Blog

Top Stories

Bombay Chamber post-budget webinar: Navigating India’s economic outlook amidst global uncertainty

Bombay Chamber post-budget webinar: Navigating India’s

The Bombay Chamber of Commerce and Industry organised a Post-Budget Analysis Webinar on 5 February 2026, bringing together economists, industry leaders, and policy experts to examine the Union Budget 2026–27 and its implications for India’s growth trajectory amid an increasingly complex global environment.

Delivering the welcome address, Rajiv Anand, on behalf of the Chamber, emphasised that the Union Budget is not merely an annual financial exercise but a strategic statement of national priorities. He noted that post-budget dialogues play a critical role in interpreting policy intent, assessing real-world impact, and enabling businesses to align their strategies with emerging economic priorities.

He highlighted key signals from the Budget, including the record capital expenditure allocation of ₹12.2 lakh crore to strengthen long-term productive capacity, continued emphasis on manufacturing and MSME growth, enhanced focus on connectivity and urban development, targeted policy reforms to support investment-led growth, and a significant defence allocation of approximately ₹7.8 lakh crore underscoring national security and indigenous capability building.

Anand underscored that while these measures present strong opportunities, they also raise important questions around execution, demand recovery, cost structures, exports, and credit availability. He reaffirmed the Bombay Chamber’s role as a trusted bridge between government and industry, committed to equipping its members with clarity, confidence, and actionable insights through knowledge-driven platforms.

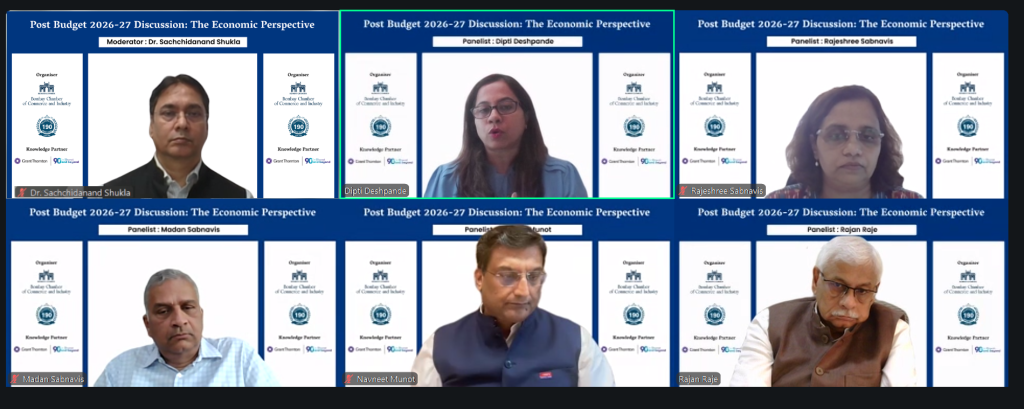

The session was moderated by Dr. Sachchidanand Shukla, Chair, EPRD Committee, Bombay Chamber, and Group Chief Economist, L&T, and featured Navneet Munot, Director, Bombay Chamber, and MD & CEO, HDFC Asset Management Company; Madan Sabnavis, Chief Economist, Bank of Baroda; Rajan Raje, Director, Bombay Chamber, and Founder & CEO, NICHEM Solutions; Dipti Deshpande, Principal Economist, CRISIL; and Rajeshree Sabnavis, Director, Bombay Chamber, and Senior Advisor – Tax, GT Bharat LLP.

Setting the global context, Dr. Shukla observed that the world is entering a phase of heightened uncertainty driven by geopolitical shifts and changing economic assumptions. “We are witnessing a new global disorder, and the Union Budget must be viewed as part of a broader strategy to manage volatility while sustaining growth,” he said.

Providing a macroeconomic assessment, Dipti Deshpande noted that India’s fundamentals remain resilient despite global headwinds. “The macro house is in order, with sustainable growth, moderating inflation, and improved fiscal metrics. This budget extends India’s growth runway through continued capex and structural reforms,” she said.

