and global best practices into its training framework. This partnership not only ensures the development of a robust and future-ready maritime enforcement training ecosystem but also reinforces India’s commitment to fostering institutional synergies to safeguard its maritime interests. The Marine Customs Training Centre, empowered by this collaboration, is poised to emerge as a centre of excellence for marine enforcement training in the region and beyond.

Government of India Taking Measures Against Misuse of Personal Data

Government of India Taking Measures Against Misuse of Personal Data

Unsolicited Commercial Communications (UCC) are regulated by the Telecom Regulatory Authority of India (TRAI). TRAI has issued Telecommunications Commercial Communications Consumers Preference Regulations, 2018 (TCCCPR-2018) which deals with UCC. Under the TCCCPR-2018 regulations a number of directions have been issued for the implementation of its provisions. These directions inter-alia have provisions for registering preferences for commercial communication where a telecom subscriber can opt to block all commercial communications or can selectively block commercial communications as per preference categories.

Customers can register complaint against senders of UCC through Mobile App, sending SMS or calling on a specific number 1909.

The Government of India has taken major initiatives like enactment of Information Technology (IT) Act, 2000, setting up of Indian Computer Emergency Response Team and National Critical Information Infrastructure Protection Centre, releasing of National Cyber Security Policy 2013, appointing Chief Information Security Officer, thus ensuring security and privacy of personal information of users in India. The Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011 under the IT Act prescribes reasonable security practices and procedures to protect sensitive personal data of users.

Digital Personal Data Protection Act, 2023 (“DPDP Act”) provides the legal framework for processing of personal data, notice to be issued to data principal, consent of the data principal including withdrawal of such consent, rights of the data principal, obligations of the data fiduciaries, penalties for non-compliance, etc.

The DPDP Act provides legal framework for Data Fiduciaries to notify breaches and ensure effective observance of the provisions Act by implementing appropriate technical and organizational measures.

Further, the DPDP Act establishes a robust framework of accountability mechanisms to ensure the lawful processing of digital personal data with Data Protection Board of India as an independent adjudicatory body empowered to investigate complaints, conduct inquiries, and impose penalties. Ministry of Home Affairs has also established the Indian Cyber Crime Coordination Centre to deal with cyber-crimes in a comprehensive and coordinated manner.

Public awareness campaigns, such as Cyber Security Awareness Month and Safer Internet Day, are organized to educate citizens about online safety, secure online transactions and digital services.

This information was given by the Union Minister of Railways, Information & Broadcasting and Electronics & Information Technology Shri Ashwini Vaishnaw in Rajya Sabha today.

Micro-lending unlocks potential of India’s hidden entrepreneurs

Micro-lending unlocks potential of India’s hidden entrepreneurs

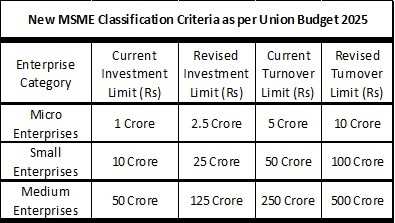

The micro, small, and medium enterprise (MSME) sector has often been hailed as the backbone of India’s economy, driving innovation, fostering employment, and contributing significantly to the gross domestic product (GDP) growth. Yet, beneath this celebrated narrative lies the sector’s perpetual struggle for financial support. With micro-lending emerging as a critical tool to bridge this gap, a series of regulatory shifts and strategic advancements are reshaping the sector, steering it towards resilience and sustainability. This challenge was discussed at a CareEdge webinar titled ‘Exploring MSME Growth and the Evolving Micro LAP Landscape’.

A new regulatory era

The MSME financing landscape has undergone a seismic shift with the introduction of a stricter 90-day default norm, replacing the earlier 180-day standard. While this move aligns with global practices, it has ushered in significant changes for lenders, who now face the dual challenge of adapting to regulatory compliance and ensuring financial accessibility for small enterprises. This transition demands precision and innovation, particularly as many MSMEs operate with unpredictable cash flows.

One transformative solution has been the adoption of digital tools to assess cash flow patterns, enabling lenders to accurately gauge the financial health of these businesses. For example, advanced algorithms now analyse transaction histories and supply chain activities, offering a more comprehensive picture of creditworthiness. These digital advances have proved invaluable in addressing the sector’s hallmark challenge — a lack of formal financial records.

