Blog

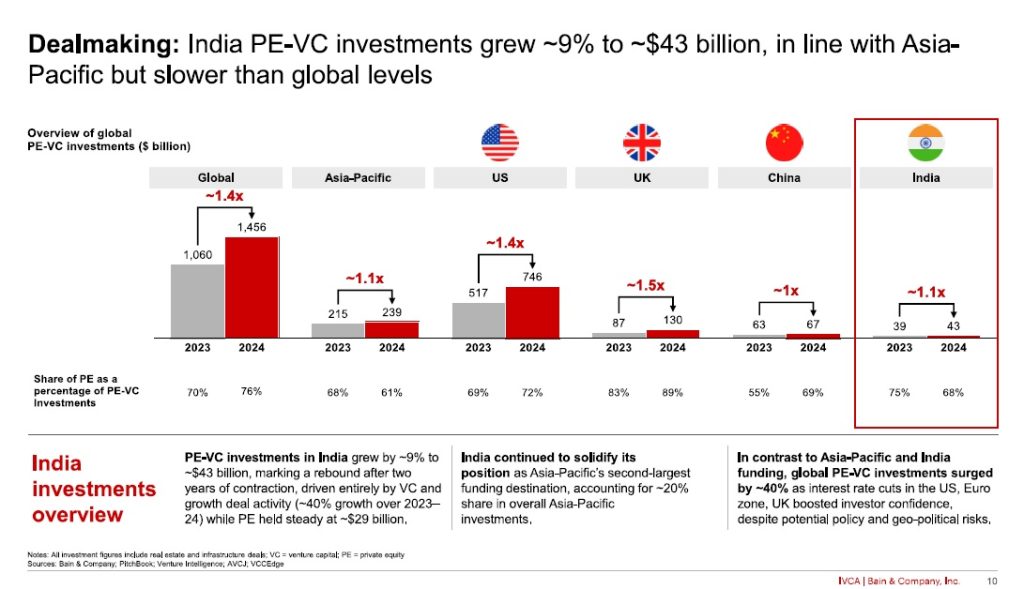

India’s private equity and venture capital (PE-VC) market rebounded strongly in 2024, reversing two years of contraction with a 9% rise in investments to reach $43 billion across 1,600 deals. As Asia-Pacific’s second-largest PE-VC hub, India continues to attract global capital, signalling renewed investor confidence in its macroeconomic stability and long-term growth potential.

According to Bain & Company’s ‘India Private Equity Report 2025’, published in collaboration with the Indian Venture and Alternate Capital Association (IVCA), while growth-stage investments drove much of the resurgence, private equity remained steady at $29 billion. A major shift towards buyouts was evident, with their share of total PE activity surging to 51% from 37% in 2022. Investors are increasingly securing control positions in high-quality assets, leveraging record dry powder reserves to pursue scalable opportunities.

Real estate and infrastructure emerged as standout performers, collectively accounting for 16% of total PE-VC funding, with deal values soaring by 70% compared to the previous year. Financial services also experienced robust growth of 25%, particularly within non-banking financial companies (NBFCs), driven by affordable housing finance, micro-lending, and MSME financing. Large transactions in companies such as Shriram Housing Finance and Aavas Financiers underscore investor confidence in high-yield, asset-secured businesses.

The healthcare sector maintained strong momentum, with an 80% increase in deal volume. Investments in medical technology, pharmaceutical outsourcing, and single-specialty hospitals – particularly in areas like eyecare, oncology, and IVF – highlighted a strategic push towards underpenetrated categories.

Meanwhile, IT-enabled services saw remarkable expansion, with deal activity tripling. Notable transactions such as Perficient’s $3 billion deal, Altimetrik’s $900 million investment, and GeBBS’s $865 million acquisition reinforced the sector’s growing dominance in digital transformation and revenue cycle management.

India also led the Asia-Pacific region in private equity exits, with exit values reaching a record-breaking $33 billion across 360 deals, marking a 16% year-over-year increase. Public market exits gained prominence, making up 59% of total exit value compared to 51% in 2023, as strong IPO activity fuelled investor optimism. The IPO landscape expanded significantly, with 33 listings in 2024 – up from 23 the previous year – driven largely by consumer-focused sectors.

Domestic fundraising hit new highs, further strengthening India’s private capital ecosystem. Kedaara Capital closed a landmark $1.7 billion fund, while ChrysCapital raised a record $2.1 billion. Global funds also intensified their presence, with Blackstone announcing plans to double its India-based assets under management from $50 billion to $100 billion, reflecting growing international confidence in India’s economic trajectory.

The private equity and venture capital market in India rebounded in 2024 and the outlook for 2025 remains positive. However, sustaining the momentum will require funds to navigate shifting economic and market conditions. Investors with strong operational capabilities, sector-specific expertise, and a focus on sustainable value creation will be best positioned to capitalise on opportunities. As the market tilts towards traditional industries and domestic fundraising reaches new highs, India’s PE-VC landscape looks set for a steady and long-term growth.

(Write to us at editorial@bombaychamber.com)