Explaining fiscal and bond market dynamics, Madan Sabnavis addressed concerns around government borrowing. “The focus should be on net borrowing rather than headline numbers. Fiscal deficit control remains the key anchor, and post-budget market volatility was largely a short-term overreaction,” he said.

From a capital markets perspective, Navneet Munot advised investors to look beyond immediate market movements. “Budget day reactions are often misleading. India’s long-term growth story, supported by strong corporate balance sheets and domestic liquidity, remains firmly intact,” he said.

Addressing taxation and compliance, Rajshree Sabnavis highlighted steps taken to improve predictability and reduce compliance burden. “There is a clear move towards rationalisation, certainty, and lower compliance costs, although customs duty reform remains an area for further progress,” she said.

Focusing on MSMEs, Rajan Raje welcomed the shift from short-term relief to long-term capability building. “The Budget recognises that sustainable MSME growth requires upskilling, integration into formal supply chains, and innovative financing mechanisms,” he said.

The panel also discussed the outlook for the rupee, private sector capex revival, FDI flows, and the balance between public and private investment. Speakers broadly agreed that while the Budget remains capex-led, its success will depend on effective execution and stronger private sector participation.

Bids -2

Ref.: MCM/ADM/11

The Director General

Bombay Chamber of Commerce and Industry

Mackinnon Mackenzie Building

3rd floor, 4, Shoorji Vallabhdas Road

Ballard Estate, Mumbai – 400 001

Dear Sir/Madam,

Please see enclosed notices for invitation for bids from organizations in Mauritius.

Prospective bidders may be requested to regularly visit the website to take cognizance of any addendum and/or clarification(s) issued.

The Consulate would highly appreciate if you could kindly circulate the Notices among the members of your Organization.

Thank you for your understanding and cooperation.

Yours sincerely,

1107, Regent Chambers

11th Floor, Jamnalal Bajaj Marg

208, Nariman Point

Mumbai – 400 021

Tel. : 022 22825421 /22

Fax No. 022 22845468

Government of Maharashtra extends ESI Act coverage to Educational and Medical Institutions employing ten or more persons

Government of Maharashtra extends ESI Act coverage to Educational and Medical Institutions employing ten or more persons

Notification attached.

Notification regarding functioning of existing authorities under Industrial Disputes Actt, Standing Orders Act and Trade Unions Ac

Notification regarding functioning of existing authorities under Industrial Disputes Act, Standing Orders Act and Trade Unions Act.

Notification attached

Repeal of Industrial Disputes Act, Industrial Employment Standing Orders Act and Trade Unions Act

Industrial Disputes Act, Industrial Employment Standing Orders Act and Trade Unions Act stand repealed from 21.11.25

Notification attached.

Central Government notifies wage limit for coverage of Supervisors as ‘Worker’ under the Labour Codes

Central Government notifies wage limit for coverage of Supervisors as ‘Worker’ under the Labour Codes.

Notification attached

Budget 2026–27: Record ₹12.2 Lakh Crore Infra Push and Major Boost for MSMEs, Manufacturing

Budget 2026–27: Record ₹12.2 Lakh Crore Infra Push and Major Boost for MSMEs, Manufacturing

Nirmala Sitharaman Outlines Three ‘Kartavya’ Priorities to Drive India’s Growth, Inclusion and Reform Agenda

In her ninth consecutive Union Budget 2026-27, Finance Minister Nirmala Sitharaman delivered a Budget which placed a large emphasis on infrastructure, with the government raising public capital expenditure to ₹12.2 lakh crore for the upcoming fiscal year—an increase of nearly 9 % from the previous year’s allocation and a record high aimed at strengthening national infrastructure across roads, railways, ports, metro projects and logistics networks.

In addition to the infrastructure thrust, the Budget included measures to support industry, including the launch of a ₹10,000 crore SME Growth Fund to enhance capital access for Micro, Small and Medium Enterprises, a ₹4,000 crore top-up to the Self-Reliant India Fund, and expanded credit and liquidity mechanisms for smaller businesses. Further manufacturing support was outlined through initiatives such as the expanded Electronics Components Manufacturing Scheme with a ₹40,000 crore outlay and continued emphasis on strategic sectors like semiconductors, biopharma, textiles and container manufacturing.