Moreover, lenders are crafting empathetic and tailored recovery models to mitigate the stress of rigid compliance. Personalised solutions, such as phased repayment plans, help strike a delicate balance between meeting regulatory demands and supporting MSMEs through their unique financial journeys. The successful alignment with the 90-day norm highlights the sector’s ability to adapt, yet it serves as a reminder of the vigilance required to maintain momentum.

Profitability in a competitive landscape

For lenders, staying profitable in an increasingly competitive environment is no easy feat. The MSME sector, however, offers untapped potential that can be a game-changer. Recent industry reports reveal that only a fraction of India’s estimated 63 million MSMEs currently have access to formal credit channels, leaving vast opportunities for financial institutions to explore.

The key lies in understanding the complexities of MSME financing. Addressing higher credit costs, for instance, requires nuanced pricing strategies that ensure fairness without compromising margins. A case in point is the willingness of borrowers to absorb moderate interest rate increases — data suggests that even a 3% hike has had minimal impact on demand, allowing lenders to maintain profitability while passing on costs.

Customer-centric execution has also emerged as a vital strategy. By tailoring services to the specific needs of micro-enterprises, lenders are not only fostering loyalty but also creating a competitive edge. For example, non-banking financial companies (NBFCs) offering flexible collateral options have gained significant traction among MSMEs, reinforcing the importance of adaptability in service delivery.

As funding costs show signs of easing, the future holds promising opportunities for higher margins. However, long-term success hinges on a deeper understanding of the sector’s intricacies and a commitment to innovation.

The role of technology in monitoring and growth

Technology has been a powerful enabler in redefining micro-lending. The deployment of account aggregator systems, for instance, has provided lenders with unparalleled visibility into borrowers’ financial transactions. These platforms streamline the end-use monitoring of loans, ensuring greater transparency and accountability.

Yet, challenges remain. While account aggregators simplify access to bank statements, the fungibility of money often obscures the precise utilisation of loan funds. To address this, lenders are continuously enhancing their systems, incorporating machine learning and blockchain technology to improve accuracy and traceability.

Take the example of fintech start-ups partnering with traditional banks to develop blockchain-based loan tracking systems. These collaborations are not only meeting regulatory requirements but are also setting new standards in responsible lending practices. Such innovations highlight the symbiotic relationship between technology and traditional approaches, paving the way for a more robust financial ecosystem.

Harnessing the promise of MSMEs

The MSME sector stands as a beacon of resilience and untapped potential. By embracing regulatory changes, leveraging technology, and addressing the unique challenges faced by micro-enterprises, stakeholders can unlock new avenues for growth and transformation.

For those at the forefront of micro-lending, the message is clear: dive deeper, innovate boldly, and stay attuned to the needs of this vibrant sector. With countless opportunities awaiting exploration, the story of MSMEs is one of determination, dynamism, and an unwavering drive to succeed.

Sector Overview

As of 4 February 2025, the Udyam Portal boasts 5,93,38,604 registered MSMEs, with the vast majority classified as micro-enterprises. Beyond their economic contributions, these MSMEs have created substantial employment opportunities, providing jobs to more than 25.18 crore individuals.

During the financial year 2023-24, the Prime Minister’s Employment Generation Programme (PMEGP) supported 89,118 enterprises, fostering entrepreneurship across various sectors. The scheme disbursed ₹3,093.87 crore as margin money subsidy, helping small businesses scale operations and sustain growth. Consequently, an estimated 7,12,944 employment opportunities were created, reaffirming PMEGP’s role in bolstering self-employment and job creation nationwide.

Contribution to gross domestic product: The MSME sector contributes approximately 30% to India’s gross domestic product, with micro-enterprises accounting for 97% of the total share.

Contribution to gross domestic product: The MSME sector contributes approximately 30% to India’s gross domestic product, with micro-enterprises accounting for 97% of the total share.

Credit access: Despite their significance, only 2.5 crore MSMEs out of 63.4 million units have accessed formal credit channels. This highlights the untapped potential for micro-lending.

Women entrepreneurs: Women-owned MSMEs make up 38% of registered enterprises, reflecting the growing role of women in this sector.

Export contribution: MSMEs contribute around 45.79% in 2024-25 (up to May 2024) of India’s total exports, showcasing their importance in global trade.

(Write to us at editorial@bombaychamber.com)

Maharashtra Government introduces Bill to provide for the regulation of private placement agencies

Maharashtra Government introduces Bill to provide for the regulation of private placement agencies.

