Blog

Mumbai: When the Goods and Services Tax (GST) Invoice Management System (IMS) went live on October 1, 2024, it arrived as a quiet revolution in the nation’s GST architecture. Introduced with the promise of real time visibility into business-to-business (B2B) transactions, the system is currently optional – a testing ground rather than a mandate. Yet within months, it became obvious to tax professionals and corporate leaders alike that IMS would reshape not only compliance routines but the very dynamics of trust and transparency across the supply chain.

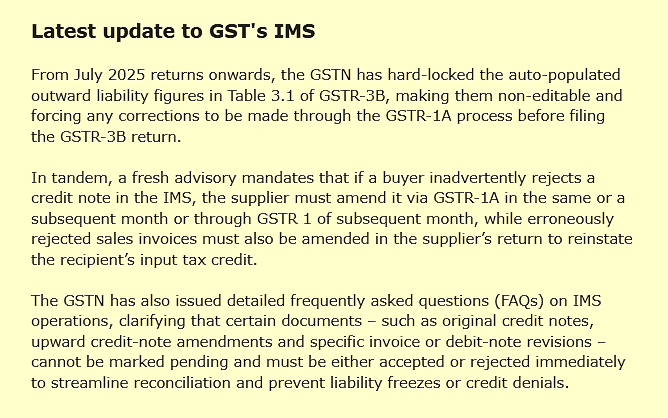

As Komal Sampath, Director – Indian Tax Practice at Deloitte Touche Tohmatsu India LLP, explained at a recent webinar organised by the Bombay Chamber of Commerce & Industry, the true turning point comes with the decision to freeze outward liability in the GSTR 3B return from the July 2025 tax period onwards. At that juncture, any rejection of credit notes by the customers under their IMS may no longer directly be corrected under summary returns of GSTR 3B – a deadline that demands urgent attention from every taxpayer.

On the surface, the GSTN Portal itself presents a deceptively simple layout. Vendors upload their B2B transactions as soon as they are issued, and these records appear in the recipient’s dashboard that allows them to cross-verify entries against their own available records. Yet behind this simplicity lies an intricate choreography of data feeds and validation checkpoints. As transactions initially populate in the ‘No action’ section, recipient may take appropriate action and digital cut-throughs ensure near-instantaneous updates of both the supplier’s and the recipient’s IMS dashboards.

Filters by GSTIN, invoice number, and month enable finance teams to monitor high-value transactions and identify potential discrepancies. Furthermore, for quarterly filers, GSTR-2B is not generated during the first two months of the quarter, permitting them to undertake necessary actions on a quarterly basis.

It is in the dance between acceptance and rejection that the system’s power becomes evident. Should a recipient recognise a transaction as legitimate, a click of the accept button seamlessly authorises the corresponding input tax credit. If the transaction appears spurious or mis-addressed, rejection becomes an immediate deterrent against fraud – alerting both vendor and tax authority to the anomaly.

And where doubts persist, the pending status allows additional scrutiny, perhaps triggering an internal audit or a supplier follow-up. This triage of invoices not only curtails credit claims on counterfeit documents but also strengthens the integrity of each firm’s self-assessment.

Yet practical experience has also revealed obstacles, Karthik Gandhi, Head – Indirect Tax at Siemens India, shared at the same webinar that integration between IMS and legacy ERP systems remains a thorny issue for multinational groups. “We are dealing with multiple entities, each on a different digital platform,” he noted. “Ensuring that transactions captured in one system synchronise accurately with IMS, without duplications or time lags and requires intensive coordination between finance and vendor support teams,” said Gandhi.

Additionally, many practitioners believe further refinements are still required, particularly for taxpayer registered PAN India where tax documents are received at multiple offices and it may delay verification of tax documents by weeks. Calls for extended timelines for taking action on credit notes are already being tabled by industry associations, though any reprieve will need to balance ease-of-use with the government’s broader objectives of plugging revenue leakages.

For businesses large and small, the strategic implications of IMS extend far beyond compliance. Real time invoice matching can accelerate working capital cycles by giving suppliers confidence that credits will be honoured without delay subject to fulfilment of provision of GST law.

Conversely, any backlog in reconciliation can put pressure on cash flows, as the freeze on outward liability could leave invoices in limbo and credits unclaimed. Financial controllers thus find themselves at the nexus of legal compliance, treasury management and supplier relations – a role that demands both technical acumen and diplomatic finesse.

At its heart, the IMS represents a step towards a more transparent, accountable commercial ecosystem. No longer can shell companies hide behind fabricated invoices or delay reporting without immediate consequence. Simultaneously, genuine traders gain the reassurance of on-demand verification, reducing the friction of inter-company settlements. The transformation may be gradual – after all, the initial phase remains optional – but with each month of voluntary participation, taxpayers refine their processes in anticipation of the mandatory horizon.

As the IMS evolves, so too will the skills demanded of India’s tax professionals. Tomorrow’s finance teams/tax professionals will need data analytics expertise to monitor dashboard metrics, legal insight to interpret emerging advisories and change-management know-how to embed new procedures across dispersed operations.

The freeze effective July 2025 is not merely a technical adjustment; it is a signal that digital compliance has arrived irreversibly. Firms that adapt swiftly will not only avoid penalties but stand to gain a competitive edge in the increasingly data-driven marketplace.

In the end, India’s journey towards real time invoice reporting is a microcosm of its aspirations for a fully digitised economy. By merging technology with regulatory intent, the government seeks to construct a fiscal architecture that is both resilient against fraud and conducive to growth. The road ahead will doubtless present further challenges, from system enhancements to policy fine-tuning, but the direction of travel is clear.

For those who embrace the change, the IMS offers a pathway to greater efficiency, stronger compliance and deeper collaboration across the supply chain. And when the next chapter of India’s tax story is written, it will surely be defined by the lessons learned from the first months of IMS in action.

(Write to us at editorial@bombaychamber.com)