Blog

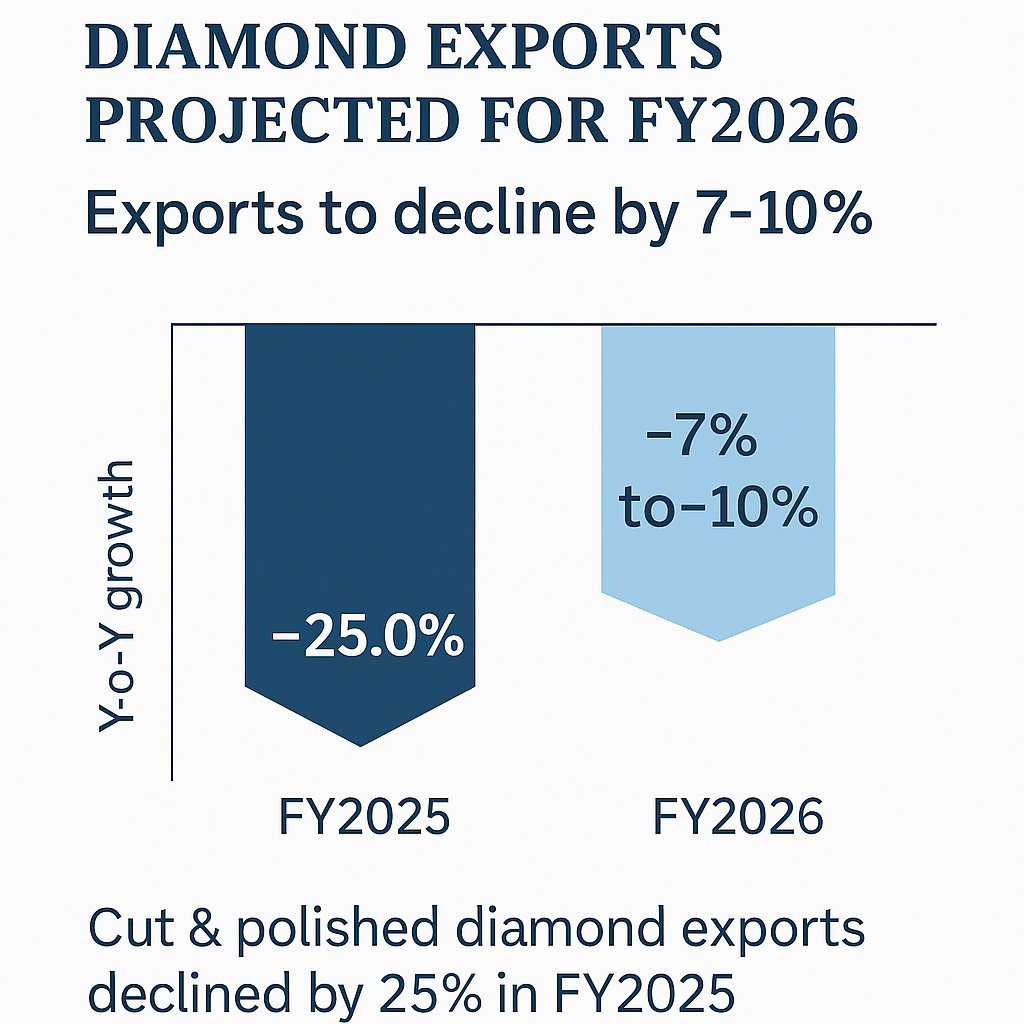

Mumbai: India’s cut and polished diamond (CPD) industry is confronting another challenging year, as export volumes are expected to decline by up to 10 percent on a year-on-year basis to about $12 billion in FY2026. Industry sentiment remains subdued following the steep 17 percent contraction to $13 billion in FY2025, driven by global economic headwinds, heightened competition from lab-grown diamonds (LGDs), and a pronounced drop in demand across key markets including the United States and China.

ICRA, in its latest report, has maintained a negative outlook for the sector, cautioning that the imposition of US tariffs and ongoing preference for LGDs may further erode profitability. A baseline tariff of 10 percent currently applies to Indian CPD exports to the US — a pivotal market accounting for over a third of outbound shipments. Diamantaires are exploring rerouting options through regions such as Dubai, Belgium, and Israel to offset tariff burdens and retain competitiveness.

While demand for LGDs continues to climb, capturing 8 percent of India’s polished diamond export value in FY2025, the sharp price correction — driven by technological advances and new market entrants — has squeezed margins. In contrast, fancy coloured diamonds (FCDs) have demonstrated relative price stability, offering a buffer for companies dealing in niche, high-quality stones.

Polished diamond prices reached historic lows in the second half (H2) of FY2025 and are expected to remain range-bound through the first half (H1) of FY2026. Meanwhile, rough diamond imports have declined sharply, reflecting cautious inventory management and weak global appetite. Despite reductions in procurement and extended seasonal closures, working capital cycles remain stretched, and operating margins for ICRA-rated entities are forecast to dip further to around 3.6-3.7 percent.

Survey responses from leading CPD players indicate muted optimism. Over 75 percent expect export volumes to be impacted by tariffs, while nearly 90 percent anticipate re-routing through favourable trade hubs. Most diamantaires predict stagnant rough prices, and volume degrowth exceeding 10 percent remains a concern.

As the industry recalibrates its strategies, success hinges on balancing cost controls with evolving consumer preferences. With bridal jewellery and luxury spending showing early signs of recovery in select markets, companies are watching closely for a demand revival in H2 FY2026.

(Write to us at editorial@bombaychamber.com)