Copy of notification attached.

Sundays and other paid holidays should be taken into account for treating continuous service of the workman Rajasthan HC

Sundays and other paid holidays should be taken into account for treating continuous service of the workman.

Copy of judgement attached.

For a person to claim employment under any organization, a direct master-servant relationship has to be established on paper- Supreme Court

For a person to claim employment under any organization, a direct master-servant relationship has to be established on paper

Copy of judgement attached.

Empowerment can help women seafarers navigate their careers with dignity and pride: Capt. Aakriti Barthwal

Empowerment can help women seafarers navigate their careers with dignity and pride: Capt. Aakriti Barthwal

In August 2005, nine girls enrolled with the Maritime Training Institute, The Shipping Corporation of India (SCI), with the dream of making a successful career in the male-dominated shipping industry. This was a unique situation at the time, as very few females chose to train as pre-sea cadets. The nine girls were equally divided into three batches comprising 40 students in each.

“The numbers clearly established the fact that it was a male-dominated industry. It was also a very bold step for us nine girls to be joining shipping at that time. Later, I did realise that very few of us would come up (the ranks),” said Capt. Aakriti Barthwal, QHSE Superintendent, Synergy Navis Marine Pvt. Ltd.

Continuing her journey, chalking out a growth plan, proving her capabilities, credibility and dedication for the next over a decade, her efforts finally got rewarded. In January 2017, she earned her command on board the vessel Swarna Krishna, owned and managed by SCI.

“This was only possible because The Shipping Corporation of India gave us females the opportunity and the floor to grow, expand and know our horizons. I also had immense support from my family, especially my husband, who, being a seafarer himself, understood the challenges and rewards of a career in shipping,” she shared.

Interestingly, among the nine girls who took up training as pre-sea cadets, only one made it to the rank of a master. Of her eight batchmates, some advanced to positions like second officer or chief officer, others diversified their careers, and a few left the field entirely to pursue non-shipping careers. “I often wondered why this happened,” Capt. Barthwal reflected.

Citing reasons that were possibly responsible for such an outcome, she said that while women began exploring a career in shipping in the years between 2004 and 2008, there was a lot of apprehension among their parents and relatives as the career path and growth was not very clear.

“There were challenges on board including bitter experiences, lack of inclusivity and gender biases. Also, despite the selection criteria being the same for everyone, there was a sense of unacceptability on board for many females, which made them lose out. The roadblock is still the same and that’s why discussions about women in shipping and identifying ways and means for them to grow are very crucial,” she said.

Sharing her personal experience about challenges faced, Capt. Barthwal said that it took her 11 months to find a shore job after she decided to leave (for family reasons) sailing in January 2019. “It may look easy now but landing a shore job was a huge challenge five years ago. Despite the fact that I was a master mariner from an oil and chemical tankers background, companies were still hesitant on taking a female for the job,” said Capt. Barthwal. She added that after numerous meetings and rounds of interviews, she finally succeeded in November 2019 and became a QHSE (Quality, Health, Safety, and Environmental) Superintendent at Synergy Navis Marine.

“Synergy gave me the opportunity to become their first-ever female QHSE Superintendent after I proved that women bring equal credibility, having undergone the same rigorous training and work experiences,” she said.

Another significant milestone came in December 2024 when Capt. Barthwal became India’s first female RightShip inspector. RightShip, the world’s leading ESG (Environmental, Social, and Governance)-focused maritime platform, is renowned for its expertise in safety, sustainability, and social responsibility.

So how is the industry scenario like now for women aspiring to make a career in shipping? She said, “Things have changed drastically. There are various initiatives by the Government of India like the Maritime India Vision 2030 that has outlined 150 initiatives including becoming a top seafaring nation with world-class education, research and training.”

She pointed to the 2019 guidelines issued to ensure a conducive work environment for women on board ships. Initiatives like scholarships by the Maritime Training Trust and the ‘Sagar Mein Samman’ programme aim to enhance the role of women in the maritime sector. “This programme fosters respect and empowerment, helping women seafarers navigate their careers with dignity and pride,” she added.

Additionally, companies have embraced diversity, equity, and inclusion (DEI) initiatives, offering scholarships to underprivileged girls to remove financial barriers.