The Budget was anchored around three key “Kartavya” priorities outlined by the Finance Minister—accelerating and sustaining economic growth, fulfilling aspirations and building capacity, and ensuring inclusive access to growth. These priorities were reflected across announcements spanning infrastructure expansion, support for MSMEs and strategic manufacturing sectors, continued reforms to simplify processes and improve efficiency, and people-centric measures aimed at strengthening education, skills and access to essential services.

Reactions from Bombay Chamber Leaders:

Rajiv Anand, President, Bombay Chamber and Managing Director & CEO IndusInd Bank Limited:

“The Union Budget 2026 maintains continuity by focusing on capital expenditure, with a moderate increase in budgetary spending, while keeping the tax code largely unchanged, thereby providing policy stability. Fiscal consolidation anchored in a debt-to-GDP target offers flexibility to pursue countercyclical support, if needed, amid a challenging external environment. A comprehensive review of banking system regulations, development of transport and logistics infrastructure, capital and liquidity support for MSMEs, budgetary support for strategic sectors in manufacturing and services, and initiatives to develop skills will help enhance factor productivity and drive long-term growth.”

Sudhanshu Vats, Sr Vice President, Bombay Chamber and Managing Director, Pidilite Industries Ltd.

The Union Budget 2026–27 reinforces strong confidence in India’s growth trajectory, anchored in manufacturing, infrastructure and consumption. The continued focus on domestic manufacturing across chemicals, electronics and capital goods strengthens supply-chain resilience and supports India’s ambition to be a globally competitive production hub. With public capex at ₹12.2 lakh crore, demand across housing, construction and infrastructure-linked industries will remain robust. It will also dial up tourism and employers . The emphasis on digital infrastructure, Automation & AI-led Customs reforms and trade facilitation will enhance ease of doing business and global integration. Overall, the Budget provides the confidence to invest, innovate and scale alongside India’s long-term economic vision. Onwards to a Viksit Bharat 2047.

Nilesh Shah, Past President, Bombay Chamber and Group President & MD, Kotak Mahindra AMC:

This budget has proposed a capital expenditure of Rs 12.10 lac crore which is more than the net market borrowing of Rs 11.70 lac crore. I pray that a path is laid where one day capital expenditure will be more than the total borrowing including small savings.

Sudhir Kapadia, Past President Bombay Chamber and Senior Advisor, EY

The reform process has continued steadily into 2026, building strongly on the Viksit Bharat 2047 vision. The TCS-related announcements appear globally competitive and send a clear signal of long-term policy intent—possibly the first taxation measure framed with a horizon extending up to 2047. Portfolio investment prospects also look promising. The proposed measures, including support for data centres, are particularly significant given that Indian data centre companies are expected to attract investments of nearly USD 11 billion in the sector.

Key Highlights of the Budget 2026-27

Fiscal and Expenditure Highlights

• Record capital expenditure allocation: ₹12.2 lakh crore for FY 2026–27, up from ₹11.2 lakh crore in the previous year—continuing a strong infrastructure push.

• Defence budget increase: Allocation expanded significantly with around ₹7.8 lakh crore earmarked for defence.

Infrastructure and Connectivity

• Seven new high-speed rail corridors announced connecting major cities such as Mumbai–Pune, Pune–Hyderabad, and Hyderabad–Bengaluru.

• Dedicated freight corridors and rare earth mineral corridors planned in mineral-rich states to support strategic manufacturing and logistics.

• Expansion of 20 national waterways and coastal/service logistics enhancements.

• Introduction of a Seaplane VGF (Viability Gap Funding) Scheme to improve regional connectivity and tourism access.

• Focus on developing Tier II and Tier III temple towns through improved infrastructure and visitor amenities.

Industry, Manufacturing & Investment

• India Semiconductor Mission 2.0 launched with a ₹40,000 crore outlay to boost chip production and tech supply chains.

