Blog

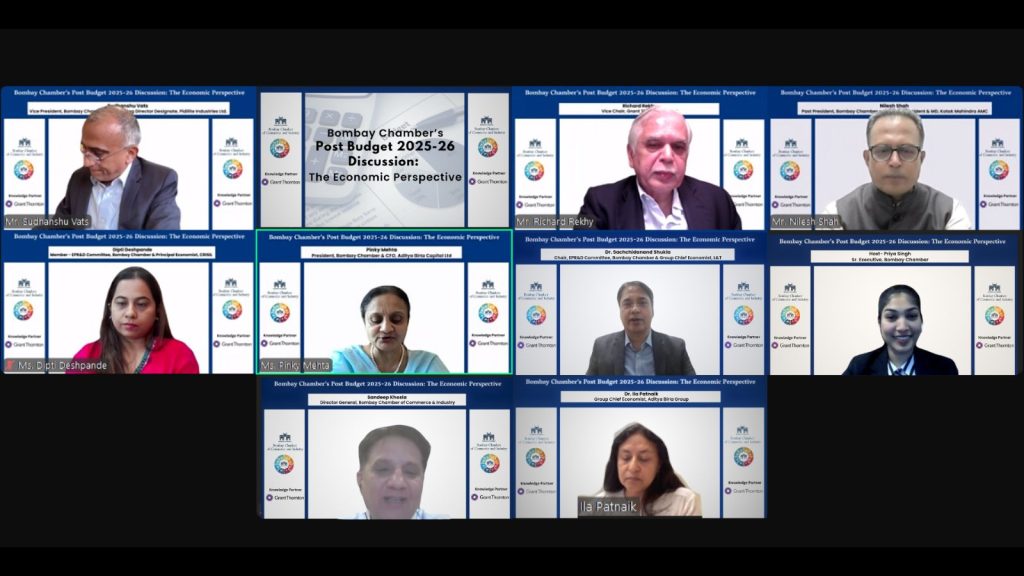

Mumbai, February 4, 2025 – The Bombay Chamber of Commerce & Industry, under the aegis of its Economic Policy Research & Development (EPR&D) Committee hosted a post-budget discussion on the economic perspective following the Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman on February 1, 2025.

The webinar commenced with a welcome address by Pinky Mehta, President of the Bombay Chamber and CFO of Aditya Birla Capital Ltd., who highlighted the budget’s focus on strengthening private sector investments, boosting household sentiment, and enhancing middle-class purchasing power. She noted that Finance Minister Sitharaman reaffirmed the government’s commitment to inclusive growth through targeted initiatives for the poor, youth, farmers, and women, while also underscoring MSMEs as the “second engine” of the economy. Key budget highlights included the Prime Minister Dhan-Dhaanya Krishi Yojana, which aims to enhance agricultural productivity across 100 districts, and the announcement of five National Centres of Excellence for skilling, supporting India’s ambition to become a global manufacturing hub.

The panel discussion, moderated by Dr. Sachchidanand Shukla, Chair of the EPR&D Committee at the Bombay Chamber and Group Chief Economist at L&T, featured distinguished experts, including Dr. Ila Patnaik, Group Chief Economist at Aditya Birla Group; Nilesh Shah, Past President of the Bombay Chamber and Group President & MD at Kotak Mahindra AMC; Sudhanshu Vats, Vice President of the Bombay Chamber and Managing Director Designate at Pidilite Industries.; Dipti Deshpande, Principal Economist at CRISIL; and Richard Rekhy, Vice Chair at Grant Thornton Bharat.

Discussions focused on tax reforms, economic growth, fiscal discipline, and global trade. Shah highlighted the need for better tax compliance and expressed optimism for a more favourable tax regime in the coming years. Deshpande noted that despite tax relief measures, income tax collections are projected to grow by 20.6 percent, driven by structural changes, compliance, and digitalisation. She also highlighted the government’s commitment to fiscal prudence, noting that the fiscal deficit has been reduced to 4.4 percent and remains on track to fall below 4.5 percent in 2025-26. Revenue spending cuts, strong tax collections, and PSU dividends are key drivers of this fiscal consolidation, reinforcing India’s long-term economic stability.

Dr. Patnaik stressed the importance of removing the inverted duty structure to create a level playing field for Indian industries and noted that policy changes are advancing the Make in India initiative. Vats described the budget as balanced and forward-looking, citing the one lakh crore rupees tax rebate as a bold move to stimulate middle-class consumption and drive growth in manufacturing, services, and GST revenues. Addressing global trade concerns, Shah emphasised the need for India to engage in strategic partnerships to avoid negative impacts from ongoing trade tensions.

Rekhy pointed out that while middle-class spending is rising, challenges such as food inflation, underemployment, and regulatory complexities persist. He highlighted the importance of skilling initiatives to support India’s goal of becoming a global talent hub.

The panellists agreed that the Union Budget 2025-26 maintains a strong balance between fiscal prudence and economic growth, with continued policy implementation and regulatory reforms being key to sustaining long-term stability.The session concluded with a vote of thanks by Sandeep Khosla, Director General of the Bombay Chamber.