Blog

India’s Micro, Small and Medium Enterprises (MSME) sector has seen robust growth in its commercial credit portfolio, rising by 13% year-over-year (YoY) as the total credit exposure reached Rs 35.2 lakh crore by the end of March 2025. This surge has primarily been attributed to an increased supply of credit to existing borrowers, as outlined in the latest MSME Pulse Report from TransUnion CIBIL and the Small Industries Development Bank of India (SIDBI). The MSME sector includes borrowers with credit exposures up to Rs 50 crore.

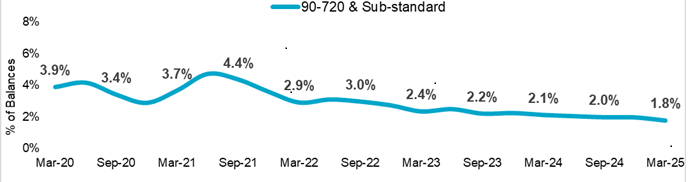

Alongside this expansion in credit, the sector has witnessed a notable improvement in balance-level serious delinquencies — measured as 90 to 720 days past due (DPD) and reported as ‘sub-standard’, which dropped to a five-year low of 1.8%. This improvement, particularly among borrowers with exposures ranging from Rs 50 lakh to Rs 50 crore, marked a 35 basis points decline from the previous year. In contrast, borrowers with exposures of up to Rs 10 lakh saw a slight deterioration, with delinquency levels climbing to 5.8% from 5.1% a year earlier. Similarly, delinquency rates among those with exposures between Rs 10 lakh and Rs 50 lakh rose marginally to 2.9%.

Highlighting the significance of MSMEs to the economy, Manoj Mittal, Chairman and Managing Director of SIDBI, noted that the sector plays a vital role in employment generation and export growth. “Though the credit flow to the sector has improved over the years, the sector still has an addressable credit gap. Providing support to MSMEs can help the sector’s growth and aid the overall economic growth of our country,” he said, underscoring the need for continued efforts to foster innovation, enhance skill development and improve access to financial resources.

While demand for commercial credit grew by 11% year-over-year in the quarter ending March 2025, supply increased at a slower pace, rising by just 3% YoY in the financial year 2024-25. The last quarter of the fiscal year, however, saw an 11% decline in credit supply, possibly due to heightened caution among lenders in response to external economic uncertainties. Nevertheless, credit extended through new cash credit facilities demonstrated resilience, posting a 7% YoY increase. The share of New-to-Credit (NTC) MSME borrowers among total loan originations remained significant at 47%, although lower than the 51% recorded a year earlier.

Public sector banks played a key role in supporting new borrowers, accounting for 60% of NTC loan originations in the quarter ending March 2025. The trade sector contributed the largest proportion of NTC borrowers at 53%, while the manufacturing sector recorded the highest year-over-year growth at 70% in the number of new MSME borrowers securing commercial loans.

Bhavesh Jain, MD and CEO of TransUnion CIBIL, asserted that MSMEs require assistance in accessing formal credit and managing debt effectively. “Fluctuations in the business cycle affect these enterprises disproportionately, as they often lack the financial reserves or support necessary to navigate adverse conditions. Therefore, it is crucial to extend support to this sector and equip them with tools for effective financial management,” he said.

Despite representing only 23% of total loan originations, the manufacturing sector commanded a greater share of the origination value at 34%. However, its share of loan originations by value has steadily declined over the last two years, shifting towards professionals, other services and other industries, which now account for 36% of new loan disbursements –– an increase of five percentage points over the past four years.

Geographically, Maharashtra, Gujarat, Tamil Nadu, Uttar Pradesh and Delhi continued to lead in commercial lending, collectively accounting for 48% of overall originations in the quarter ending March 2025. While the manufacturing sector dominated originations in Maharashtra, Gujarat, Tamil Nadu and Delhi, Uttar Pradesh saw the highest number of loans granted to the trade sector.

(Write to us at editorial@bombaychamber.com)