• New support schemes for Biopharma, textiles, chemicals and container manufacturing to strengthen domestic value chains.

• A ₹10,000 crore SME Growth Fund to deepen access to capital for MSMEs.

Tax Reforms & Compliance

• Continued simplification of the tax system with an updated Income Tax Act coming into effect from 1 April 2026.

• Reduced TCS (Tax Collected at Source) on overseas travel, education, and medical remittances to 2% under the Liberalised Remittance Scheme.

• Additional procedural ease measures, extended return filing timelines and foreign asset disclosure relief for small taxpayers.

• Customs duty on goods imported for personal use reduced from 20% to 10%.

• Revised rules to enhance baggage allowance for travellers and simplify temporary carriage of goods.

• TCS on overseas tour packages rationalised from 5%/20% to a flat 2%.

• TCS under LRS for education and medical purposes reduced from 5% to 2%.

Social Welfare & Human Capital

• Proposals for one girls’ hostel in every district to improve educational access.

• Expansion of healthcare facilities, multiple AYUSH institutes, and training programmes for allied health professionals.

• Focus on tourism, education-to-employment frameworks, and digital media content labs in schools and colleges.

• Medical tourism to be strengthened through 5 regional hubs.

• National Institute of Hospitality to strengthen training and workforce readiness in the hospitality sector.

• Training of 10,000 tourist guides across 20 sites through a 12-week programme (in partnership with IIMs).

• Creation of a National Destination Digital Knowledge Grid to digitally map and strengthen destination planning and promotion.

• Development of 15 archaeological sites to enhance heritage and cultural tourism.

• Development of Buddhist tourism sites across 6 Northeast states.

• Promotion of trekking and hiking through sustainable trail development.

• Global Big Cat Summit 2026 to support wildlife conservation and eco-tourism.

Macroeconomic Targets

• Fiscal deficit targeted at ~4.3% of GDP, indicating continued fiscal discipline alongside expanded public spending.

Employer must give first preference to the erstwhile contract workers while recruiting regular workers – Supreme Court.

When an employer intends to employ regular workers in place of contract labour, then the employer must give first preference to the erstwhile contract workers.

Supreme Court

Invitation for bids from organizations in Mauritius

Ref.: MCM/ADM/11 23 January 2026

The Director General

Bombay Chamber of Commerce and Industry

Mackinnon Mackenzie Building

3rd floor, 4, Shoorji Vallabhdas Road

Ballard Estate, Mumbai – 400 001

Dear Sir/Madam,

Invitation for Bids

Please see enclosed notices for invitation for bids from organizations in Mauritius.

Prospective bidders may be requested to regularly visit the website to take cognizance of any addendum and/or clarification(s) issued.

The Consulate would highly appreciate if you could kindly circulate the Notices among the members of your Organization.

Thank you for your understanding and cooperation.

Yours sincerely,

D. K. Bucktowar

Consul General

Consulate of the Republic of Mauritius

1107, Regent Chambers11th Floor, Jamnalal Bajaj Marg

208, Nariman Point, Mumbai – 400 021

Tel. : 022 22825421 /22, Fax No. 022 22845468

India–EU Free Trade Agreement Concluded: A Strategic Breakthrough in India’s Global Trade Engagement

India–EU Free Trade Agreement Concluded: A Strategic Breakthrough in India’s Global Trade Engagement

Hon’ble Prime Minister Shri Narendra Modi and European Commission President H.E Ms. Ursula von der Leyen, today jointly announced the conclusion of the India–European Union Free Trade Agreement (India–EU FTA) at the 16th India–EU Summit, held during the visit of the European leaders to India. This announcement marks a historic milestone in India–EU economic relations and trade engagement with key global partners.

The conclusion of this FTA positions India and the European Union as trusted partners committed to open markets, predictability, and inclusive growth. The FTA comes after intense negotiations since the re-launch of negotiations in 2022. The announcement of the FTA today marks the culmination of years of sustained dialogue and cooperation, between India and the EU, demonstrating the political will and shared vision to deliver a balanced, modern, and rules-based economic and trade partnership.