Seminars and webinars held by the government and private organisations have also played a role in addressing parents’ concerns, encouraging them to support their daughters’ ambitions in shipping.

Today, women are excelling in various roles, not just as officers but also as ratings professionals on chemical tankers, gas tankers, and other vessels. “These developments prove that when given the chance, women thrive and succeed in their shipping careers,” said Capt. Barthwal.

Despite all the initiatives and programmes by the government and the private sector to bring more women in shipping, challenges remain. Women constitute less than 2% of the global seafaring workforce. While more women are entering the field, only a small fraction rises to managerial or commanding positions. Entry into the industry has become easier, but career growth remains a challenge.

She stressed that promotions, leadership roles, and access to advanced training courses are still hurdles for women, whether on board ships or in shore-based roles. “The real challenge isn’t just recruiting women into shipping, it’s retaining them, supporting their growth, and enabling them to take leadership roles. Only then can the industry’s goals of gender equality and inclusivity become a reality,” she concluded.

Initiatives to foster leadership among women

To bridge the gap and support women in taking on leadership roles, the sector needs to:

– Provide more opportunities for women to gain experience and take on challenging assignments that prepare them for leadership positions.

– Implement structured mentorship programs that pair experienced women leaders with aspiring female seafarers and shore-based professionals.

– Offer leadership development training and coaching specifically tailored for women in the industry.

– Ensure fair and transparent promotion processes that evaluate candidates based on merit, not gender biases.

– Foster an inclusive work culture that values diversity and actively supports the career advancement of women.

– Collaborate with industry associations and the government to create policies and initiatives that enable women’s progression to senior roles.

(Write to us at editorial@bombaychamber.com)

Kerala HC directs State Government to formulate guidelines for anonymising details of the complainant from public domain during the enquiry proceedings under POSH Act

Kerala HC directs State Government to formulate guidelines for anonymising details of the complainant from public domain during the enquiry proceedings under POSH Act

State Government directed to formulate guidelines for anonymising details of the complainant from public domain during the enquiry proceedings under the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 (POSH Act)

Copy of judgement attached

Procurement Notice–State Pharmaceuticals Corporation of Sri Lanka

Procurement Notice–State Pharmaceuticals Corporation of Sri Lanka

I wish to inform you that the Chairman, Departmental Procurement Committee of the State Pharmaceuticals Corporation of Sri Lanka has invited sealed bids for supply of following item to the Ministry of Health.

| Bid Number | Closing Date & Time | Item Description | Non – refundable Bid Fee (LKR) |

| DHS/L/WW/104/25 | 03.04.2025 at 09.00 a.m. | Laboratory Specific Consumables | 3,000/- + tax |

| DHS/L/WW/23/26 | 03.04.2025 at 09.00 a.m. | Test kits for Virology | 12,500/- + tax |

| DHS/L/WW/24/26 | 03.04.2025 at 09.00 a.m. | Test kits for Chemical Pathology | 3,000/- + tax |

| DHS/L/WW/25/26 | 03.04.2025 at 09.00 a.m. | Cardiac Troponin I qualitative strips | 12,500/- + tax |

| DHS/L/WW/26/26 | 03.04.2025 at 09.00 a.m. | Slide cleaning solution concentrate and RBS 25 solution concentration for cleaning glassware | 3,000/- + tax |

| DHS/L/WW/27/26 | 03.04.2025 at 09.00 a.m. | Test kits for Virology | 12,500/- + tax |

| DHS/L/WW/28/26 | 03.04.2025 at 09.00 a.m. | Ethanol (96%) AR | 20,000/- + tax |

Please find attached herewith a copy of the procurement notices of the above.

It would be appreciated, if you could kindly make necessary arrangements to disseminate the same among your membership.

Thank you.

With warm regards,

Shirani Ariyarathne

Actg. Consul General

Minister (Commercial)

Consulate General of Sri Lanka

34, Homi Mody Street, Fort

Mumbai 400001

Tel: (+ 91 22 )22045861/22048303

Fax: (+ 91 22) 22876132

E -mail: slcg.mumbai@mfa.gov.lk

Writ petition does not ordinarily lie against a charge-sheet issued in disciplinary proceedings – Rajasthan HC

Writ petition does not ordinarily lie against a charge-sheet issued in disciplinary proceedings – Rajasthan HC

Copy of judgement attached

It is a long established fact that a reader will be distracted by the readable content of a page when lookin