The European Union is India’s one of the largest trading partner, with bilateral trade in goods and services growing steadily over the years. In 2024–25, India’s bilateral trade in goods with the EU stood at INR 11.5 Lakh Crore (USD 136.54 billion) with exports worth INR 6.4 Lakh Crore (USD 75.85 billion) and imports amounting to INR 5.1 Lakh Crore (USD 60.68 billion). India-EU trade in services reached INR 7.2 Lakh Crore (USD 83.10 billion) in 2024.

India and EU are 4th and 2nd largest economies, comprising 25% of Global GDP and account for one third of global trade. Integration of the two large diverse and complementary economies will create unprecedented trade and investment opportunities.

Union Minister for Commerce and Industry, Shri Piyush Goyal, lauded the strategic vision and steadfast leadership of Hon’ble Prime Minister Shri Narendra Modi. He stated:

“The conclusion of the India–European Union Free Trade Agreement represents a defining achievement in India’s economic engagement and global outlook. This supports India’s approach to secure trusted, mutually beneficial and balanced partnerships.

Beyond a conventional trade deal, it represents a comprehensive partnership with strategic dimensions and is one of the most consequential FTA. India has secured unprecedented market access for more than 99% of Indian exports by trade value to the EU that also bolsters the ‘Make in India’ initiative. Beyond goods, it unlocks high-value commitments in services complemented by a comprehensive mobility framework enabling seamless movement of skilled Indian professionals. India, powered by a young and dynamic workforce and one of the fastest-growing major economies, stands poised to leverage this FTA to create jobs, spur innovation, unlock opportunities across sectors, and enhance its competitiveness on the global stage.”

The India-EU trade pact covers conventional areas such as trade in goods, services, trade remedies, rules of origin, customs and trade facilitation, as well as emerging areas such as SMEs and digital trade, amongst others. The India–EU FTA gives a decisive boost to its labour-intensive sectors such as textiles, apparel, leather, footwear, marine products, gems and jewellery, handicrafts, engineering goods, and automobiles bringing down tariffs up to 10% on almost 33 bn USD of exports to zero on entry into force of the Agreement. Beyond enhancing competitiveness, it empowers workers, artisans, women, youth, and MSMEs, while integrating Indian businesses more deeply into global value chains and reinforcing India’s role as a key player and supplier in global trade.

On automobiles, calibrated and carefully crafted quota based auto liberalisation package will not only allow EU auto makers to introduce their models in India in higher price bands but also open the possibilities for Make in India and exports from India in future. Indian consumers to benefit from high tech products and greater competition. The reciprocal market access in EU market will also open up opportunities for India made automobiles to access EU market. India’s agricultural and processed food sectors are poised for a transformative boost under the India–EU FTA, creating a level playing field for Indian farmers and agrarian enterprises. Key commodities such as tea, coffee, spices, fresh fruits and vegetables, and processed foods will gain enhanced competitiveness, strengthening rural livelihoods, promoting inclusive growth, and reinforcing India’s position as a trusted global supplier. India has prudently safeguarded sensitive sectors, including dairy, cereals, poultry, soymeal, certain fruits and vegetables, balancing export growth with domestic priorities.

Beyond tariff liberalisation, the FTA provides measures to tackle non-tariff barriers through strengthened regulatory cooperation, greater transparency, and streamlined customs, Sanitary and Phytosanitary (SPS) procedures, and Technical Barriers to Trade disciplines. Through CBAM provisions, commitments have been secured including a forward-looking most-favoured nation assurance extending flexibilities if any granted to third countries under the regulation, enhanced technical cooperation on recognition of carbon prices, recognition of verifiers, as well as financial assistance and targeted support to reduce greenhouse gas emissions and comply with emerging carbon requirements.

Services being dominant and faster-growing part of both economies will trade more in future. Certainty of market access, non-discriminatory treatment, focus on digitally delivered services, ease of mobility will provide boost to India’s services exports. The FTA secures expanded and commercially significant commitments from the EU across key sectors of Indian strength, including IT and IT-enabled services, professional services, education, financial services, tourism, construction, and other business sectors.

India’s predictable access to EU’s 144 subsectors (which includes IT/ITeS, Professional Services, Other Business Services and Education Services) will provide boost to Indian service providers and enable them to provide competitive world class Indian services to EU’s consumers while EU’s access to 102 subsectors offered by India will bring in high tech services, investment into India from EU resulting in a mutually beneficial arrangement.

On mobility, the India-EU FTA provides a facilitative and predictable framework for business mobility covering short-term, temporary and business travel in both directions. These enable professionals to travel between the two economies to provide services under different scenarios. EU and India is providing mobility commitments to each other for Intra-Corporate Transferees (ICT) and Business Visitors, along with entry and working rights for dependents and family members of ICTs. The EU has also offered commitments in 37 sectors/sub-sectors for Contractual Service Suppliers (CSS) and 17 sectors/sub-sectors for Independent Professionals (IP), many of which are sectors of interest to India, including Professional Services, Computer and related Services, Research and Development Services, and Education Services.

India also secured a framework to constructively engage on Social Security Agreements over a five-year horizon, together with framework supporting student mobility and post-study work opportunities. Additionally, India has also secured access for practitioners of Indian Traditional Medicine to work under home title in EU Member States where traditional medical practices are not regulated.

In financial services, the FTA promotes cooperation to advance innovation and secure cross-border electronic payments, while providing India with enhanced market access across several major EU member states. These provisions are expected to deepen financial integration and support the growth of financial services trade. These commitments not only unlock high-value employment opportunities but also reinforce India’s position as a global hub for talent, innovation, and sustainable economic growth.

The FTA reinforces intellectual property protections provided under TRIPS relating to copyright, trademarks, designs, trade secrets, plant varieties, enforcement of IPRs, affirms Doha Declaration and recognises the importance of digital libraries, specifically the Traditional Knowledge Digital Library (TKDL) project initiated by India. The FTA is expected to facilitate cooperation in critical areas like Artificial Intelligence, clean technologies, and semiconductors, supporting India’s technological advancement.

The FTA is expected to substantially scale up trade, enhance export competitiveness, and integrate Indian businesses more deeply into the European and global value chains. The India–EU FTA marks a new chapter in bilateral economic engagement, strengthening trade, and strategic cooperation between India and the 27-member EU bloc. Cognizant of multifarious objectives placed on trade, dynamic nature of trade, fast evolving technologies and increasing regulatory complexities, the Agreement embeds multiple review, consultation and response mechanisms to deal with new, sudden challenges which emerge in future. The Agreement relies on strong stewardship and trust to deliver gains for both sides.

EU becomes India’s 22nd FTA partner. The Government since 2014 has signed trade deals with Mauritius, UAE, UK, EFTA, Oman and Australia, and announced trade deal with New Zealand. In 2025, India signed trade deal with Oman and UK and announced conclusion of trade deal with NZ. The India-EU trade deal, along with India’s FTA with the UK and the EFTA effectively opens up the entire European market for Indian businesses, exporters and entrepreneurs.

Beyond boosting commerce, it reinforces shared values, fosters innovation, and creates opportunities across sectors and stakeholders from MSMEs, women and skilled professionals to farmers and exporters. Aligned with India’s vision of “Viksit Bharat 2047,” the FTA positions India as a dynamic, trusted, and forward-looking partner on the global stage, setting the foundation for inclusive, resilient, and future-ready growth for both regions.

Source: Press Information Bureau, Government of India.

Chamber Note

As India strengthens its global trade partnerships, the Chamber continues to convene industry leaders and policymakers to deliberate on opportunities in shipbuilding and maritime innovation. These themes will be explored at the upcoming International Conference on Shipbuilding Global Harit Nauka Summit: Trust, Collaborate, Impact

It is a long established fact that a reader will be distracted by the readable content of a page when lookin